10 Best Ecommerce Accounting Software Shortlist

Here's my pick of the 10 best software from the 20 tools reviewed.

With so many different ecommerce accounting software solutions available, figuring out which is right for you is tough. You know you want to streamline complex accounting tasks such as tracking sales, calculating taxes, managing inventory costs—but now need to figure out which tool is best. I've got you! In this post, I'll help make your choice easy, sharing my personal experiences using dozens of different accounting tools with online stores of all sizes, with my picks of the best ecommerce accounting software overall.

What is Ecommerce Accounting Software?

Ecommerce accounting software is a specialized tool designed for managing the financial transactions and records of online businesses. It automates and organizes sales, expenses, inventory, and tax calculations, integrating seamlessly with various ecommerce platforms and payment processors.

The purpose is to simplify the accounting process, provide real-time financial insights and aid in accurate reporting. It's essential for ecommerce businesses to maintain financial accuracy, comply with tax regulations, and make informed financial decisions, thereby supporting the overall efficiency and growth of the business in the digital marketplace.

Overviews Of The 10 Best Ecommerce Accounting Software

Here’s a brief description of each ecommerce accounting software to showcase each one’s best use case, some noteworthy features, screenshots, and pricing information.

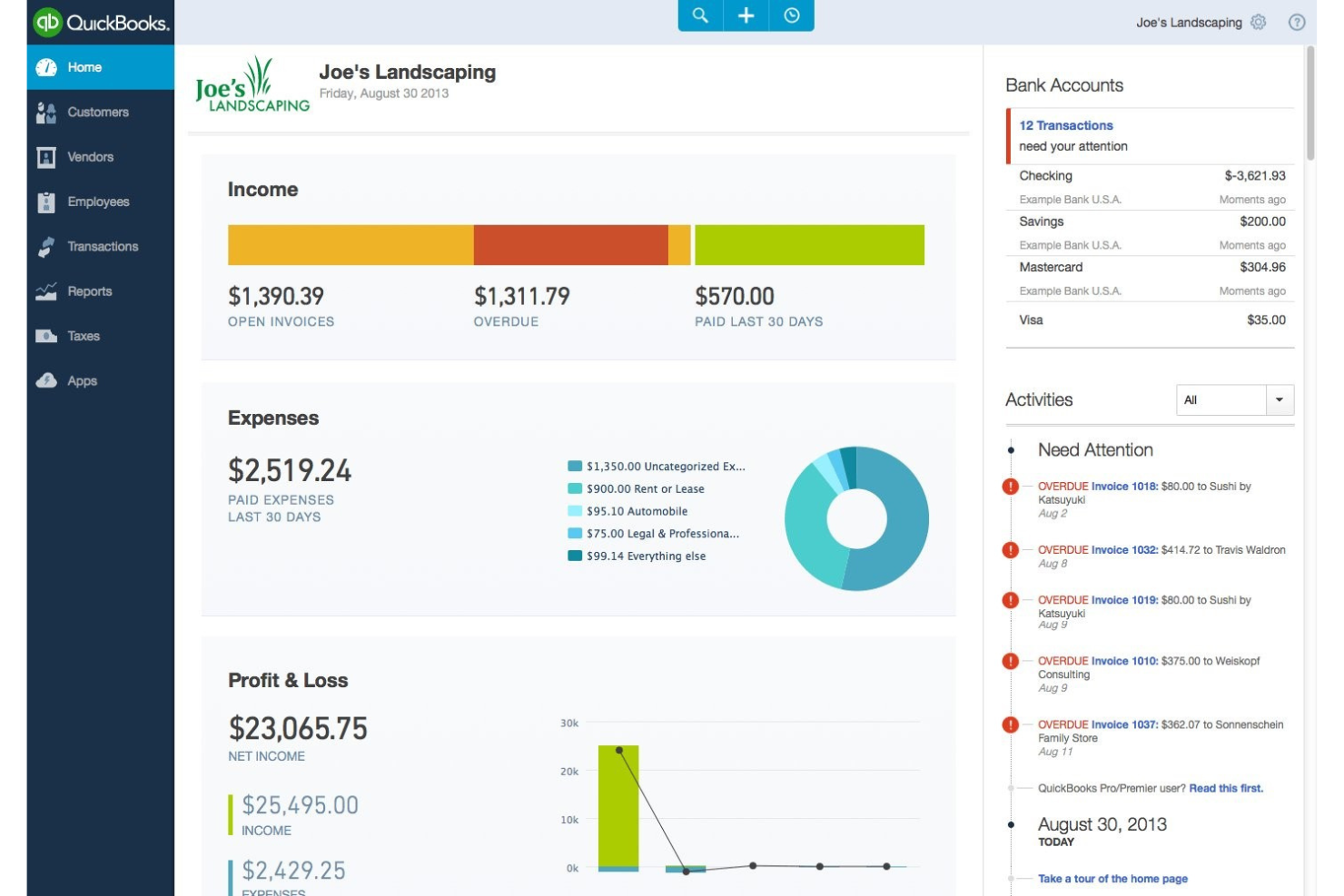

Quickbooks Online provides a comprehensive accounting platform that allows businesses to organize finances from one place.

Why I picked Quickbooks Online: The platform has been around for a long time and provides comprehensive features that will help you manage cash flow and taxes. Quickbooks Online makes it easy for you to manage balance sheets, expense tracking, inventory management, invoicing, and other business essentials. What sets Quickbooks Online apart is its ability to automatically look up sales taxes in different jurisdictions and tell your customers how much they owe in sales tax.

