10 Best Ecommerce POS Systems Shortlist

Here's my pick of the 10 best software from the 20 tools reviewed.

There are seemingly countless ecommerce POS systems available, so figuring out which is best for you is tough. You want to efficiently track sales, update inventory in real-time, and provide valuable insights into sales trends—but now need to figure out which tool is the best fit. I've got you! In this post, I make things simple, leveraging my experience managing managing large online commerce businesses, and using dozens of different POS tools to bring you this shortlist of the best ecommerce POS systems overall.

What Is a Ecommerce POS System?

Ecommerce POS (Point of Sale) systems are integrated digital platforms that manage online retail transactions. They combine the functionalities of processing sales, handling inventory, and maintaining customer data, all in one streamlined interface.

The purpose is to to facilitate a smooth checkout experience for customers, while providing merchants with real-time inventory updates, sales tracking, and insights into customer preferences and trends.

Overviews Of The 10 Best Ecommerce POS Systems

Here are my overviews of some of the best ecommerce POS systems available based on features, pricing, and pros and cons.

Shopify POS is a popular ecommerce point-of-sale system for businesses that sell products online. But, these merchants can also use the system when considering selling in person, either temporarily during an event or permanently in a brick-and-mortar location.

Why I picked Shopify POS: When planning for the next growth stage of your ecommerce business, you might consider opening an in-person location where your customers can see and feel your products before buying. So, I wanted to kick start this list with Shopify POS because it’s able to handle multichannel sales and connect the inventory from all locations. If you only want to focus on online sales, Shopify POS has you covered because the platform provides integrations to help you sell on social media channels.

Shopify POS Standout Features and Integrations

Features include staff management tools that allow you to track each staff member’s performance and generate customized reports to match your staff training requirements for each team member. Shopify POS also provides a significant number of reports you can develop, such as cash flow, retail sales, discounts, products, and so on, that gives you actionable data to help you optimize short- and long-term operational strategies.

Integrations include connections with tools that will help you enhance your store’s processes and share information between applications, such as ApparelMagic, Ordoro, PartnerStack, PayPal, QuickBooks Commerce, ShippingChimp, Shopventory, SMS Storetraffic, Valigara, Zinrelo, and other software options. If you need to make custom integrations, you can use third-party applications such as Zapier or APIWORX, or Shopify POS’s API to make the connections you need.

Pros and cons

Pros:

- Simple navigation

- Significant number of features

- Easy to use

Cons:

- Not customizable

- No free plan

CAKE is an all-in-one restaurant POS that allows you to handle online ordering, in-house ordering, back of house, and process payments. It is a versatile POS system that helps you create better dining experiences.

Why I picked CAKE: I selected this system because of how versatile it is and the way it seamlessly connects your FOH and BOH. FOH staff can benefit from taking orders at both the POS and from tablets that facilitate mobility. They can even create QR codes for tables to manage their orders from their table and reduce wait times.

Meanwhile, BOH benefits from a mirror system that displays orders for them in the same way they come in. These orders will communicate if the order is a dine-in, to-go, or online delivery so they can handle it accordingly.

Finally, CAKE's self-service kiosk and gift card management capabilities will give your restaurant a whole new dimension and the ability to increase your revenue through different avenues.

CAKE Standout Features & Integrations

Features that I'd like to highlight are its loyalty program and kitchen display system. The loyalty program is great to help increase repeat visits from customers and this particular one does not require loyalty cards. Every time a customer registers, they will provide their email which will be the channel where they'll be receiving points and rewards information. I also had to highlight the kitchen display system as it provides an order management view for the kitchen that mirrors what has been ordered at the POS plus any online order that comes in. This will keep everyone in sync and serving orders FIFO-style.

Integrations are available with 15+ apps, including Quickbooks, Xero, 7shifts, Paytronix, Orca, Uber Eats, Doordash, and CheddrSuite.

Pros and cons

Pros:

- Connects FOH & BOH

- Reduces order errors

- Helps you reduce lines at the counter

Cons:

- Pricing only includes the first hardware terminal

- Loyalty program unlocks in PRO plan

Helcim is a full-service merchant POS system that can handle high sales volumes for ecommerce brands.

