10 Best Credit Card Processing Software for Ecommerce Shortlist

Here's my pick of the 10 best software from the 20 tools reviewed.

There are so many ways to handle credit card processing for ecommerce, so making a shortlist of the best tools can be tricky. You want to enable your online business to accept and process credit card payments securely and efficiently—and now need the right tool for your team. I've got you covered! In this post, I share from my personal experience managing ecommerce stores of all sizes, using many different payment processing solutionds, and share my picks of the best credit card processing for ecommerce overall.

Why Trust Our Reviews

We’ve been testing and reviewing ecommerce software since 2018. As ecommerce managers ourselves, we know how critical, and difficult it is to make the right decision when selecting software.

We invest in deep research to help our audience make better software purchasing decisions. We’ve tested more than 2,000 tools for different ecommerce use cases and written over 1,000 comprehensive software reviews. Learn how we stay transparent & our software review methodology.

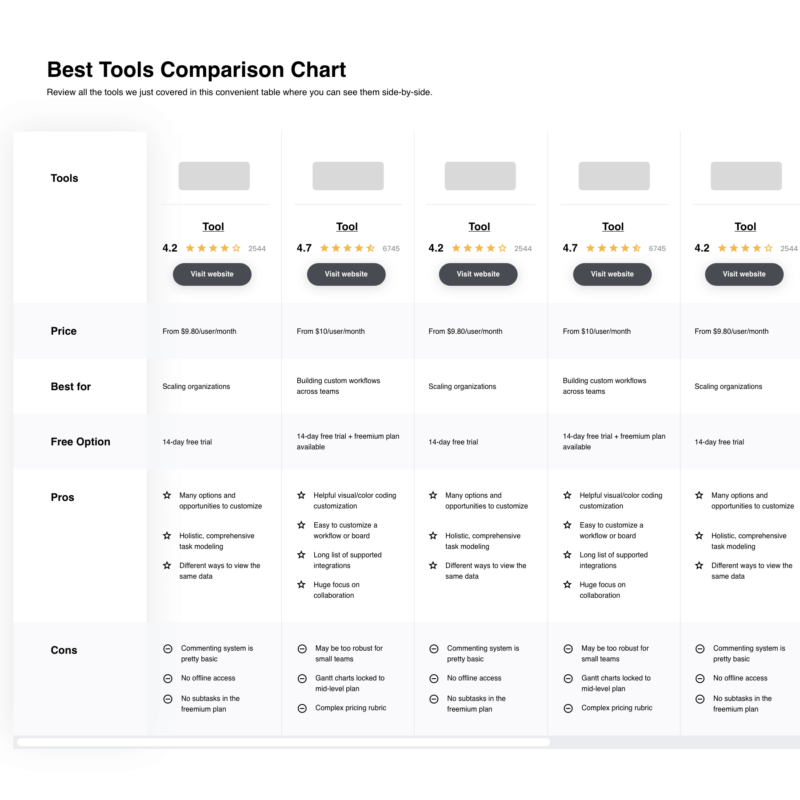

The Best Credit Card Processing For Ecommerce Summary

Here’s a comparison chart that summarizes basic details about each of my top choices for the best credit card processing software for ecommerce. You can view their pricing details side-by-side to help you find the best option for your budget and business needs.

| Tools | Price | |

|---|---|---|

| Shopify POS | Plans start at $31/month | Website |

| Helcim | From 0.50% + $0.25 per transaction | Website |

| Clover | From 2.3% + $0.1 per transaction | Website |

| Payment Depot | From $79/month | Website |

| Merchant One | From $13.95 plus 0.29% + 1.55% per transaction | Website |

| Square | From $36/month plus 2.9% + $0.30 per transaction | Website |

| Stripe | From 2.9% + 0.30 per transaction | Website |

| Worldpay | Pricing upon request | Website |

| PayPal | From 2.9% + $0.49 per transaction | Website |

| Moneris Gateway | From 1.18% per transaction | Website |

Compare Software Specs Side by Side

Use our comparison chart to review and evaluate software specs side-by-side.

