10 Best Ecommerce Fraud Prevention Software Shortlist

Here's my pick of the 10 best software from the 20 tools reviewed.

With so many different ecommerce fraud prevention software solutions available, figuring out which is right for you is tough. You know you want to employ advanced algorithms and data analysis to detect and prevent unauthorized transactions, identity theft, and other types of online fraud—but now need to figure out which tool is best. I've got you! In this post, I'll help make your choice easy, sharing my personal experiences using dozens of different fraud prevention tools with online stores of all sizes, with my picks of the best ecommerce fraud prevention software overall.

What is Ecommerce Fraud Prevention Software?

Ecommerce fraud prevention software is a specialized tool designed to safeguard online businesses against fraudulent activities. It uses advanced algorithms and data analysis techniques to detect and prevent unauthorized transactions, identity theft, and other types of fraud in real-time. The purpose is to scrutinize each transaction, flag suspicious activities, and help businesses avoid financial losses and reputational damage.

Overviews Of The 20 Best Ecommerce Fraud Prevention Software

Here’s a brief description of each ecommerce fraud protection software to showcase each one’s best use case, some noteworthy features, screenshots, and pricing information.

Kount is an identity trust software that uses AI to protect your online store from different types of fraud.

Why I picked Kount: The AI uses a model that evaluates every interaction with your ecommerce store and weighs the risk to give you an estimate of the transaction’s impact on your business. The platform reports each fraudulent action with a safety rating. This rating ranges from .1, which indicates an unsafe transaction, to .99, which is a safe transaction.

Kount offers enterprises an end-to-end fraud detection and protection solution. The platform’s solutions enable businesses to reduce chargebacks and mobile fraud while simultaneously increasing their sales and order reviews. You can use the platform’s customization capabilities to change several data points in the AI’s fraud prevention decisions to align with your desired outcome.

Kount Standout Features and Integrations

Features include digital identity verification, account takeover protection, bot detection, chargeback prevention, friendly fraud protection, adaptive authentication, dispute management, and data on demand.

Integrations BlueSnap, Bizintel 360, Shift4Shop, ResponseCRM, BehavioSec, Ekata, AppHelp, AppWise, Sublytics, Chargeback Gurus, and Kompliant.

Pros and cons

Pros:

- Customer history insights.

- Effective onboarding team.

- In-depth transaction information.

Cons:

- Downloading reports are slow.

- No dashboard customization.

ClearSale is a complete ecommerce fraud protection system that can protect online stores from common cyber crimes such as friendly fraud.

Why I picked ClearSale: The platform provides online stores with the tools and resources to prevent fraudulent chargebacks, including friendly fraud. Friendly fraud is a common cybercrime that involves consumers intentionally making an online purchase which they dispute with their bank. ClearSale uses a combination of fraud analysts and artificial intelligence to collect customer data, analyze risk, and discover fraudulent activity.

ClearSale caters to businesses of any type and size, no matter their geographical location. The platform provides simple, secure, valuable fraud protection to help enterprises to conduct safe and profitable transactions. For every transaction on your store, ClearSales’ human experts will review the purchase process to ensure your business doesn’t receive any false declines.

ClearSale Standout Features and Integrations

Features include false decline protection, artificial intelligence, fraud scoring, order scanning, fraud analysis, chargeback protection and guarantees, data import and export, analytics dashboard, and 2-factor authentication.

Integrations include Bigcommerce, Magento, Vtex, Shopify, Prestashop, WooCommerce, Shift4Shop, Zoey, Volusion, Salesforce, and nopCommerce.

Pros and cons

Pros:

- Automated fraud detection.

- Integration with major ecommerce platforms.

- Easy to learn.

Cons:

- Takes time to approve transactions.

- No clear pricing.

SEON helps ecommerce stores discover fraud patterns to help them get complete control over every order and opportunity. They provide both paid and limited free-forever plans.

Why I picked SEON: It helps businesses improve fraud detection by providing valuable insights into interactions and financial transactions. SEON’s digital footprint technology tells you who they are or aren’t by assessing social networks and digital services. This information can help you discover fraud patterns, and the platform will use this data to give you recommendations based on these patterns.

SEON enables small, medium, and large organizations to identify thieves, carders, and sophisticated cybercriminals. The platform aims to help your company reduce risk throughout your customers’ entire purchasing journey. You can even use the data SEON gathers to dispute chargebacks with your merchant and prove your experience of friendly fraud.