Why I picked Helcim: What I believe makes Helcim stand apart from the other options on this list is its ability to handle large sales volumes. Helcim does this by offering competitive rates and discounts for ecommerce businesses with over $25,000 in card transactions. Helcim also provides extensive tools such as merchant accounts, payment gateways, invoicing, and other business management capabilities.

Helcim Standout Features and Integrations

Features include up-to-date inventory management with automated synchronization that helps you set up and manage your product inventory and understand that everything is accurate. Helcim’s reporting feature enables you to learn what your customers want with details such as sales trends, best-selling products, and other actionable insights.

Integrations include efficient connections with popular third-party applications to help integrate payments with your current systems. These integrations include tools such as Foxy.io, Great Exposure, QuickBooks, and WooCommerce.

Pros and cons

Pros:

- Transparent pricing

- Responsive customer support

- No monthly payments

Cons:

- Not many integrations are available

- Complicated dashboard

Clover is a robust point of sale (POS) system designed to simplify transactions for businesses of all sizes. With a focus on efficiency and ease of use, it integrates seamlessly with payment processing, inventory management, and customer analytics, all in one streamlined platform. Clover's flexibility allows for customization according to specific business needs, making it a reliable ally in managing daily operations and enhancing customer experience.

Why I Picked Clover: Clover excels in offering a versatile and intuitive point of sale system that caters efficiently to various business needs. Its strengths lie in seamless payment processing, comprehensive inventory management, and insightful analytics, enabling businesses to streamline operations and make informed decisions. The system's adaptability allows for easy customization with apps and accessories, ensuring that it fits the unique demands of any business, from retail to restaurants. and Integrations

Clover Standout Features and Integrations

Features include its extensive app marketplace, which allows businesses to enhance their system's functionality by integrating a wide variety of third-party applications. From advanced inventory management tools to customer loyalty programs and beyond, Clover's open ecosystem supports a broad array of add-ons, enabling businesses to create a highly customized POS solution that caters to their unique needs.

Integrations include QuickBooks, Mailchimp, Shopify, Gusto, Xero, WooCommerce, Square, Google Sheets, Slack, and TSheets.

Pros and cons

Pros:

- User-friendly interface

- Comprehensive feature set

- Versatility and customization for all business types

Cons:

- Slight learning curve for advanced features

- Limited offline functionality

Best customizable payment solutions tailored to specific business needs

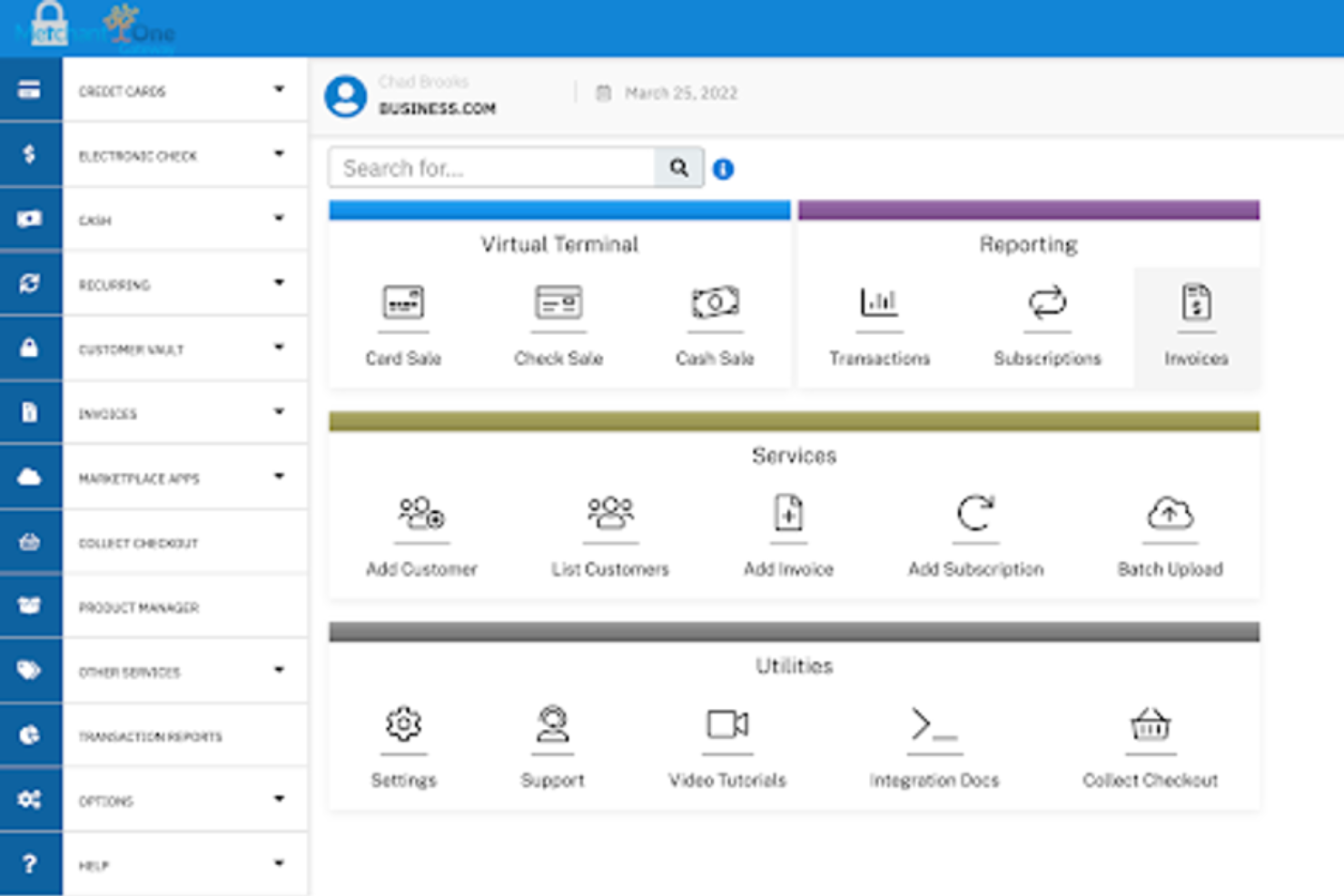

Merchant One is a payment processing tool that specializes in direct credit card processing, providing businesses with a direct link to credit card networks for efficient transaction handling. With over 20 years of experience and serving more than 100,000 customers, Merchant One stands out as a reliable choice for businesses seeking a cost-effective and trustworthy solution for their payment processing needs.

Why I Picked Merchant One: Merchant One excels as an ecommerce POS system by offering seamless integration with online stores, supporting a wide range of payment methods to accommodate diverse customer preferences. It ensures transaction security through strict adherence to PCI DSS standards, protecting both merchant and consumer data. The system is designed for high approval rates, even for high-risk businesses, broadening access to reliable payment processing solutions. With dedicated account management, Merchant One provides personalized support, helping businesses optimize their POS setup and troubleshoot any issues swiftly.

Merchant One Standout Features and Integrations

Features include support for a wide array of payment acceptance channels, including in-store POS systems, online payments, mobile payments, and telephone payments. This versatility ensures businesses can cater to customers regardless of how they choose to shop, providing a cohesive payment experience across all sales channels. Plus, the platform offers detailed reporting and analytics features, giving businesses valuable insights into their sales trends, payment method preferences, and transaction history.

Integrations include Authorize.net, Payeezy Gateway, Payflow Pro, Paytrace Gateway, USAePay, Aloha, Micros, Maitre’D, 1ShoppingCart, BigCommerce, ecwid, Fishbowl, Magento, PrestaShop, Salesforce, and dozens more ecommerce platforms, shopping cart solutions, and sales enablement tools.

Pros and cons

Pros:

- Customizable payment solutions tailored to the specific needs businesses

- Dedicated account managers for each client

- High approval rates for high-risk businesses

Cons:

- Learning curve for advanced features

- Cost cosiderations for smaller businesses

Payment Depot is a merchant services provider that specializes in offering businesses a transparent interchange+ pricing model for credit card processing. This approach is designed to help businesses save on transaction fees by providing a clear and straightforward pricing structure without hidden costs.