Quickbooks Online is a leading accounting software for small-to-medium-sized businesses that need a platform that provides everything to help manage finances from one place. The software can automatically include all line items, shipping, and tax information on each order from your ecommerce store. Quickbooks Online can also quickly import orders and refunds from your online store into its system and ensure everything is up to date.

Quickbooks Online Standout Features and Integrations

Features include business funding, bill payment and management, expense management, sales tax calculation, contractor payments, cash flow planning, project profitability, financial reports, inventory management, and order tracking and fulfillment.

Integrations include Chargebee, Clockify, Domo, Freshdesk, Hubstaff, Ledgible, Mailchimp, Nutshell, Pipedrive, ProjectManager, Salesforce, Wrike, Zapier, Zendesk, Zoho CRM, and other software options.

Quickbooks Online costs from $30/month when paying monthly or $15/month when paid annually. Quickbooks Online provides a free 30-day trial for new subscribers.

Pros and cons

Pros:

- It’s accessible from anywhere.

- User-friendly interface.

- It automatically backs up financial data.

Cons:

- It offers limited customizability.

- Inconsistent customer support.

NetSuite is a comprehensive, cloud-based software that offers a whole suite of business applications, including ecommerce accounting.

Why I picked Netsuite: I was looking for a tool that could handle all my accounting needs in one place. I needed something that could keep up with the fast pace of ecommerce, and NetSuite seemed to fit the bill. It's designed for businesses of all sizes, so whether you're a small startup or a large corporation, NetSuite has got you covered.

One of the standout features of NetSuite is its real-time financial dashboard. This gives you a bird's eye view of your business's financial health, with up-to-the-minute data on everything from cash flow to sales trends Plus, NetSuite's ecommerce accounting features are pretty robust. It can handle everything from sales tax calculations to multi-currency transactions, which is great if you're selling internationally.

Netsuite Standout Features and Integrations

Features include inventory tracking, forecasting, supplier management, general account ledger, tax management, data import and export, analytics, budgeting, and data visualization.

Integrations include Five9, Concur, Expensify, Kronos Workforce Ready, BambooHR, ProofHQ, Box, Bill.com, Ascentis, Bronto, Boomi, and DocuSign.