SEON Standout Features and Integrations

Features include risk scores and rues, social media lookup, email analysis, behavior analytics, address profiling, device fingerprinting, machine learning, and collaboration tools.

Integrations include hundreds of third-party systems via SEON’s API. You can also connect through Zapier to unlock more integrations.

Pros and cons

Pros:

- Very easy to use.

- Saves time with fraud investigations.

- Constantly improving features.

Cons:

- Challenging for new users.

- Slow loading times.

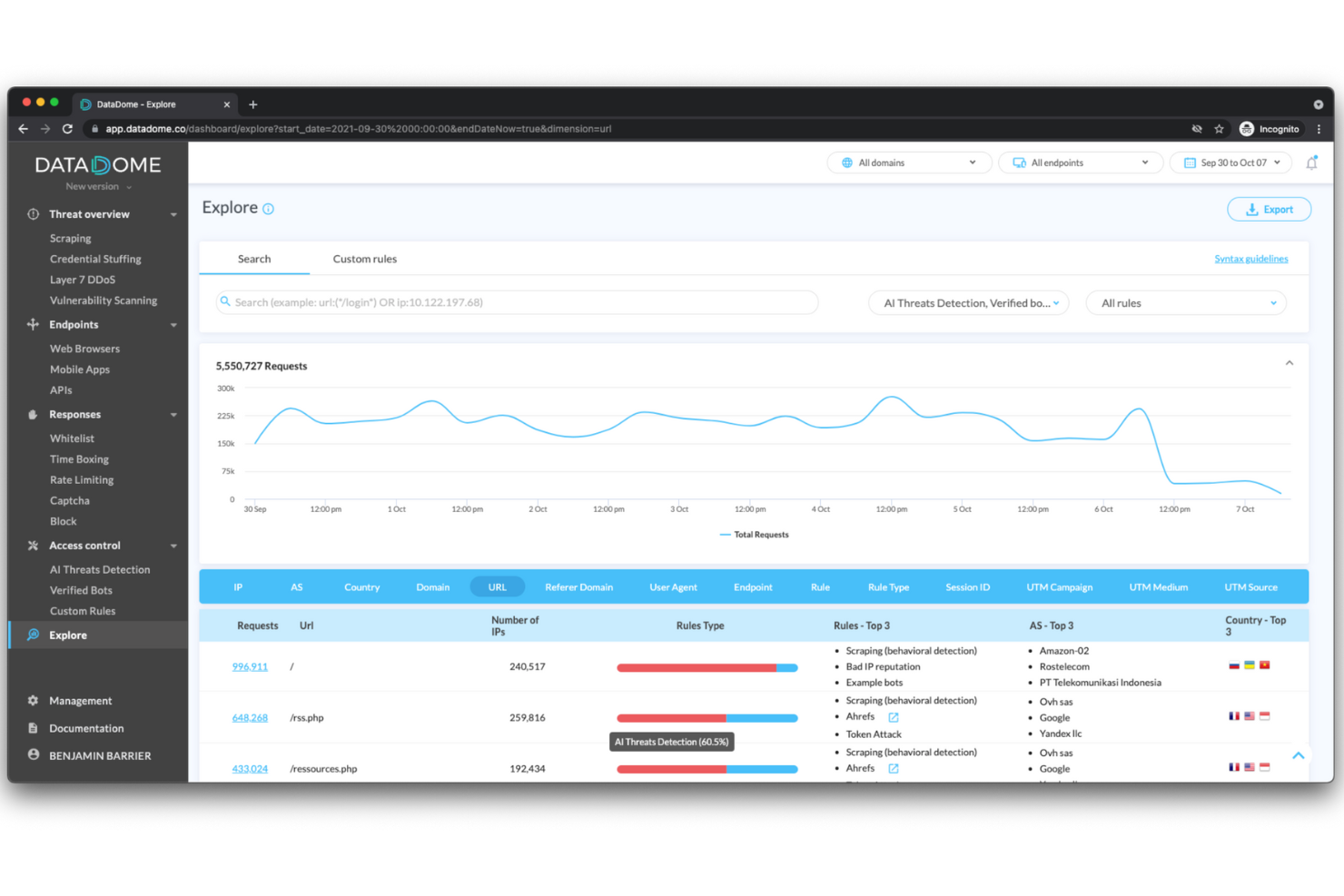

DataDome is an online fraud and bot protection platform that accurately detects attacks.