Compare SoftwareHow to Choose Credit Card Processing for Ecommerce

With so many different credit card processing for ecommerce available, it can be challenging to make decisions on what credit card processing for ecommerce is going to be the best fit for your needs. As you're shortlisting, trialing, and selecting credit card processing for ecommerce, consider the following:

- What problem are you trying to solve - Start by identifying the credit card processing for ecommerce feature gap you're trying to fill to clarify the features and functionality the credit card processing for ecommerce needs to provide.

- Who will need to use it - To evaluate cost and requirements, consider who'll be using the software and how many licenses you'll need. You'll need to evaluate if it'll just be the ecommerce team, or the whole organization that will require access. When that's clear, it's worth considering if you're prioritizing ease of use for all, or speed for your ecommerce software power users.

- What other tools it needs to work with - Clarify what tools you're replacing, what tools are staying, and the tools you'll need to integrate with, such as accounting, CRM or HR software. You'll need to decide if the tools will need to integrate together, or alternatively, if you can replace multiple tools with one consolidated credit card processing for ecommerce.

- What outcomes are important - Consider the result that the software needs to deliver to be considered a success. Consider what capability you want to gain, or what you want to improve, and how you will be measuring success. For example, an outcome could be the ability to get greater visibility into performance. You could compare credit card processing for ecommerce features until you’re blue in the face but if you aren’t thinking about the outcomes you want to drive, you could be wasting a lot of valuable time.

- How it would work within your organization - Consider the software selection alongside your workflows and delivery methodology. Evaluate what's working well, and the areas that are causing issues that need to be addressed. Remember every business is different — don’t assume that because a tool is popular that it'll work in your organization.

Reviews of the Best Credit Card Processing Software For Ecommerce

Here are the top 10 credit card processing for ecommerce that I will outline in detail, including the best use case for each, key features, and pros/cons. I’ll follow up this list with a quick summary of my other picks, so keep reading even if you don’t find anything you love here.

Shopify POS streamlines retail and online sales through a unified system, offering seamless inventory, order, and customer data management. Designed for efficiency, it supports a range of payment methods, enhances customer service with its user-friendly interface, and provides actionable insights through detailed analytics.

Why I PIcked Shopify POS: Shopify POS excels in credit card processing by offering secure, swift, and versatile payment solutions tailored to both merchants and customers. It supports a broad spectrum of credit and debit cards, facilitating transactions through encrypted data handling for enhanced security. The system's integration with Shopify Payments simplifies reconciliation and provides real-time insights into sales and financial health.

Shopify POS Standout Features and Integrations

Features include omnichannel selling, deep ecommerce integration, customizable checkout experience, secure credit card processing, real-time inventory management, unified customer profiles, detailed sales analytics, mobile compatibility, support for multiple payment methods, and loyalty program integration.

Integrations include with a variety of tools, including Shopify Payments, Shopify Shipping, Shopify Email, QuickBooks, Xero, Klaviyo, Google Analytics, Oberlo, Printful, and Gift Cards & Loyalty Program by Smile.io

Pros and cons

Pros:

- Advanced inventory management tools

- Robust omnichannel capabilities

- Seamless integration with Shopify

Cons:

- Shopify POS primarily supports hardware sold through Shopify

- Cost can be a deterrent for small businesses

Helcim

Best credit card processing software for good interchange rates

Helcim is a credit card processing software that enables ecommerce business owners to offer multiple payment options while benefiting from reasonable interchange fees.

Why I picked Helcim: Helcim has an easy onboarding process and a smooth learning curve. The solution offers proprietary payment pages, which can simplify the deployment process.

Unlike other credit card processors, Helcim doesn’t charge monthly fees for online transactions, which makes it ideal for startups and small businesses who are just starting out in the ecommerce industry. The software uses interchange plus pricing, which is a transparent model that’s easy to understand.

Helcim Standout Features and Integrations

Features include POS, online checkout, a virtual terminal, recurring plans, payment links, invoicing, QR codes, SMS payments, a physical credit card reader, and a card vault.

Integrations include Great Exposure, Foxy.io, Magento, QuickBooks, WooCommerce, and others.

Pros and cons

Pros:

- No hidden fees

- Interchange-plus pricing model

- Great for startups and small businesses

Cons:

- Payment processing rates are correlated to your sales volume

- Some features may lag at times

Clover

Best credit card processing software for brick-and-mortar stores who want to sell online

Clover is an out-of-the-box point-of-sale (POS) system that enables physical stores who want to transition to ecommerce to integrate their payment options into their website.