Pros and cons

Pros:

- Navigation throughout the platform is easy.

- Remote teams can access the company’s data from anywhere.

- It provides the reports you need to monitor and track transactions.

Cons:

- It provides the reports you need to monitor and track transactions.

- The software can be complex for new users because of the customization options.

A2X helps businesses focus on their ecommerce stores by integrating with a wide variety of third-party applications to automate accounting processes.

Why I picked A2X: The software is a cloud-based ecommerce accounting solution that can help you direct transactional data from sales platforms such as Shopify, BigCommerce, and Amazon. A2X integrates with other popular ecommerce accounting software, such as Xero and Quickbooks, to easily migrate to your financial records. A2X acts as the missing piece that connects these tools to simplify your back office and unlock new opportunities.

A2X helps businesses of all sizes automate their accounting processes. It can properly categorize and summarize all your transaction to give you complete cash flow visibility. A2X can quickly reconcile your payouts from your sales platforms and automatically make the necessary adjustments to your general ledger to ensure financial accuracy and save time in detecting errors.

A2X Standout Features and Integrations

Features include general ledgers, billing and invoicing, bank reconciliation, multi-currency accounting, analytics and reporting, order management, sales tracking and analysis, inventory management, sales channel management, and data synchronization.

Integrations include Amazon, eBay, Etsy, NetSuite, Quickbooks, Sage Business Cloud Accounting, Shopify, Walmart, and Xero.

Pros and cons

Pros:

- It’s easy to use.

- It provides straightforward integrations.

- Excellent user interface.

Cons:

- The setup process has a learning curve.

- Customer support needs work.

Zoho Books is an accounting platform that’s included within the Zoho business management suite.

Why I picked Zoho Books: If you currently use any of the products within Zoho, Zoho Books is another application you can use to manage the accounting side of your business. Zoho Books is a cloud-based accounting platform that can help you manage invoicing, inventory, and expense tracking. It’s an end-to-end accounting solution that can automate financial workflows, so you don’t need to worry about time-consuming tasks.

Zoho Books is suitable for small businesses that need a solution that will scale with them as they grow, but it’s fully capable for medium businesses across any industry. The software can help you manage finances, prepare tax information, and work across multiple departments. Zoho Books also provides convenient reporting tools that enable you to get an overview of your store’s performance.

Zoho Books Standout Features and Integrations

Features include invoicing, estimate creation, customer portals, expense receipts management, bill generation, banking reconciliation, project billing, inventory management, sales orders, purchase orders, sales tax tracking, and automated workflows.

Integrations include Avalara, Campaign Monitor, Contractbook, Dropbox, Evernote, Fundbox, Google Drive, HubSpot CRM, Office 365, Slack, Surepayroll, Twilio, Wrike, Zapier, Zendesk, and other software options.

Pros and cons

Pros:

- Simple user interface layout.

- It’s easy to set up banking feeds.

- Users can customize reports.

Cons:

- Share options need improvement.

- It doesn’t have many advanced features.

Bench is an ecommerce accounting software that provides hands-off financial tools.

Why I picked Bench: The platform is a done-for-you bookkeeping tool that provides the same accounting visual reporting as other options, but it has the bonus of an expert bookkeeper to help you when needed. Bench can help take vital accounting tasks off your hands when you’re having difficulties keeping up with your growing ecommerce store. The vendor has experts to work behind the scenes for you and keep your financial records up-to-date and tax-compliant. Bench also provides expert accounting advice so you can make sense of the reports you see when using the platform.

Bench works for businesses of all sizes that need an all-in-one accounting tool kit. It can connect with the big ecommerce platforms, such as Shopify and BigCommerce. Bench will provide the same accuracy as other options, but the software can save you time because it can handle administrative bookkeeping tasks as well as importing transactions.

Bench Standout Features and Integrations

Features include one-on-one expert support, tax-ready financials, tax filing, financial reporting, expert bookkeeping, custom tax support, cash management, purchase orders, expense tracking, general ledgers, and bank reconciliation.