Why I picked DataDome: The platform enables businesses to identify and prevent real-time bot attacks using pattern databases with machine learning and AI. The anti-bot protection lets business teams manage unwanted traffic from various locations and filter endpoints according to custom rules. DataDome attaches ID tags to your business’s transactions, which you can use to monitor false positives and get daily or weekly reports.

DataDome works for medium and large businesses searching for secure solutions to protect account takeovers, card cracking, and credential stuffing. Their bot detection engine can do this by processing over one trillion data pieces daily. DataDome is scalable and operates anywhere in the cloud, growing with your business and its increased requirements.

DataDome Standout Features and Integrations

Features include web threat management, web traffic reporting, internet usage monitoring, bot detection, activity dashboard, behavioral analytics, DDoS protection, and endpoint management.

Integrations include DataDog, Slack, Splunk, Magento, Kubernetes, Apache, Salesforce, ASP.net, Cloudflare, Fastly, and Microsoft Teams.

Pros and cons

Pros:

- Easy to manage.

- Get started immediately.

- Excellent customer support.

Cons:

- Threat overview lacks context.

- Dashboard is challenging to navigate.

Bolt connects to your online store’s entire checkout experience to analyze multiple data points for accurate fraud decisions.

Why I picked Bolt: The software has a unique fraud detection process that integrates with your checkout user interface and payment processing. It provides excellent visibility into payment lists to collect behavioral data. Bolt uses this visibility to generate over 200 variables to help your store detect fraud.

Bolt helps any business with an ecommerce store protect it from fraud with a 100% fraud coverage guarantee. It also provides tools to help you optimize your checkout process to give your customers an incredible shopping experience while maximizing your revenue. The platform’s merchant dashboard gives you analytic feedback on various metrics in one view, with the ability to export the data to share.

Bolt Standout Features and Integrations

Features include one-click checkout, payment processing, fraud protection, analytics and insights, progressive web app, product page checkout, and dynamic personalization.

Integrations include BigCommerce, Salesforce Commerce Cloud, BigCommerce, Quickbooks, Shopify, Order Desk, JetRails, Volusion, Solidus, and Adobe.

Pros and cons

Pros:

- Nearly 100% uptime.

- Fast account manager response.

- Implements fast checkout times.

Cons:

- Some refunds don’t process.

- Onboarding process is slow.

Arkose Labs provides solutions for rooting out various forms of fraud, such as bot attacks, to ensure you transact with legitimate customers.

Why I picked Arkose Labs: The platform offers businesses a ZeroBot guarantee against various forms of fraud, including automated attacks, website scraping, and scaled new account fraudsters. Arkose Labs implements a unique assurance solution with adaptive step-up challenges. This asks potential customers who show bot-like behavior to complete actions to show they’re human.

Arkose Labs helps businesses of any size in various industries, such as retail, travel, finance and fintech, online gaming and gambling, and technology platforms. It purposely frustrates fraudsters and delivers user-centric account security using enterprise-grade CAPTCHAs to beat persistent bot and fraud attacks. Arkose Labs provides risk assessments, machine learning analytics, and risk insights to help you monitor your fraud prevention efforts.

Arkose Labs Standout Features and Integrations

Features include account takeover prevention, bot and abuse management, micro-deposit fraud, website scraping, payment fraud management, and new account fraud management.

Integrations include Tableau, AWS, Okta, Splunk, and Fastly. The platform offers a flexible API that enables users to create custom integrations with their current systems.

Pros and cons

Pros:

- Insights provide potential risk information.

- Dedicated analyst team.

- Improves user experience.

Cons:

- Latency with synchronous events.

- Dashboards and reports need work.

Unit21 provides ecommerce businesses with an advanced tool to help detect suspicious activity throughout their online store.

Why I picked Unit21: The software provides a straightforward API and dashboard to help you detect advanced risks and fraudulent activity. Unit21’s system comes with over 100 thresh hold-based rules and tools. The vendor has active partnerships with leaders in identity verification, crypto blockchain forensics, adverse media screening, and other security industries.