Why I picked Clover: Clover is more than a credit card processing solution. It’s a complete POS system that comes with its own hardware, enabling you to process payments in physical stores. Clover also syncs your physical and ecommerce sales, making it easy to manage your inventory.

Clover is an adaptable system you can customize with the help of add-ons. Some of the available add-ons are free, while others may cost extra, but you can use them to build a robust solution that’s tailored to your business needs.

Clover Standout Features and Integrations

Features include item and inventory management, stock tracking, loyalty programs, multi-channel selling, a seller dashboard, hotspot payments, and reporting & analytics.

Integrations include Balance Till, Cash Track, Digital Loyalty, Footfall, Invoiss, OrderOut, RewardUp, Thrive Inventory, Time Clock, Stream, and others.

Pros and cons

Pros:

- Well-designed dashboard that allows you to oversee your store’s financials

- User interface is friendly toward novice users

- Detailed reports

Cons:

- Customizing your reports could be easier

- Some merchants may find the pricing structure complicated

Payment Depot is a merchant services provider that specializes in credit card processing with a focus on transparent interchange+ pricing. This pricing model is considered best for businesses seeking clarity and cost savings on transaction fees, as it allows them to pay the wholesale rate plus a fixed monthly membership fee, avoiding the markups that are typical in the industry.

Why I Picked Payment Depot: Payment Depot excels in offering a transparent and cost-effective credit card processing solution, particularly suited for businesses with high transaction volumes.The platform provides a comprehensive suite of tools including a free payment gateway, virtual terminal capabilities through partnerships like SwipeSimple, and support for various POS systems including Clover. Payment Depot's user-friendly interface and intuitive reporting dashboard enhance its ease of use, making financial management straightforward for business owners.

Payment Depot Standout Features and Integrations

Features include subscription-based pricing, free payment gateway, virtual terminal through swipesimple, compatibility with pos systems like clover and vital select, user-friendly interface, support for mobile and ach payments, integration with major ecommerce platforms, no hidden fees, and dedicated customer support.

Integrations include OpenCart, PrestaShop, 3dCart, BigCommerce, WooCommerce, Magento, Zen Cart, NCR, Authorize.Net, PayTrace, and others.

Pros and cons

Pros:

- Comprehensive equipment offerings

- User interface is straightforward and intuitive

- Cost-effective for businesses with high transaction volumes

Cons:

- Not ideal for low-volume businesses

- Limited to US-based, non-high-risk merchants

Merchant One is a credit card processing solution that’s willing to approve most merchants, including high-risk merchants who don’t have great credit histories.

Why I picked Merchant One: Merchant One enables businesses of all sizes to integrate credit card payments into their online stores. The solution is easy to implement, and the provider also offers card readers and POS systems for physical store owners too.

Merchant One has a simple interface that’s easy to navigate and use. The software enables you to accept multiple types of payment, including recurring, mobile, and contactless payments, and it also allows you to send invoices and receipts.

Merchant One Standout Features and Integrations

Features include gift cards, loyalty programs, text marketing, PCI compliance, fraud protection, data security, mobile payments, invoicing, and billing.

Integrations include BigCommerce, Designcart, Ecwid, Microsoft Dynamics, PrestaShop, Salesforce, Weebly, Wix, WordPress, ZenCart, and others.

Pros and cons

Pros:

- 24/7 support for ecommerce stores

- Helpful support team

- Good for both in-store and online selling

Cons:

- Pricing model could be clearer

- Limited online knowledge base

Square

Best credit card processing software for mobile-first shopping experiences

Square Online is a credit card processing software that enables ecommerce store owners to create mobile-first shopping experiences.

Why I picked Square Online: Square Online helps you create mobile-friendly checkout pages without a developer. The software transforms your checkout page into something that’s easy to navigate on every mobile device, reducing any friction associated with the payment process.

Square Online offers native integrations with the world’s most popular ecommerce platforms, allowing you to create a hassle-free payment process with ease. With Square Online, you can also customize your checkout page and buttons to match your brand.