Integrations include Amazon, BigCommerce, Freshbooks, Shoeboxed, Shopify, Square POS, and Stripe.

Pros and cons

Pros:

- Excellent expense tracking tools.

- Great email and phone support.

- The user interface is easy to use.

Cons:

- There’s a learning curve to preparing reports.

- It doesn’t connect all business accounts.

Yooz is a cloud-based accounts payable automation platform designed to process and approve invoices in real-time.

Why I Picked Yooz: I chose Yooz for ecommerce accounting software after determining its capabilities in providing real-time accounts payable automation based in the cloud. Its distinction lies in being a easy-to-use, cloud-based e-invoicing and purchase-to-pay (P2P) automation solution. It integrates with a variety of ERP and financial systems. The cloud-based system also supports mobile access, handles multiple entities and currencies, offers customizable dashboards, and maintains a user-friendly interface while adhering to security and compliance standards.

The Yooz platform leverages optical character recognition (OCR) technology for Smart Data Capture, enabling automatic extraction of invoice data, which becomes more accurate with each document processed. Additionally, Yooz offers fraud detection capabilities, integrates with over 250 financial systems for data transfer, and provides real-time analytics for insights into accounts payable.

Yooz Standout Features and Integrations

Features include streamlined AP workflows, accounts payable processes, paperless operations, PR/PO creation, AI-based data extraction, and all-in-one P2P automation.

Integrations QuickBooks Desktop Enterprise, Quickbooks Online, Dynamics 365, Xero, SAP Concur, NetSuite, Sage Intacct, SAP Business One, CDK, and MS Dynamics.

Pros and cons

Pros:

- Extremely easy to use software

- Tons of 3rd-party integrations

- Excellent auto matching feature

Cons:

- Can't sort by document date

- Can be difficult to customize the dashboard

Multiview ERP helps businesses break down data silos in their accounting to get more financial visibility.

Why I picked Multiview ERP: The platform is an enterprise resource planning tool that provides you with a single source of truth to enable more visibility in your accounting data. Multiview ERP uses robust features, such as its general ledger capabilities, to give you timely access to the financial information you need. Its business intelligence tools will help you drill down to get the most in-depth finance data from your dashboards and accounting statements.

Multiview ERP is built for any sized business that needs a highly robust accounting tool that’s data-centric. It’s a fully integrated budgeting and forecasting suite that will help you get greater control of data visualizations and forecast accurate financial outlooks. Multiview ERP’s multi-dimensional capabilities provide near-limitless and fully scalable reporting options.

Multiview ERP Standout Features and Integrations

Features include project accounting, general ledgers, fund accounting, accounts payable and receivable, expense tracking, bank reconciliation, billing and invoicing, fixed asset management, cash management, tax management, and purchase orders.

Integrations include ancora Software, Avalara, Azalea EHR, Cerner, EasyVoice, EpicCare EMR, John Daniel Associates, MDI Solutions, Paylocity, Paymerang, and Salesforce.

Pros and cons

Pros:

- Excellent customization capabilities.

- The reports provide a complete information summary.

- Great customer support.

Cons:

- There’s a steep learning curve.

- The navigation is complex.

NetSuite ERP offers ecommerce accounting features for large enterprise organizations.

Why I picked NetSuite ERP: The platform specifically helps large enterprises with its cloud-based financial and accounting features. NetSuite ERP can help your business design, transform, and simplify your accounting operations and processes. The software combines foundational finance and accounting capabilities with robust compliance management. This combination can enhance your store’s performance and efficiency while reducing costs.

NetSuite ERP offers large enterprises features you might not normally find in other accounting software. I can support global accounting processes if your store operates in multiple countries worldwide. The analytics within the NetSuite ERP platform will help you understand what you need to do with your accounting operations and how your actions are helping the company.