Unit21 is an excellent option for businesses of all sizes looking to implement data-driven fraud, risk, and compliance decisions. The platform uses various data sources to detect suspicious activity in your online store. Unit21 uses a risk and compliance team to define the fraud rules and workflows, so you don’t need to hire a new engineer to do it for your business.

Unit21 Standout Features and Integrations

Features include identity verification, transaction monitoring, case management, fraud detection, suspicious activity monitoring, compliance management, suspicious activity reporting, and money laundering monitoring.

Integrations include Affirm, Socure, Google Cloud Platform, Gusto, Coinbase, Chime, and Chainalysis. The platform also offers an API to allow businesses to connect the software to their current systems.

Pros and cons

Pros:

- Easily monitor all transactions.

- Provides excellent rule-creation features.

- Regularly accepts new customer ideas.

Cons:

- Difficult to use.

- Long implementation process.

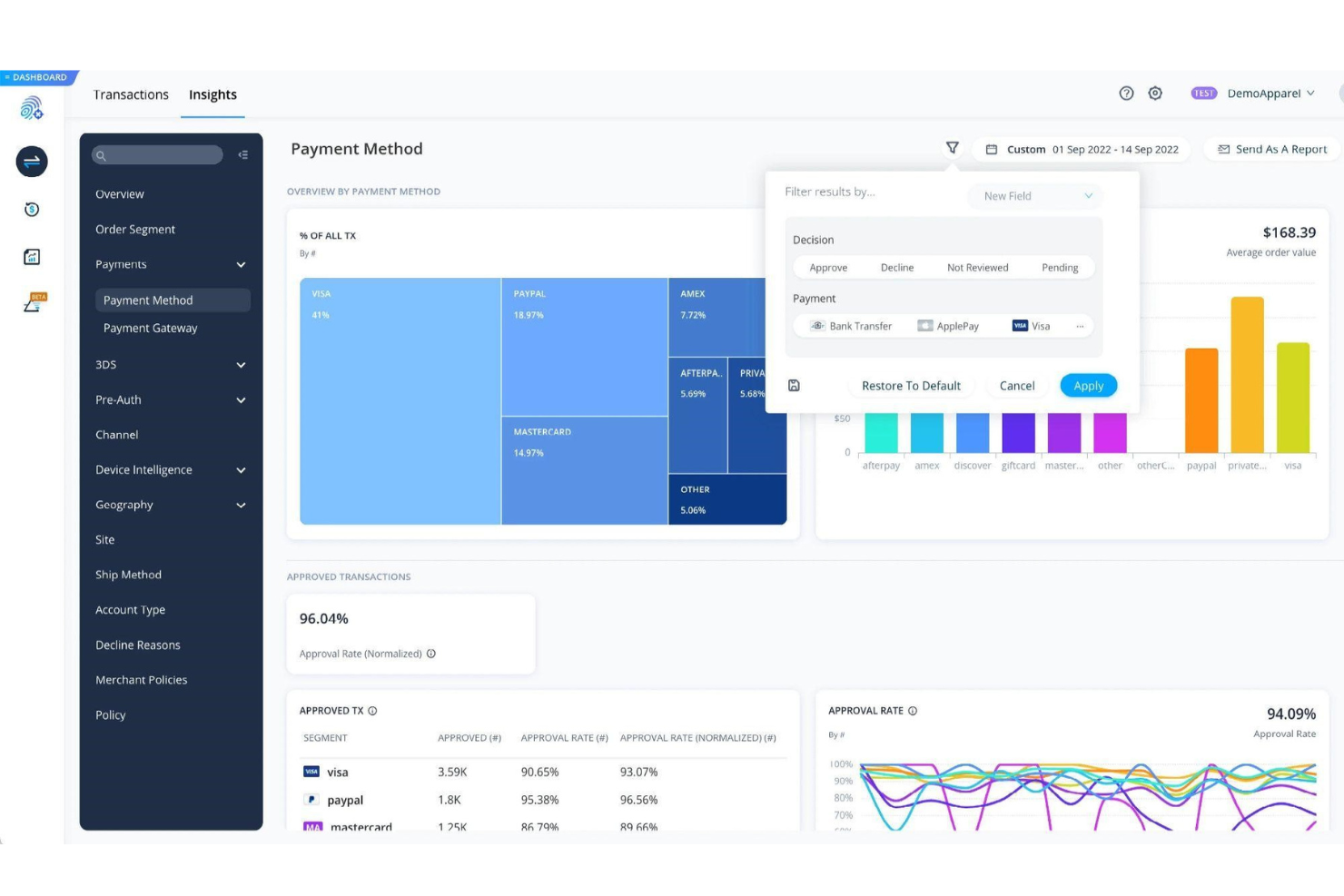

Riskified uses advanced machine learning modeling and fraud protection to protect your customers’ accounts and keep your business safe.

