Most ecommerce business owners are entrepreneurial spirits who would rather be doing anything than ecommerce accounting.

But entrepreneurs are also wise in keeping track of the money they spend on their business, which is probably why over 40% of small business owners do their own ecommerce accounting and bookkeeping.

However, ecommerce accounting is complex, especially since brands can now ship to different countries with different laws and tax systems.

In this guide, we will explore the key concepts and best practices of ecommerce accounting, including tax considerations, inventory management systems, financial reporting, and accounting software. So let’s jump in.

What is Ecommerce Accounting?

Ecommerce accounting is the practice of tracking, recording, and reporting financial transactions for online brands, using specialized tools to address the unique challenges of ecommerce selling.

Ecommerce businesses are often quite complicated, with transactions made in multiple countries, currencies, and platforms.

In my own ecommerce business, I sell products on marketplaces such as Amazon, Etsy, and Walmart, on my own Shopify store, and wholesale via the wholesale marketplace Faire.

There are many different types of transactions that need to be tracked and reported, and ecommerce accounting is the system online business owners use to manage this.

Why is Ecommerce Accounting Important?

Ecommerce accounting is essential because without a sound accounting system in place, it can be challenging to understand the financial health of your business.

When brands start out, they often look at their bank account balance, and providing there is money there, they're happy with the business' health.

But your bank balance doesn’t consider things like the cost of goods sold (COGS), returns, and which products are selling well or are not profitable.

Without this information, it’s impossible to work out the overall profitability of your business.

Financial reporting isn’t the only reason you must have a good ecommerce accounting system. Understanding your tax liabilities can be complex without a system, especially if your business sells products in multiple countries, provinces, states, etc.

While setting up an accounting system can be time-consuming, if your business ever gets tax audited, you will be so thankful that you spent time getting it sorted!

Managing your business finances is much more straightforward with a good accounting system in place.

Ecommerce Accounting vs Bookkeeping: What’s the Difference?

Bookkeeping and accounting are both parts of ecommerce accounting tasks, but they are different.

Bookkeeping is the process of recording all your transactions in and out of the business and reconciling each transaction to make sure they are being recorded correctly.

Transactions include things like sales, refunds, returns, and expenses.

Accounting has a much broader scope and encompasses your entire financial history, including reporting and analysis.

It also includes your tax compliance, allowing your accounting and finance teams to pay the correct amount of tax.

In short, bookkeeping is one part of your overall accounting process that allows you to record your transactions.

In contrast, accounting is a much broader term covering all your business's financial processes, reports, and analyses.

They often get confused, as ecommerce bookkeeping is the day-to-day process of recording and viewing transactions in your business.

This means that, as a business owner, you will usually use bookkeeping processes more often than strategic accounting processes.

Methods of Ecommerce Accounting

There are two methods of accounting for ecommerce businesses: cash and accrual.

When choosing an accountant or accountancy software partner, you must decide which method you are using. The method you choose to implement can have an impact on your end-of-year income taxes and how you record your transactions.

Accrual accounting vs cash accounting for ecommerce

Most businesses will use the accrual method in their accounting system, but let's look at the pros and cons of each below.

Cash basis accounting

Cash accounting essentially measures the amount of money in the bank account. Sometimes this method gets the name bank account accounting for this very reason.

The way it works is the income or expenses are only counted when the money has entered or has left your account.

For example, if you sell a product for $100, the income will only be accounted for in your system when it arrives in your bank account.

On the expenses side, you may have bought 100 units of this product, which cost $10 each, meaning you would have an expense of $1,000. This $1,000 will only be accounted for in your system when it has left the account.

This may sound like the simplest and most logical way to run your accounts.

Still, it is very difficult to make profitability forecasts using this method, as it doesn’t consider the COGS (cost of goods sold) in each sale, making it difficult to forecast how many products you need to sell and at what price to make money.

Cash accounting can be ideal for small and simple businesses, but for complex companies such as ecommerce businesses, it will become too challenging to manage quite quickly.

Accrual accounting

Accrual accounting is more beneficial for forecasting, as it incorporates the cost of goods sold and storage costs when a sale is made.

The main reason this is better for ecommerce businesses is stock. For example, if you place a large order for stock, a large sum of money will come from your bank account.

Say, for example, the order was $10,000 for 10,000 units.

With cash accounting, your accounting system will record a cost of $10,000. This will likely make you unprofitable for that month, as a large amount has come from your bank account.

This means if you were going to report on your figures, it would be difficult to accurately report how profitable the business is.

With accrual method accounting, the cost of each of the units is only incurred when a product is sold. This means it is much easier to understand how much money you would need to spend on a product to ensure you are always in stock.