Why I Picked Payment Depot: Payment Depot offers a compelling solution for ecommerce POS systems, leveraging its subscription-based pricing and robust integration capabilities to create a cost-efficient and versatile platform for online businesses. The inclusion of a free payment gateway and virtual terminal capabilities, provided through partnerships like SwipeSimple, allows merchants to process payments online, via mobile, and over the phone without incurring additional gateway fees.

Payment Depot Standout Features and Integrations

Key features include subscription-based pricing, free payment gateway, virtual terminal through swipesimple, compatibility with pos systems like clover and vital select, user-friendly interface, support for mobile and ach payments, integration with major ecommerce platforms, no hidden fees, and dedicated customer support

Integrations include OpenCart, PrestaShop, 3dCart, BigCommerce, WooCommerce, Magento, Zen Cart, NCR, Authorize.Net, PayTrace, and others.

Pros and cons

Pros:

- Cost-effective for businesses with high transaction volumes

- User interface is straightforward and intuitive

- Comprehensive equipment offerings

Cons:

- Not ideal for low-volume businesses

- Limited to US-based, non-high-risk merchants

Zoho Creator enables ecommerce businesses to create custom point-of-sale processes without the need for an experienced coder or programmer.

Why I picked Zoho Creator: Zoho is a popular business software vendor that provides applications for many business aspects, and for the purpose of this article, I’ll be focusing on the Creator application. Under the Zoho Creator application, you can use the provided POS app from the App Deck to manage all retail sales data. Zoho Create is fully customizable with a drag-and-drop builder, allowing you to add new functionality and modules to fit your ecommerce needs.

Zoho Creator Standout Features and Integrations

Features include KPI tracking capabilities that will help you make informed decisions after keeping an eye on sales and best-selling products. Zoho Creator can also help you maintain proper inventory levels through its reordering process tools.

Integrations include connections with popular business management platforms to help you pass along vital information and sales data to improve efficiency. These include integrations with systems such as ActiveCampaign, Box, Dropbox, Google Drive, Microsoft OneDrive, Pabbly Form Builder, QuickBooks, Salesforce, WordPress, Workato, and other software options.

Pros and cons

Pros:

- Easy to use

- No code workflows

- Great for small businesses

Cons:

- Integrations are complex

- Customer support needs work

Stripe provides a POS solution that can help ecommerce merchants operate their business in over 135 currencies, making it an excellent option for stores that have a global reach.

Why I picked Stripe: If you have any kind of experience in ecommerce, you’ve likely heard of Stripe. The platform offers a point-of-sale solution that allows you to expand your business globally thanks to its ability to work in an extensive number of currencies. You can also operate in multiple online locations, such as Amazon, Facebook, Etsy, and other marketplace options, as well as on your website.

Stripe Standout Features and Integrations

Features include risk management tools that will help you feel more confident about fighting fraud with a machine-learning fraud system that’s integrated with the payment features. The platform also offers payment management capabilities that help you get paid fast and allows you to manage historical and future deposits.

Integrations include native ecommerce software connections to help you efficiently set up payment processes in your online store and manage them, such as 1Password, Accenture, Bench Accounting, Better Reports, Chargebee, ChartMogul, Databox, Flatly, HubSpot, Jotform, and other software options. You can also use Stripe’s API to create custom integrations with your systems.

Pros and cons

Pros:

- Flexible platform

- No monthly fee

- Easy to use

Cons:

- Support is slow sometimes

- Refunds take a few days to process

Revel Systems helps ecommerce merchants create excellent customer loyalty experiences. The system provides loyalty program tools to help online stores develop ways to build and maintain customer interest.

Why I picked Revel Systems: Convincing customers to keep coming back to your online store can be challenging, so I wanted to add Revel Systems to this article. The platform provides a robust loyalty program for your ecommerce store, allowing buyers to earn points and incentives to shop at your store again. Revel System’s loyalty program also allows you to engage with customers with omnichannel communications, enabling you to connect with them with the perfect offer.

Revel Systems Standout Features and Integrations

Features include customer relationship management capabilities that allow you to sync customers’ experiences and tailor marketing campaigns, as well as store buying history details. Revel Systems is known for reporting and analytics tools that offer multiple reports, allowing you to get an in-depth overview of your store’s performance.