Why I picked Riskified: The platform provides a full suite of conversion-based solutions to help prevent fraud throughout your customer’s experience with your store. The account protection, dynamic checkout, and payment authorization tools help you increase conversions while blocking fraud attempts. Its account takeover prevention solutions can help your business protect its loyalty programs.

Riskified can help businesses of any size safely approve orders, expand globally, and decrease fraud costs. The software becomes more accurate with every order it analyzes, every insight it feeds to the system’s machine learning models, and every new merchant joining your network. Riskified’s teams of developers, researchers, and data scientists constantly work to improve the platform’s performance so your business can experience its full potential.

Riskified Standout Features and Integrations

Features include chargeback protection, accurate fraud reviews, automated dispute resolution, account takeover protection, fake account prevention, unauthorized reseller blocking, fake item not received claim prevention, and transaction risk analysis.

Integrations include Stripe, Shippo, Salesforce, Shopify, Shoplazza, Chargeback Gurus, Cider, and Primer.

Pros and cons

Pros:

- Displays all pertinent information.

- Explains why it denies orders.

- Excellent turnaround time.

Cons:

- Complex API documentation.

- Large learning curve.

Midigator helps businesses simplify chargeback disputes to recover more revenue.

Why I picked Midigator: The software’s advanced technology creates intelligent, custom responses that will have the best possible chance of winning. All you have to do is add order information to the platform’s merchant account data to start matching chargebacks to the original orders, so you can build a compelling case. Midigator will manage the process to improve dispute efficiency and accuracy to help you stay in good standing with your merchant accounts.

Midigator is an excellent option for businesses of all sizes that need ways to simplify payment disputes. You can use the platform to get in-depth data on why customers are initiating chargebacks. By breaking down the details Midigator provides, you can identify underlying reasons for these disputes and solve issues at their source.

Midigator Standout Features and Integrations

Features include chargeback prevention alerts, dispute responses, custom notifications, account reporting, data consolidation, customer responses, and performance tracking.

Integrations include Stripe, Shopify, WooCommerce, ShipStation, Maxio, Worldpay, Sticky.io, Authorize.net, 29 Next, Verifi, Paysafe, and OpenPath.

Pros and cons

Pros:

- Easy to use platform.

- Finds and disputes chargebacks efficiently.

- Simple integrations with systems.

Cons:

- Long onboarding process.

- Load times are slow.

Forter uses a massive database to differentiate real customers from fraudsters with instant yes or no responses.

Why I picked Forter: It’s an automated tool that provides businesses with instant responses that either allow or disallow every transaction. Forter uses a comprehensive database of over 175 million identities to prevent fraudsters from making purchases or performing other cybercrime actions in real-time. The platform uses this rapidly growing database in combination with predictive fraud modeling and research and the ability to allow users to customize the software for their specific business requirements.

Forter is a cloud-based fraud prevention solution for any sized enterprise that provides various fraud prevention solutions. These solutions include payment protection, intelligent routing for automated payment decisions, and policy abuse protection. Forter’s solutions are an excellent match for ecommerce owners in multiple sectors, such as retail, travel, and food and drink.

Forter Standout Features and Integrations

Features include account takeover prevention, multiple account creation blocking, authentication automation, real-time decision-making, instant assessments, identity-based decisions, and policy enforcement.

Integrations include Adobe, Salesforce, SAP, Shopify, Bigcommerce, Shoplazza, Flutterwave, Nuvei, GlobalPayments, FreedomPay, Logicbroker, and Workarea.

Pros and cons

Pros:

- Easy to use.

- User-friendly dashboard.

- Automatic purchase evaluation.

Cons:

- Setup is challenging.

- Doesn’t work on iOS browsers.