Accrual accounting is the preferred method for most ecommerce businesses because it offers a more accurate and realistic view of financial health.

It captures the business's true performance by aligning revenues and expenses with the period they relate to, allowing for better business decision-making and financial analysis.

This is particularly important if you hope to sell your business in the future, as potential buyers expect to see transparent and accurate financial reports.

Most accounting software will help support accrual accounting. You will simply need to add COGS into the system, and the software will reconcile each sale.

Key Ecommerce Accounting Terms to Know

There is some accounting jargon that you should be aware of when setting up an ecommerce accounting system.

Learn the terms below to help you get your system set up faster, and you can impress your accountant.

Cost of goods sold (COGS)

COGS are all costs directly related to creating a product.

The general formula is:

COGS = Beginning Inventory + Purchases During the Period - Ending Inventory

For most ecommerce businesses, this includes production costs, local taxes, shipping/freight, and storage.

For some ecommerce businesses, you might include certain fees in the COGS, too, such as inspection/testing reports, product design, or photography.

However, these costs are sometimes recorded as other expenses, such as marketing.

Gross profit and net profit

Gross profit is your revenue minus any COGS.

Net profit is revenue minus COGS minus other business operating costs, such as Amazon fees, IT software, shipping costs, insurance, marketing costs, staffing, etc.

Here are those formulas:

Gross Profit = Total Revenue - Cost of Goods Sold

Net Profit = Total Revenue - Cost of Goods Sold - Operating Expenses - Interest - Taxes

Sales tax and VAT

Most countries have some kind of sales tax.

In Europe, sales tax is generally called VAT (Value Added Tax). In the US, sales tax is added to the sale price, whereas in Europe, VAT is generally included in the price the customer pays.

Your tax requirements will differ depending on where you’re selling and the local tax regulation.

For example, if you sell on Amazon in the US, Amazon will collect your sales tax for you, whereas in Europe, you will be expected to collect tax and pay it as part of your tax return.

Generally, ecommerce businesses must collect the tax on behalf of the government and pay this as part of their tax return.

Accounts payable and accounts receivable

Accounts payable are invoices your business needs to pay, whereas accounts receivable are invoices your business expects to receive.

For example, if you order new stock, that invoice would go into accounts payable.

If you have a customer who orders 1,000 units but pays for them on delivery, this invoice will go into accounts receivable.

Do I Need Ecommerce Accounting Software?

When I started my business, I was only selling on Amazon, and I simply checked how much money was in my bank account to see if I had enough money to buy more stock.

But this meant I went out of stock a lot, as I couldn’t clearly forecast how much stock I would need and how much cash I would need to fund that stock.

Accounting software helps you manage your ecommerce accounting effectively, as it generally links to the selling platform you use to import all your transactions and record them correctly into your accounts.

Over 67% of CPA accountants prefer to work with businesses that use accountancy software, which shows how the industry is moving towards accountancy software.

What to Look For in Your Accounting Software

When it comes to choosing an accounting software partner, there are several things you should take into consideration.

Changing accounting software is a pain, so you must choose the right one the first time.

Banking integrations

Typically, your bank account will integrate with your accounting system so that you can see your current balance and transactions.

However, sometimes you may have multiple bank accounts.

For example, my business is based in the UK, so I have a UK business account. However, I make sales in the US via Amazon and Walmart, so I have a US bank account with Payoneer to save money on exchange rates.

I also have a PayPal account for handling wholesale orders.

All my bank accounts integrate with my Xero accounting system so I can track the funds coming in and out of the business.

Payment processor integrations

Most ecommerce companies sell through a payment provider such as PayPal, Square, or Stripe.

Most of these credit card processing tools will integrate with most accounting systems, but it is essential to check that the provider you use in your country integrates with your accounting system.

Sales platform integrations

Most accounting software integrates with all the leading ecommerce platforms such as Shopify, Bigcommerce, and WooCommerce.

Suppose you sell primarily through marketplaces such as Etsy, Amazon, or Walmart.

In that case, you may need intermediary software such as A2X, or Link My Books to reconcile all the sales transactions with your accounting system.

Inventory tracking

The best accounting tools will also integrate with your inventory management system.

This is a massive benefit for understanding your overall business health, as you can see how much stock has been accounted for in your financial records.

If you use accrual method accounting, this integration is vital, as you need to be able to count the stock down as a sale is made and add stock when a new shipment arrives.

Sales tax

Sales tax, or VAT, differs in each country.

In the US, every state has its own sales tax rate, which must be collected and accounted for in your accounts.