Integrations include simple connections with third-party applications to help your business operate the way you want. These include integrations with systems such as Apicbase, Avero, CheckMate, Compeat, Decision Logic, Envysion, Harri, JoyUp, LoyaltyPlant, Otter, and other software options.

Pros and cons

Pros:

- Easy to learn

- Intuitive interface

- User friendly

Cons:

- Limited reporting

- Complex inventory upload process

Vend can help ecommerce businesses track employee performance and help train staff and get them selling quickly.

Why I picked Vend: The platform is a top choice for onboarding new staff, which is why it’s a top pick on this list, especially if your business is in the expansion stage. Vend’s training mode for new employees allows them to try out the software without getting access to vital details, such as sales history, settings, or status. This feature makes it easy for new staff to familiarize themselves with the platform without jeopardizing your store’s data.

Vend Standout Features and Integrations

Features include tools that allow your customers to split payments or process payments from multiple parties. Vend can also help you increase your bottom line with flexible, brandable gift cards to gain new customers and boost revenue.

Integrations include connections with popular ecommerce applications that provide you with the flexibility you need, such as BigCommerce, Ecwid, HubSpot, Inventory Planner, Lokad, Mailchimp, QuickBooks Online, Shopify, WooCommerce, Xero, and other software options. You can also create custom connections by using Workato or Vend’s API.

Pros and cons

Pros:

- Extensive integrations

- Accurate reports

- Easy to use

Cons:

- Navigation is complex

- Customer support needs work

The Best Ecommerce POS Systems Summary

| Tools | Price | |

|---|---|---|

| Shopify POS | Plans start at $31/month | Website |

| CAKE | From $69 /month | Website |

| Helcim | From 0.50% + $0.25 per transaction | Website |

| Clover | From 2.3% + $0.1 per transaction | Website |

| Merchant One | From $13.95 plus 0.29% + 1.55% per transaction | Website |

| Payment Depot | From $79/month | Website |

| Zoho Creator | From $10/user/month (billed annually) | Website |

| Stripe | From 2.9% + 0.30 per transaction | Website |

| Revel Systems | From $99/month. | Website |

| Vend | From $99/month | Website |

Compare Software Specs Side by Side

Use our comparison chart to review and evaluate software specs side-by-side.

Compare SoftwareOther Options

The following are other ecommerce POS system options that are worth your consideration:

- Erply

Best POS feature set

- Clover POS

Best all-in-one POS system

- Lightspeed Retail

Best for inventory management

- ProMerchant

Best for next-day funding for merchant accounts

- Square Point of Sale

Best for small businesses

- PayPal Zettle

Best for value for money

- Hike POS

Best for lay-pay sales

- Loyverse POS

Best for multi-store management.

- Epos Now

Best for scaling businesses.

- Magento POS

Best for omnichannel sales.

Selection Criteria For Ecommerce POS Systems

Here’s a short summary of the main selection and evaluation criteria I used to develop my list of the best ecommerce POS system for this article:

Core Functionality

These are the basic core functionalities that the software must meet in order to be considered for placement on this list. I like to include this section because POS systems can be quite different when it comes to features or niche customer base, but this is what qualifies them for comparison for my purposes here.

- Ability to accept payments from customers through your ecommerce website, preferably with a variety of sources (credit card, PayPal, Amazon Pay) and currencies available

- Ability to integrate with your ecommerce platform of choice, whether you use Shopify, BigCommerce, WooCommerce, and so on

Key Features

The right ecommerce POS system features will make it easier to operate your online store and simplify transaction processes. Here are some of the features that you should find in an ecommerce POS solution:

- Inventory Management: Some basic POS systems might only support a product catalog, whereas others will track inventory at component or ingredient levels; some tools include purchase ordering and vendor management capabilities to handle reordering processes.

- Customer Management: POS systems will provide varying customer management capabilities; some help you capture basic customer information, such as emails, so you can create email marketing contact lists, and others provide customer relationship management (CRM) tools so you can create customer profiles.

- Loyalty Programs: Your ecommerce POS systems can help you reward your best customers with built-in loyalty features; this tracks customers’ shopping details and enables you to create reward and loyalty programs with that information.