Square Online Standout Features and Integrations

Features include order status text alerts, abandoned cart recovery, an unlimited product catalog, time-based product categories, scheduled item updates, SEO tools, social media ads, and coupons & discounts.

Integrations include Bookkeep, Facebook Ads, Google Ads, Instagram, Pinterest, QuickBooks Online, Squarespace, Thrive Inventory, Wix, WooCommerce, and others.

Pros and cons

Pros:

- Easy implementation

- Native integrations with major ecommerce platforms

- Free plan available

Cons:

- Onboarding tutorials could be better

- Manipulating elements on your checkout page can feel clunky at times

Stripe is a credit card processing software that helps ecommerce merchants offer friction-free shopping experiences with multiple payment options.

Why I picked Stripe: Stripe helps ecommerce vendors of all sizes make their payment process easy. The software offers multiple payment options, allowing merchants to sell products, services, and subscriptions without difficulty.

Stripe’s dashboard is easy to navigate and understand. The solution’s reports give a clear overview of how your business is doing and offer insights that enable you to identify in-demand products and pipelines that may need optimization.

Stripe Standout Features and Integrations

Features include embeddable checkout, invoice support, a custom UI toolkit, 135+ currency support, local payment methods, real-time reporting, and iOS and Android mobile apps.

Integrations include 10clouds, 1Password, Accenture, Amazon Web Services, Bonsai, Capital One, Giftpro, HubSpot, Shopify, Squarespace, and others.

Pros and cons

Pros:

- Allows you to set up memberships, subscriptions, and free trials with ease

- Multiple checkout templates

- Supports dozens of currencies

Cons:

- Deposits take a couple of business days to process

- Full customization requires some coding skills

Worldpay is a credit card processing solution that helps ecommerce stores who are present on multiple channels accept payments in different currencies.

Why I picked Worldpay: Worldpay enables you to accept payments on all channels, whether you’re selling on your website, social media profile, ecommerce platform, a marketplace, or at virtual events. The software supports most popular digital wallets and accepts a wide range of credit cards, making it easy for your customers to complete their payments.

Worldpay enables you to accept alternative payment methods (APMs), such as cryptocurrency payments. You can connect your APM processor to Worldpay’s API to sync your data and offer customers more payment options.

Worldpay Standout Features and Integrations

Features include subscription management, mobile payments, multi-currency payments, split funds, refunds and chargebacks management, customizable reports, and payment routing.

Integrations include Commercetools, Magento, NetSuite, Optile, Recurly, Salesforce, SAP Commerce, Shopify, Vtex, Zuora, and others.

Pros and cons

Pros:

- Supports a wide range of payment options

- Great for recurring payments, such as subscriptions

- Enables online businesses to accept payments from 146 countries

Cons:

- UI could be improved

- Some features can feel clunky at times

PayPal is a credit card processing solution that encourages customers around the world to complete their payment process thanks to the brand’s recognition.

Why I picked PayPal: PayPal helps ecommerce businesses set up their merchant accounts in minutes. According to the brand’s insights, online shoppers are nearly three times more likely to make a purchase when PayPal is available at checkout, thanks to the software’s reputation.

PayPal’s Seller Protection can help ecommerce store owners avoid chargebacks and reversals so they can avoid merchant fraud. The software is available in 202 countries and accepts payments through all major credit cards and debit cards, including Visa, American Express, Mastercard, Discover, Maestro, and JCB.

PayPal Standout Features and Integrations

Features include Venmo checkout, installment payments, crypto payments, analytics and reporting, seller protection, and fraud protection.

Integrations include BigCommerce, GoDaddy, Miva, OpenCart, Shopify, Volusion, Wix, WooCommerce, and others.

Pros and cons

Pros:

- Easy implementation and onboarding

- Customers know and trust the brand

- No long-term contracts

Cons:

- Self-help portal could be more extensive

- Transaction fees can add up for small business owners

Moneris Gateway is a fully-hosted credit card processing solution that enables Canadian ecommerce store owners to accept international payments.

Why I picked Moneris Gateway: Moneris Gateway is easy to set up and run. The solution offers native integrations with multiple ecommerce platforms, allowing you to start accepting payments quickly.