Your accounting system must record this tax collection correctly to file your tax return.

Some accounting software has this feature built-in, but it can also be useful to get an integration such as Avalra or Taxjar, as it will record the tax rate for you based on where you made the sale.

Taxjar also integrates with big platforms such as Shopify, making tax collection seamless.

When you use marketplaces, such as Amazon, the marketplace usually collects sales tax, but make sure you check this with the terms and conditions of the marketplace.

Financial reports

Financial reports, or financial statements, are one of the most critical parts of your accounting system, as they allow you to see how profitable your business is on a detailed level.

These are the most important reports:

Profit and loss report (P&L or PnL Report)

The P&L statement (or income statement) is a report that summarizes all the transactions in and out of your business over a set period, such as a year or a quarter.

This report is essential to show your business's financial health and will give you and your accountant insights into how profitable the business is.

This report will also form the basis of the valuation of the business if you ever come to sell it.

Balance sheet

The balance sheet is the report showing the business’ assets, liabilities, and owner and shareholder equity in the business.

Essentially it shows what the business owes and what the business is owed.

It’s particularly useful for investors as it gives them an insight into what a business is worth.

Cash flow statement (CFS)

The CFS shows the movement of cash in and out of the business over time.

This report becomes critical if you use accrual accounting, as it will help you understand how much cash you will need over the coming year.

Sales by product report

This report shows the revenue generated by each product in your inventory, helping you identify top-selling products, underperforming items, and trends over time.

Sales by channel report

This report breaks down your sales by each sales channel, such as your own online store, Amazon, eBay, or other marketplaces.

It helps you evaluate the performance of each channel and allocate resources accordingly.

Accounts payable and accounts receivable reports

These reports show you how much money you are owed and how much you owe, and the invoices that relate to these accounts.

The Best Ecommerce Accounting Software Options

When setting up your ecommerce accounting system, you need to consider the different sales channels you have and also think about what other tools you use in your business.

The first decision you must make is choosing ecommerce accounting software, and there are three main options for ecommerce business owners.

1. QuickBooks Online

Pros

- Very easy to use and intuitive. Clearly shows important financial data and metrics.

- Large range of features, including invoicing, reporting, inventory management, and payroll.

- Lots of integrations with other third-party apps and ecommerce platforms.

- Mobile app.

- Pricing grows with the business. When your business grows, your access to features also grows.

- Intuitive and user-friendly interface, making it easy for beginners.

Cons

- Can be more expensive than other options, especially when adding additional features.

- Some additional features, such as payroll, are charged separately.

2. Xero

Pros

- Clean, user-friendly interface with an easy-to-use dashboard - this is the software I use in my business

- There are lots of third-party integrations which make it ideal for ecommerce businesses

- Excellent inventory management features

Cons

- Additional features, such as payroll, are charged separately.

3. Zoho Books

Pros

- Zoho Books is part of Zoho's family of tools, so if you use Zoho for other parts of your business, the integration is really straightforward.

- Simple and intuitive interface.

- Affordable for small businesses.

Cons

- Doesn’t have as advanced features if you are planning on scaling the business.

- Some of the functionality is limited.

- Fewer third-party integrations are available.