NetSuite ERP Standout Features and Integrations

Features include accounts payable and receivable, cash management, billing and invoicing, fixed asset management, tax management, multi-currency accounting, general ledgers, purchase orders, expense tracking, and project accounting.

Integrations include BambooHR, Constant Contact, DealRoom, DocuSign, Domo, Fieldmagic, HubSpot Marketing Hub, Ledgible, Mailchimp, Orange Logic, Project Insight, Recurly, TrueCommerce, Twilio Flex, Zendesk, and other software options.

Pros and cons

Pros:

- Easily adaptable for large teams.

- Adding features is intuitive.

- Easy to use and navigate.

Cons:

- Creating reports is complex.

- Some of the training and guidance aren’t helpful.

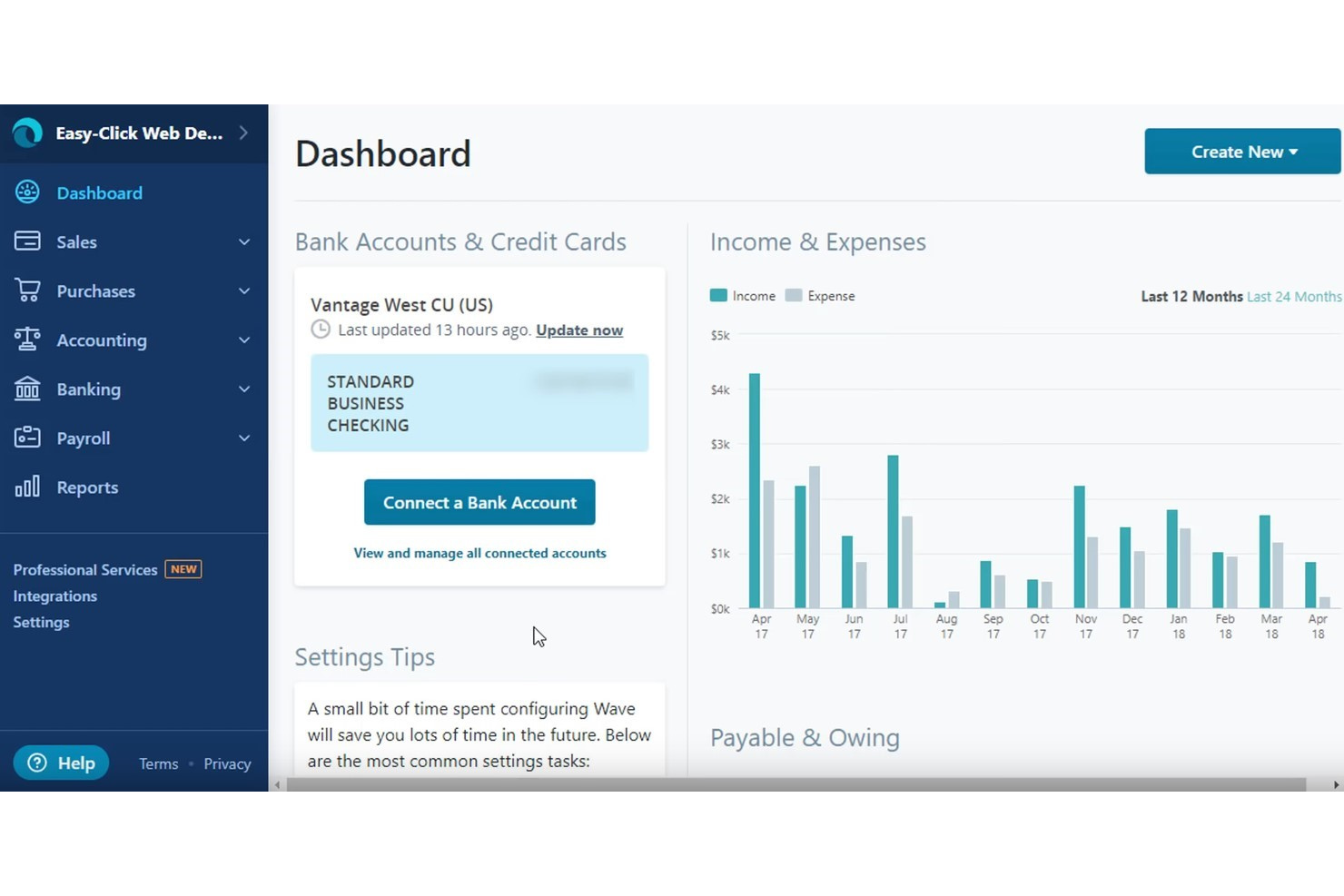

Wave Accounting is a basic accounting platform that’s free for all businesses to use.

Why I picked Wave Accounting: The platform is a popular choice because its accounting and invoicing features are free. Wave Accounting allows you to send unlimited customer invoices, set up unlimited organizations, and track all accounts at no cost. You can also use the bank reconciliation feature to link your bank accounts, PayPal accounts, and other data sources for real-time transaction tracking.

Wave Accounting is an excellent choice for small businesses that need a powerful, free, or low-cost accounting system. It’s capable of simplifying your ecommerce store’s financial accounting, invoicing, and tax returns. However, if customers are paying directly from your invoices, you’re required to pay a percentage.

Wave Accounting Standout Features and Integrations

Features include billing portals, online invoicing, customizable invoices, tax management, payroll management, general ledgers, purchase orders, cash management, expense tracking, fixed asset management, fund accounting, and bank reconciliation.

Integrations include Avaza, Boss Insights, Contractbook, Datameer, Easyflow, Google Drive, HoneyBook, HubSpot CRM, Insightly, Integrately, MinuteDock, Pabbly Connect, Railz, Stripe, Zapier, and other software options.