Moneris Gateway allows you to show product prices in over 140 currencies, making the shopping process smoother for international customers. The software also offers a drag-and-drop checkout builder, so you can tailor the checkout page to your brand.

Moneris Gateway Standout Features and Integrations

Features include fraud protection, multi-currency pricing, 24/7 customer support, customizable forms and fields, recurring payments, a payment portal, and branding.

Integrations include Apple Pay, Ecwid, Google Pay, Magento, SAP Digital Payments, WooCommerce, and others

Pros and cons

Pros:

- Dynamic currency conversion enables you to receive all payments in Canadian dollars

- Active developer community

- Supports 140 foreign currencies

Cons:

- 3-year standard contracts

- Non-disclosed early cancellation fees

Other Credit Card Processing Software

I didn’t have the space to include full reviews for each of these additional credit card processing for ecommerce but they offer some cool features and functionality that could be exactly what you need.

- Fiserv

Best credit card processing software for B2B selling

- ProMerchant

Best for next-day funding for merchant accounts

- Stax

Best credit card processing software for easy shopping cart integration

- Shopify Payments

Best credit card processing software for Shopify merchants

- National Processing

Best credit card processing software for high-risk ecommerce stores

- Verifone

Best credit card processing software for branded payment experiences

- Chase

Best credit card processing software for phone orders

- Luminous Payments

Best credit card processing software for early-age startups

- Paysafe

Best credit card processing software for cross-border selling

- WooCommerce Payments

Best credit card processing software for WooCommerce merchants

Related Ecommerce Software Reviews

If you still haven't found what you're looking for here, check out these related ecommerce tools that we've tested and evaluated.

- Ecommerce Platforms

- Inventory Management Software

- Payment Processing Software

- Shopping Cart Solutions

- Order Management Systems

- Warehouse Management Software

Selection Criteria for Ecommerce Credit Card Processing Software

Selecting the right credit card processing for ecommerce involves a careful evaluation of what they have to offer. Through extensive personal trials and research, I've developed criteria to guide software buyers towards making an informed decision.

Core Functionality: 25% of total weighting score

- Acceptance of major credit and debit cards globally

- Support for recurring billing and subscriptions

- Fraud detection and prevention measures

- Integration with major ecommerce platforms and shopping carts

- Ability to handle high volumes of transactions securely and efficiently

Additional Standout Features: 25% of total weighting score

- Tools that introduce innovative payment solutions, such as cryptocurrency payments or mobile wallet integration, set themselves apart.

- Solutions that offer advanced analytics and reporting tools provide valuable insights into sales trends and customer behavior.

- Services that enable cross-border payments with currency conversion help businesses expand their global reach.

- Identifying tools that provide customizable checkout experiences can enhance the customer's buying journey.

- Selecting services with advanced security features beyond the standard, such as tokenization and end-to-end encryption, ensures added protection for both merchants and customers.

Usability: 10% of total weighting score

- Looking for intuitive user interfaces that simplify the process of setting up and managing payments.

- Preference for dashboards that provide a clear view of transactions, refunds, and customer data.

- The balance between comprehensive features and a clean, uncluttered design is key.

Onboarding: 10% of total weighting score

- Easy-to-follow setup procedures that allow businesses to start processing payments quickly.

- Availability of resources like training videos, step-by-step guides, and interactive product tours.

- Tools that offer direct support during the onboarding process, such as dedicated account managers or responsive chat support.

Customer Support: 10% of total weighting score

- Evaluating the accessibility of customer service, including live chat, phone support, and email.

- Importance of knowledgeable support staff who can provide quick and accurate assistance.

- Availability of 24/7 support for addressing urgent issues.

Value For Money: 10% of total weighting score

- Competitive pricing structures that offer clear value for the features provided.

- Transparency in fee structures, avoiding hidden charges.

- Considering the flexibility of pricing plans to suit businesses of different sizes and transaction volumes.

Customer Reviews: 10% of total weighting score

- Analyzing feedback for mentions of reliability, ease of use, and customer service responsiveness.

- Paying attention to reviews from businesses in similar industries or with similar sales volumes.

- Valuing reviews that speak to the longevity of use and the tool's ability to scale with business growth.