- Employee Management: You can add employees to your ecommerce POS solution and manage their access to features and information with role-based access controls; others have built-in time clocks, allowing employees to use the POS system to clock in and out.

- Reporting: The best POS systems have real-time reports; some are basic with a handful of pre-built reports and limited customization; other systems are advanced with multiple reporting options and filters, allowing you to analyze sales, inventory, customer, and staff data.

- Returns and Exchanges: The customer journey doesn’t end with a purchase, so your POS system will handle returns and exchanges to help your customers return orders and manage the entire process.

Usability

All of your staff will be using your ecommerce POS system, so being able to quickly train them is essential. The platform you choose shouldn’t require advanced technical skills to use effectively. Even the newest user should be able to operate the POS tool without many difficulties.

Software Integrations

The best POS solution will work together effectively with your ecommerce platform and other systems to help you manage your ecommerce store’s operations from the same place. Using separate systems to manage inventory, customers, sales, and other vital processes is expected, but integrating these systems together will reduce errors and frustrations and help you provide excellent customer experiences. When evaluating the tools in this article, I made sure to add as many tools as possible with many native integrations with other standard ecommerce systems and allow you to make custom integrations via Zapier or through an API.

People Also Ask

Here are some of the most frequently asked questions people have when searching for new ecommerce POS systems for their business.

What are the benefits of an ecommerce POS system?

The best ecommerce POS systems provide features and capabilities that make it easier to run your online store. Some of the benefits of using these features include:

- Real-Time Inventory Overview: When operating an ecommerce business, you understand how essential it is to simplify inventory management. Since a POS system can provide a direct overview of your inventory, you don’t have to be concerned about over-selling products and canceling customers’ orders.

- No Manual Data Inputs: By integrating an ecommerce POS system with other systems, you can eliminate manually inputting data and manage product information in one place without having to update it yourself. This can save you time and allow you to focus on other crucial parts of your business.

- More Customer Information: 22% of retailers use customer purchase history to suggest new products; using POS systems in your business will provide you with insights into your customers’ behavior, allowing you to use them to improve customer relationship management.

- Improved Customer Service: Connecting a POS solution to your online store helps you create straightforward experiences for customers. These platforms allow customers to pay in various ways, simplify ordering processes, and integrate marketing strategies such as loyalty programs which can increase customer satisfaction while simultaneously addressing real-time business needs.

What ecommerce POS system is best for small businesses?

The best ecommerce POS system for small businesses is straightforward, easy to use, and provides excellent customer support. From my research, Square meets these qualifications and includes everything you need from a POS solution. Other than point-of-sale capabilities, Square provides a significant number of tools and capabilities to enhance payment processing and other workflows to enhance your customers’ purchasing experience.

How much do ecommerce pos systems cost?

When investing in an ecommerce POS system, there are two main costs to consider – a monthly or annual fee and a payment processing fee. Software plans range from free to $99/month; you might pay for higher-priced plans if you have a significant number of employees or want additional add-on features. The payment processing fees you’ll pay can range from 1.75% to 2.9% per transaction.

Other Payment Software Reviews

These software review lists may complement your search for POS software. I focused on software reviews for payment or payment-adjacent technologies, like fraud prevention or BNPL.

- Ecommerce Sales Tax Software

- Buy-Now-Pay-Later (BNPL) Platforms

- Mobile Payment Solutions

- Ecommerce Fraud Prevention Software

- Ecommerce Accounting Software

The Takeaway

Looking for new ecommerce POS systems can be a difficult task, but the options I added to this article will integrate some of the best ecommerce platforms and provide many features. At the end of the day, choosing the POS solution that fits best with your ecommerce business and provides excellent features that fit your budget is essential. No matter the products you’re selling, or the size of your catalog, the right POS system can be the deciding factor as to whether your business operations run smoothly.

If you need more advice on how to improve your ecommerce business or want more software suggestions to handle other company functions, such as customer relationship management, inventory management, or accounting software, sign up for The Ecomm newsletter.

Related Read: What Is A Payment Gateway & How Does It Work For Your Online Store?