Pros and cons

Pros:

- Easily manages invoices and yearly accounting.

- It can handle multiple businesses.

- The platform is intuitive and user-friendly.

Cons:

- Users can’t download monthly reports.

- Customer support needs improvement.

Acumatica Cloud ERP provides businesses with accounting tools they can customize to fit their changing needs.

Why I picked Acumatica Cloud ERP: The platform provides extensive customization capabilities that will help you tailor the tool to align with your accounting needs. If you have an experienced developer on your team, you can go further with the customization to tailor your processes and use AI and machine learning technologies to fit your ecommerce store. With Acumatica Cloud ERP, you get a tool that is ready to scale with your business as it grows and integrates with the way your online store works.

Acumatica Cloud ERP is suitable for any sized business that needs an accounting platform that makes all financial data available anytime, anywhere, on any device. With its integrated workflow capabilities, you can gain visibility into financial, project accounting, and inventory management data. Acumatica Cloud ERP also includes the ability to link documents to financial transactions, which will help you simplify information sharing and reduce auditing expenses.

Acumatica Cloud ERP Standout Features and Integrations

Features include order management, expense tracking, billing and invoicing, bank reconciliation, fixed asset management, cash management, accounts payable and receivable, KPIs, sales forecasting, shipping management, and warehouse management.

Integrations include Avalara, BestCPQ, BigCommerce, BudgetEngine, Cleo Integration Cloud, Dropbox, EasyEXP365, HubSpot Operations Hub, Microsoft 365, Paya, Salesforce, ShipMonk, Shopify, Tableau, TrueCommerce, and other software options.

Pros and cons

Pros:

- It’s easy to use.

- The platform is modular.

- Everything is customizable.

Cons:

- Report creation can be complex.

- The search function is confusing.