Through this detailed and balanced approach to evaluating credit card processing solutions, businesses can find a tool that not only meets their immediate payment processing needs but also supports their growth and adapts to evolving market demands.

Trends in Credit Card Processing for Ecommerce for 2024

Here are some trends I’ve noticed for credit card processing for ecommerce technology, plus what they might mean for the future of the marketing industry. I sourced countless product updates, press releases, and release logs to tease out the most important insights.

- Integration of Artificial Intelligence (AI): AI-driven fraud detection systems are becoming a staple, offering real-time analysis to minimize false positives and accurately identify fraudulent transactions. This evolution caters to the need for balancing security with a smooth customer checkout experience.

- Contactless Payments Surge: The rise in NFC (Near Field Communication) and RFID (Radio-Frequency Identification) technologies facilitates quicker, contactless payments, reflecting the consumer demand for convenience and speed in online checkouts.

- Blockchain for Payment Processing: The adoption of blockchain technology is introducing unparalleled transparency and security, reducing the risk of fraud and chargebacks, and ensuring the integrity of transactions.

- Omnichannel Payment Solutions: Unifying payment systems across multiple platforms and devices ensures a seamless payment experience for customers, whether shopping online, via mobile, or through social media channels, meeting the expectation for omnipresent commerce.

- Sustainable Payment Options: With an increasing consumer focus on sustainability, eco-friendly payment solutions, including digital receipts and green payment processing, are becoming more prominent, aligning with the environmental values of today's consumers.

- Subscription and Recurring Payment Enhancements: Improved management and customization options for subscriptions and recurring payments address the growing ecommerce trend towards subscription-based business models, ensuring flexibility and convenience for both merchants and customers.

As the industry continues to evolve, staying ahead of these trends will be crucial for ecommerce businesses aiming to provide exceptional online shopping experiences while ensuring the safety and satisfaction of their customers.

What is Credit Card Processing for Ecommerce?

Credit card processing for ecommerce is a specialized tool that enables online businesses to accept and manage credit card payments. It securely handles the transfer of payment information from the customer to the merchant and then to the payment networks.

The purpose is to validate card details, ensure transaction authorization, and facilitate the secure and efficient processing of payments. It integrates with ecommerce platforms, providing a seamless and secure checkout experience for customers, while ensuring merchants receive payments promptly and securely.

Features of Credit Card Processing Software

Key features of credit card processing software for ecommerce include:

- Fraud Detection and Prevention: Incorporates tools to identify and mitigate fraudulent activities, safeguarding both the merchant and the customer.

- Integration Capabilities: Easily integrates with eCommerce platforms, shopping carts, and accounting software for seamless operations.

- User-Friendly Interface: Provides a straightforward and efficient experience for both merchants and customers during the transaction process.

- Mobile Compatibility: Ensures smooth processing on mobile devices, catering to the growing number of mobile shoppers.

- Real-Time Processing: Processes transactions quickly, providing immediate payment confirmation.

- Reporting and Analytics: Offers detailed reports and analytics for tracking sales, understanding customer behavior, and managing finances.

- Global Transactions Support: Capable of handling international payments, including currency conversion and compliance with local regulations.

- Customer Support: Provides reliable and accessible customer service for troubleshooting and assistance.

Benefits of Credit Card Processing for Ecommerce

In the dynamic world of ecommerce, credit card processing plays a pivotal role in the success and growth of online businesses. Here are five primary benefits that credit card processing brings to users and organizations in the ecommerce landscape:

- Increased Sales Conversion: Simplifies the checkout process for customers. By offering a straightforward and secure payment option, credit card processing can significantly reduce cart abandonment rates and boost sales conversions.

- Enhanced Security and Fraud Prevention: Provides robust security measures. Utilizing advanced encryption and fraud detection algorithms, credit card processing software helps protect sensitive financial data, building trust with customers and minimizing the risk of fraudulent transactions.

- Global Market Reach: Facilitates international transactions. Credit card processing allows businesses to accept payments in multiple currencies from customers around the world, expanding their market reach and opening up new revenue streams.

- Improved Cash Flow Management: Offers faster access to funds. With efficient processing and settlement of credit card transactions, businesses benefit from improved cash flow, ensuring they have the resources needed for operational expenses and growth initiatives.