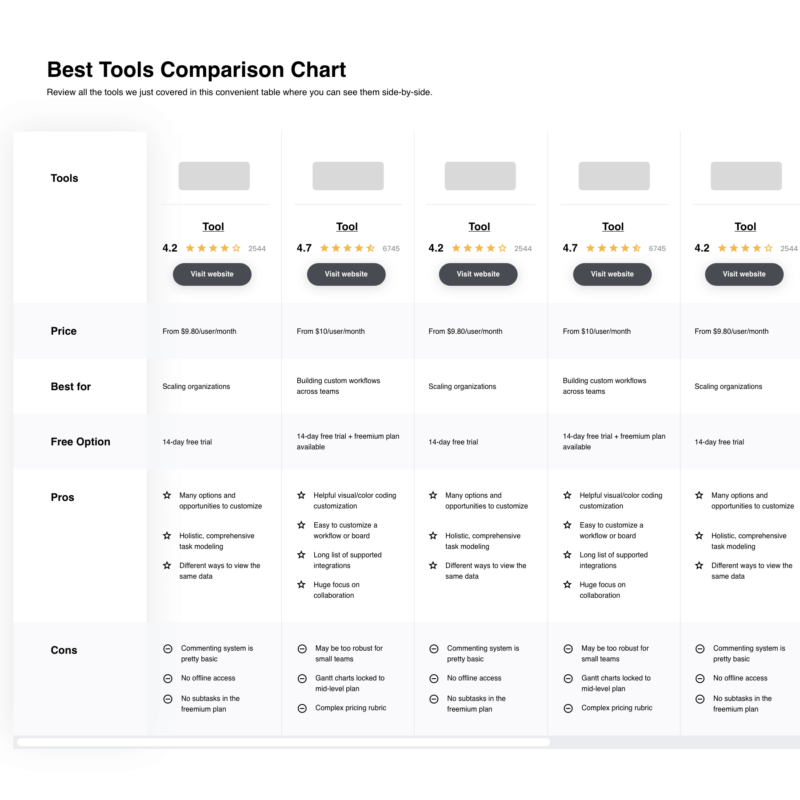

You can also check out The Ecomm Manager's in-depth guide to the top ecommerce accounting software, which digs into the details of each with ratings, pricing, and more.

Some of their picks sync with my own, as you'll see in this top ten shortlist:

And, here's a sneak peek at the pricing for each:

| Tools | Price | |

|---|---|---|

| QuickBooks Online | From $22.50/month | Website |

| NetSuite | Pricing upon request | Website |

| A2X | From $19/month | Website |

| Zoho Books | From $15 per month | Website |

| Bench | From $349/month | Website |

| Yooz | Pricing upon request | Website |

| Multiview ERP | Pricing upon request | Website |

| Kashoo | From $216/year | Website |

| NetSuite ERP | From $99/user/month (min 10 seats, billed annually) | Website |

| Wave Accounting | From $20/month | Website |

Compare Software Specs Side by Side

Use our comparison chart to review and evaluate software specs side-by-side.

Compare SoftwareOther Useful Third-Party Software for Ecommerce Brands

Finally, here are just a few more useful tools from my experience.

A2X and Link My Books

A2X, MyWorks and Link My Books are essential integrations for marketplace sellers.

They automatically import all your transactions and categorize all the sales and expenses. They both integrate seamlessly with Quickbooks and Xero.

There isn’t much that separates the two (although Link My Books is slightly more cost-effective), and they both support incoming sales from Amazon and eBay.

Shopify Integration

If you run a Shopify store, integrating your accounting software with Shopify is essential.

It seamlessly helps you manage sales, inventory, and customer data, ensuring accurate financial records. If your accounting software of choice doesn't integrate with Shopify, you may consider one of the many Shopify alternatives on the market.

Open Payout

Open Payout imports all your Etsy transactions into your accounting software, making it easy to track all your sales.

Taxjar and Avalara

These integrations help you automate sales tax calculations, reporting, and filing, ensuring compliance with tax regulations across different jurisdictions.

Make Your Brand's Financial Health a Priority

Ecommerce accounting is a vital part of your business, as it is the only way to get an idea of your business's financial health.

The best accounting systems will integrate seamlessly with your inventory management and order management systems and will also integrate with other third-party apps.

By having the best setup for your business, you can have a real-time view of what is going on with your finances to help you make the best decisions for your business.

For more essential ecommerce business insights, subscribe to The Ecomm Manager newsletter today.

Ecommerce Accounting FAQs

Here’s a final postscript where we’ll tackle some related questions that we didn’t cover in the content of this post.

How do you account for sales made through multiple online marketplaces or sales channels?

Accounting for multichannel ecommerce sales can seem daunting, but it’s pretty straightforward with the right approach.

First, you’ll want to consolidate all your sales data into one centralized system or report. From there, categorize each sale by channel and reconcile everything monthly. Don’t forget to account for any fees or commissions charged by third-party platforms too.

What are the specific accounting implications for subscription-based or recurring revenue models common in ecommerce?

With subscription models, you can’t just record the full revenue upfront.

Instead, you’ll need to spread it over the subscription period using methods like straight-line or output-based recognition. It’s also crucial to properly defer revenue for any prepaid subscription plans until you’ve delivered those goods or services. Getting it right ensures accurate financial reporting.

How do you properly recognize and account for online sales returns, refunds, and chargebacks?

Returns, refunds, and chargebacks require meticulous tracking in your books.

For returns, adjust your revenue and inventory counts accordingly. Refunds are typically a contra revenue account. And chargebacks, those can be tricky—you’ll need to account for any additional fees, penalties, or even legal costs involved.

Having robust processes prevents accounting headaches later.

What are the best practices for integrating ecommerce accounting with inventory management, order management, and other operational systems?

Integrating your accounting with operational systems is a major advantage for ecommerce businesses.

Look for solutions that sync sales, inventory, and order data seamlessly across platforms to minimize manual entry errors. Automated reconciliation keeps your books accurate in real-time.

And having centralized metrics gives you valuable insights to optimize your operations and financials.