The 20 Best Ecommerce Accounting Software Summary

| Tools | Price | |

|---|---|---|

| QuickBooks Online | from $22.50/month | Website |

| NetSuite | Pricing upon request | Website |

| A2X | From $19/month | Website |

| Zoho Books | From $15 per month | Website |

| Bench | From $349/month | Website |

| Yooz | Pricing upon request | Website |

| Multiview ERP | Pricing upon request | Website |

| NetSuite ERP | From $99/user/month (min 10 seats, billed annually) | Website |

| Wave Accounting | From $20/month | Website |

| Acumatica Cloud ERP | Pricing upon request | Website |

Compare Software Specs Side by Side

Use our comparison chart to review and evaluate software specs side-by-side.

Compare SoftwareOther Ecommerce Accounting Options

Here are a few more options that didn’t make the best ecommerce accounting software list:

- Kashoo

Best for simplifying ecommerce accounting

- Xero

Best for growing teams

- Sage Intacct

Best for accounting workflows

- Freshbooks

Best for automation

- BlackLine

Best cloud-based accounting automation tool.

- SAP Business One

Best for simplifying key accounting processes.

- TallyPrime

Best for managing multiple accounting functions.

- FreeAgent

Best for simplifying accounting tasks for small businesses.

- FinancialForce

Best for Salesforce users.

- Akounto

Best for managing cash flows.

Other Types of Ecommerce Financial Software

If you’re looking for more ecommerce financial software for your online business, here are a few hand-picked tools lists you should check:

- Buy-Now-Pay-Later Platforms

- Credit Card Processing

- Ecommerce Sales Tax Software

- Payment Processing Software

How I Selected the Best Ecommerce Accounting Software

Perhaps you're wondering how I selected the best ecommerce accounting software for this list? To build this top 10 list, I evaluated and compared a wide range of ecommerce accounting software with positive user ratings.

After determining my long list of top choices, I further honed my list by using the selection criteria below to see how each platform stacked up against the next one. I also drew on my years of ecommerce experience to pinpoint the features that add a lot of value.

Selection Criteria

Here’s a short summary of the main selection and evaluation criteria I used to develop my list of the best ecommerce accounting software for this article:

Core Functionality:

Each ecommerce accounting software should have, at minimum, the following core functionalities in order to qualify for consideration on this list:

- Ability to track money in and money out of a business, and build reports to convey this important to decision-makers

- Ability to handle payroll and the associated taxes or compliance needs

Key Features:

Here are some features the ecommerce accounting platform you implement should have to help you better manage finances:

- Tax Preparation: You can make life easier for you and your accountant with ecommerce accounting software that provides automatic tax calculations, tax reporting, and multiple tax rates.

- Bookkeeping: High-quality accounting software will handle many daily bookkeeping tasks, such as updating ledgers, bank reconciliations, asset depreciation and amortization tracking, and managing payroll and deductions.

- Financial Reporting and Projections: Your ecommerce accounting software will hold financial data and allow you to use this information to create reports and make projections to give you beneficial business intelligence.

- Accounts Receivable: Ecommerce accounting solutions can handle billing and track what customers owe and payments.

- Invoice Processing: The accounting platform you use should, at the very least, be able to handle invoicing, including printing invoices and maintaining basic customer information records, such as names, addresses, and account numbers.

- Variable Wage Schedules: Whether your team is salaried or you pay them by the hour, the platform you choose should accurately calculate what you owe them, including benefits.

- Bank Account Reconciliation: If your business has multiple bank accounts, it’s essential to use accounting software that can keep track of them and reconcile them using a general ledger function and checkbook reconciliation.

- Shipping Tools: These can save you a lot of time by simplifying the shipping process with shipping labels, shipping cost estimations, and shipment tracking tools.

- Inventory Tracking: Ecommerce accounting software that can manage stock and inventory levels and track inventory can help you ensure you don’t over or under-order products.

Usability:

Any ecommerce software should be easy to learn, use, and navigate. Ecommerce is unique in that you need many software, systems, and tools to keep things up and running. If even one of them is a pain to learn and manage, then it slows the whole process down. Ecommerce accounting software should follow this same guideline. I look for software that has robust training materials, helpful customer support, and an intutive user interface.