- Customer Convenience and Satisfaction: Delivers a seamless payment experience. By providing a variety of payment options and ensuring transactions are processed quickly and smoothly, credit card processing enhances customer satisfaction and encourages repeat business.

With the right credit card processing software, ecommerce businesses can unlock their full potential and achieve sustained success in the competitive online marketplace.

Cost & Pricing for Credit Card Processing for Ecommerce

Navigating through the myriad of credit card processing solutions available for ecommerce can be daunting, especially for software buyers who are new to this space. The right choice can significantly impact your business's operational efficiency, cost management, and customer satisfaction. Here's a simplified overview of common plan options and their pricing to help you make an informed decision.

Plan Comparison Table for Credit Card Processing for Ecommerce

| Plan Type | Average Price | Common Features |

|---|---|---|

| Basic | 2.9% + 30¢ per transaction | Standard security, 24/7 support, basic reporting, integration with major ecommerce platforms |

| Pro | Monthly fee + 2.6% + 30¢ per transaction | Enhanced security features, advanced reporting, custom integrations, dedicated account manager |

| Enterprise | Custom pricing | Tailored solutions, lowest transaction fees, premium support, dedicated server |

| Free | $0 (with limitations) | Limited transactions, basic security, standard support, basic reporting |

When considering these options, software buyers should weigh the transaction volumes, required features, and potential growth of their business to select a plan that offers the best balance between cost and functionality.

Frequently Asked Questions

Want to learn more about credit card processing software? Here are some answers to popular customer questions.

How much are credit card processing fees typically?

Credit card processing fees can vary widely depending on several factors, including the payment processor, the type of credit card used, the merchant’s business type, and the transaction method (in-person, online, etc.). Typically, these fees are a combination of percentage-based charges and fixed per-transaction fees. Here’s a general breakdown:

- Percentage Fee: This is usually between 1.3% to 3.5% of the transaction amount. The exact percentage can depend on the card issuer, the type of card (debit, credit, rewards card, etc.), and the merchant’s agreement with the processor.

- Per-Transaction Fee: This is a fixed amount charged per transaction, often ranging from $0.10 to $0.30.

- Monthly or Annual Fees: Some processors charge monthly or annual service fees, which can affect overall costs.

- Incidental Fees: These can include chargeback fees, payment gateway fees, PCI compliance fees, and others, depending on the processor and the specific services used.

- Flat-Rate Pricing: Some processors offer flat-rate pricing, where a fixed percentage and transaction fee is applied to all transactions, regardless of card type.

- Tiered Pricing: This model categorizes transactions into tiers (qualified, mid-qualified, non-qualified), each with different rates, often making it more complex and potentially more expensive.

What’s the difference between a payment processor and a payment gateway?

The difference between a payment processor and a payment gateway in the context of online transactions is quite distinct, though they work closely together:

- Payment Gateway: This is a service that authorizes and processes credit card or direct payments for online businesses. Think of it as the digital equivalent of a physical point-of-sale terminal in a store. The payment gateway securely captures and transfers the customer’s payment details (like credit card information) from the website to the payment processor. It acts as a bridge between the merchant’s website and the payment processing network.

- Payment Processor: This is the system that actually handles the transaction process, working behind the scenes. It takes the information sent by the payment gateway, verifies it with the customer’s bank or card issuer, ensures funds are available, and then approves or declines the transaction. The payment processor also handles the transfer of funds from the customer’s account to the merchant’s account.

Additional Ecommerce Payment Software Reviews

If you are looking for credit card processing software, you might be interested in these related software reviews, as well. They all focus on ecommerce finances, payments, or tax management.

- Ecommerce Sales Tax Software: Make sure all your tax calculations and payment are above board, and automate what you don't have time for.

- Shopping Cart Solutions: Build the perfect shopping cart page to help get your customers over the finish line.

- Point-of-Sale (POS) Software: Online or in-person, point-of-sale software is what you need to collect payments anywhere.

Conclusion

Credit card processing software enables you to create stress-free checkout experiences, making the shopping process more enjoyable for your customers. And that can have a significant impact on your profit margins. Don't miss out!

Subscribe to The Ecomm Manager newsletter to receive advice on the best ecommerce payment processing strategies from leading industry experts.