The Best Ecommerce Fraud Prevention Software Summary

| Tools | Price | |

|---|---|---|

| Kount | Pricing upon request | Website |

| ClearSale | Pricing upon request | Website |

| SEON | From $299/month | Website |

| DataDome | From $4,190/month | Website |

| Bolt | Pricing upon request | Website |

| Arkose Labs | Pricing upon request | Website |

| Unit21 | Pricing upon request | Website |

| Riskified | Pricing upon request | Website |

| Midigator | Pricing upon request | Website |

| Forter | Pricing upon request | Website |

Compare Software Specs Side by Side

Use our comparison chart to review and evaluate software specs side-by-side.

Compare SoftwareOther Options

Here are a few more options that didn’t make the best ecommerce fraud protection software list:

- Shield

Best for risk management

- Signifyd

Best for fraud event data collection

- Nethone

Best for learning all transaction scenarios.

- Sift

Best for disclosing all customer actions.

- FraudLabs Pro

Best for improving profits by reducing chargebacks.

- Vesta

Best for end-to-end, instant transaction verification.

- Subuno

Best for efficient fraud detection.

- Cybersource

Best cloud-based payment management.

- NoFraud

Best real-time virtual identity verification.

- Simility

Best for adaptive fraud analysis.

How I Selected the Best Ecommerce Fraud Prevention Software

Perhaps you're wondering how I selected the best ecommerce fraud protection software for this list? To build this top 10 list, I evaluated and compared a wide range of ecommerce fraud protection software with positive user ratings.

After determining my long list of top choices, I further honed my list by using the selection criteria below to see how each platform stacked up against the next one. I also drew on my years of ecommerce experience to pinpoint the features that add a lot of value.

Usability:

A significant part of using these tools will be setting up, maintaining, and regularly updating the system. Considering how time-consuming or costly implementing a fraud protection system will be is essential. So, I look for systems that are easy to establish, can deploy quickly, and do not require many resources to set up.

Reporting Dashboards:

Fraud protection systems should provide report dashboards to inform you when it stops fraud from occurring in your store. It should also give you in-depth analytics on your customers’ behavior, such as where they tap their mobile device screens, clicks on their computers, where they access your store from, and their IP addresses. This information can help you identify your customers and confirm whether they’re genuine shoppers or fraudsters.

Handling False Positives:

Many ecommerce stores don’t realize they’re missing a significant number of conversions because of false positive fraud indicators. This means they’re rejecting good customers and preventing them from buying from your store. Many ecommerce businesses don’t realize they can lose out on more revenue due to false positives than to the cost of fraud.

I look for systems that allow users to approve as many legitimate transactions as possible. These systems should use various indicators to determine whether a transaction is authentic. This helps your business capture revenue you would lose out on due to false positives in fraud detection while still filtering out fraudulent transactions.

Software Integrations:

It’s crucial to use a tool that integrates with your other systems well and connects other systems. So, I look for software ensuring your fraud management has the necessary functionality. It should also perform to your standards and remain viable when you need to add new systems to your arsenal.

Pricing:

The best pricing for your business will depend on your needs and what you want from the software. Ecommerce fraud protection software uses various pricing models based on subscriptions, volume, and transactions. Other systems use more complex pricing models that involves flexible pricing based on your industry size, company size, and other varying aspects.

Other Ecommerce Payment Software Reviews

If you are looking for ecommerce fraud prevention software, you might be interested in these related software reviews, as well. They all focus on ecommerce finances, payments, or tax management.

- Ecommerce Accounting Software

- Buy-Now-Pay-Later Platforms

- Ecommerce Sales Tax Software

- Payment Processing Software

- Shopping Cart Solutions

People Also Ask

What is Ecommerce Fraud Prevention Software?

Why Use Ecommerce Fraud Prevention Software?

What are the Key Features of Ecommerce Fraud Prevention Software?

What Other Ecommerce Software Should I Use?

Picking the Right Ecommerce Fraud Prevention Software

Fraud isn’t exciting to deal with when operating an ecommerce business. This is an ongoing battle, and keeping up with the newest scams and schemes is challenging. But, using ecommerce fraud protection software can protect your business from data breaches and financial losses. No one fraud prevention software will solve all of your challenges equally. The best system for your company will depend on your needs and scenario. But luckily, you now have this list to get you started.

If you’re searching for other ways to protect, operate, or market your business to increase revenues, try signing up for our newsletter. Here, you’ll find the latest tips, trends, tools, and insights from ecommerce professionals that can help enhance your online store.