Software Integrations:

Even with the most feature-rich, reasonably priced application at your disposal, it won’t be very helpful to your ecommerce store if the software can’t integrate with your current systems. The software you choose should integrate with third-party solutions such as ecommerce store builders, shipping systems, and payroll applications. Using ecommerce accounting software that works with your current tech stack will ensure you don’t experience any compatibility difficulties that result in possible time-consuming errors.

Value for Price:

It’s important to use an ecommerce accounting solution that provides the features you need at an affordable price and can scale as you grow. You’re going to want a platform that you can continue to use without worrying about switching to a new one. Many tools use tiered pricing that allows you to start using the software at an affordable level and enables you to make a simple transition to a more advanced level down the road. You should use programs that will allow you to pay only for what you need and make it easy to customize your subscription without spending more than necessary.

People Also Ask

Here are some popular questions that people ask when searching for new ecommerce accounting software with answers for your convenience.

What are the benefits of ecommerce accounting software?

Whether you’re starting your first ecommerce business or your company has been operating for years, there are many benefits of using ecommerce accounting software. Here are some of the benefits of using ecommerce accounting software for your organization to keep in mind.

- Saves Time: Any good ecommerce accounting platform will automate processes, such as invoicing and payment reminders that include online payment links. If an error does occur, the platform will automatically send you a notification and highlight what went wrong. Automation can eliminate manual processes, save time, and improve accuracy.

- Financial Visibility: When managing your business’s finances, the software you use will provide a simple way to pull financial reports. Your accounting platform makes it easy to gather your financial reports and information, such as accounts receivable or trial balances.

- Syncs All Financial Data: It can take a long time to go back and forth between platforms to collect essential data if it’s stored across multiple platforms, such as bank accounts, payroll services, and credit card accounts. Your ecommerce accounting software will sync all data from online accounting tools via API. This means you don’t have to download financial information from each source and spend time with data entry to create a complete financial record.

- Enhances Decision-Making: Your accounting platform will help enhance your decision-making process by providing visibility into your company’s real-time data and key metrics, such as customer purchase rates, revenue, inventory levels, and product sales. This information can define your business’s financial health. A higher level of insight and control can create a solid foundation for making critical business decisions.

- Organizes Records: Sloppy business financials is the last thing you want to see. Your ecommerce accounting software will help organize your accounting records. This platform will easily organize your accounts, invoices, receipts, and other financial records – now, you won’t have to scramble to find the information you need.

Can you use Shopify as an accounting software?

If you’re considering using Shopify for your accounting processes, there are some limitations to keep in mind. Shopify isn’t an accounting platform; it’s an ecommerce system, which means that you can use it to monitor sales and inventory, but you can’t do things like create invoices or manage accounts receivable. As your business grows when using Shopify, you should start thinking about integrating the platform into one of the ecommerce accounting software I listed above to ensure you have everything you need to ensure you maintain proper financial records and perform vital accounting processes.

Is there any free ecommerce accounting software?

Small businesses or startups may benefit from free accounting software. An example of this is Wave Accounting, which offers accounting software, invoicing software, or US-only banking software as a forever free service. Another example is Zoho Books, which offers a free forever plan tier for company revenue under $50,000 per fiscal year.

Better Businesses with Ecommerce Accounting Software

Now that you have a better understanding of the different ecommerce accounting software for your business, you can say goodbye to bundled paperwork and complex spreadsheets. The accounting tools above will handle many of the aspects you need to manage your accounting and bookkeeping for your company. As you learned, choosing the best accounting platform that meets your requirements will automate your tasks and help you make better data-driven decisions to help your business grow.

Now that you know what to consider when searching for the best ecommerce accounting software, you can make the best choice for your online store. If you need more software suggestions or ecommerce business advice, sign up for The Ecomm Manager newsletter. When you sign up, you will receive the latest and greatest software lists and expert advice that can enhance your online store’s operations.