10 Best BNPL Apps Shortlist

Here's my pick of the 10 best software from the 14 tools reviewed.

With so many different buy-now-pay-later platforms available, figuring out which is right for you is tough. You know you want to aids shoppers in affording items by spreading the cost over time, making it easier to budget for more expensive purchases—but now need to figure out which tool is best. I've got you! In this post, I'll help make your choice easy, sharing my personal experiences using dozens of different BNPL platforms with online stores of all sizes , with my picks of the best buy-now-pay-later platforms overall.

Why Trust Our Reviews

We’ve been testing and reviewing ecommerce software since 2018. As ecommerce managers ourselves, we know how critical, and difficult it is to make the right decision when selecting software.

We invest in deep research to help our audience make better software purchasing decisions. We’ve tested more than 2,000 tools for different ecommerce use cases and written over 1,000 comprehensive software reviews. Learn how we stay transparent & our software review methodology.

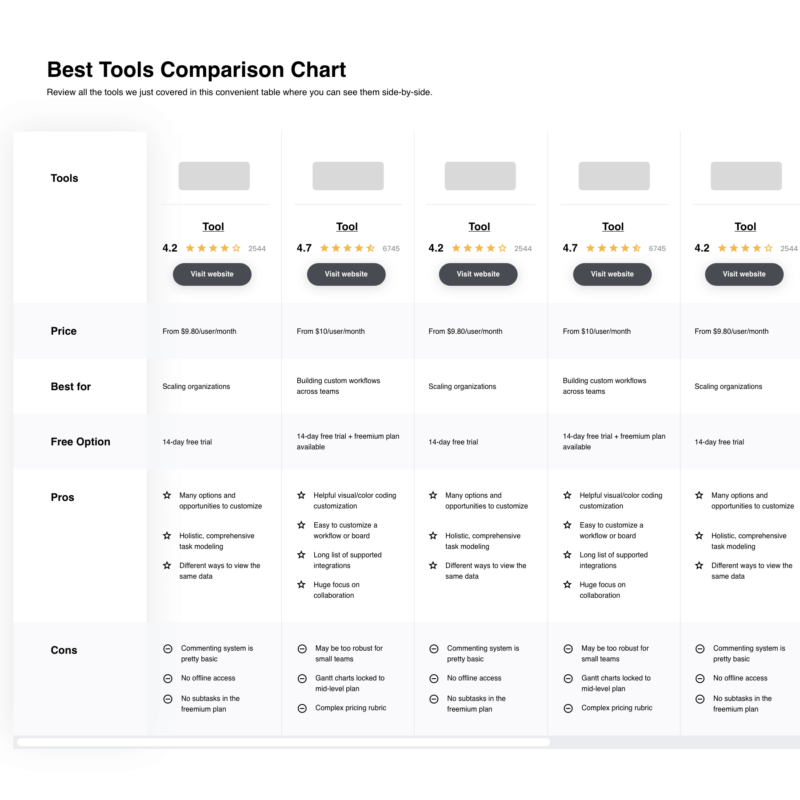

The Best BNPL Platforms Comparison Chart

| Tools | Price | |

|---|---|---|

| Four | Pricing upon request | Website |

| Humm | Pricing upon request | Website |

| Splitit | From 1.5% of each transaction and an additional $1.50 per installment | Website |

| Wisetack | Pricing upon request | Website |

| Sunbit | Pricing upon request | Website |

| Afterpay | Pricing upon request | Website |

| Uplift | Pricing upon request | Website |

| Sezzle | Pricing upon request | Website |

| Affirm | Pricing upon request | Website |

| Paypal’s “Pay-in-Four” | No price details | Website |

Compare Software Specs Side by Side

Use our comparison chart to review and evaluate software specs side-by-side.

Compare SoftwareHow to Choose BNPL Platforms

With so many different BNPL platforms available, it can be challenging to make decisions on what BNPL platforms is going to be the best fit for your needs. As you're shortlisting, trialing, and selecting BNPL platforms, consider the following:

- What problem are you trying to solve - Start by identifying the buy-now-pay-now feature gap you're trying to fill to clarify the features and functionality the BNPL platforms needs to provide.

- Who will need to use it - To evaluate cost and requirements, consider who'll be using the software and how many licenses you'll need. You'll need to evaluate if it'll just be the ecommerce team, or the whole organization that will require access. When that's clear, it's worth considering if you're prioritizing ease of use for all, or speed for your ecommerce software power users.

- What other tools it needs to work with - Clarify what tools you're replacing, what tools are staying, and the tools you'll need to integrate with, such as accounting, CRM or HR software. You'll need to decide if the tools will need to integrate together, or alternatively, if you can replace multiple tools with one consolidated BNPL platforms.

- What outcomes are important - Consider the result that the software needs to deliver to be considered a success. Consider what capability you want to gain, or what you want to improve, and how you will be measuring success. For example, an outcome could be the ability to get greater visibility into performance. You could compare BNPL platforms features until you’re blue in the face but if you aren’t thinking about the outcomes you want to drive, you could be wasting a lot of valuable time.

- How it would work within your organization - Consider the software selection alongside your workflows and delivery methodology. Evaluate what's working well, and the areas that are causing issues that need to be addressed. Remember every business is different — don’t assume that because a tool is popular that it'll work in your organization.

Best BNPL Platforms Reviews

Here’s a brief description of each buy-now-pay-later platform to showcase each one’s best use case, some noteworthy features, screenshots, and pricing information.

Four enables businesses to reach more customers through alternative payment applications such as Google and Apple Pay.

Why I picked Four: The platform doesn’t require your customers to leave your website to sign up and break down their purchase payments. Instead, it offers a simple buy now button and allows your customers to continue their purchase journey on your site, which can increase customer loyalty and decrease abandonment rates. It integrates with many digital wallets, such as Google and Apple Pay, to help your store reduce friction rates throughout the purchase process.

Four doesn’t require your customers to go through a credit check when buying your products, and they get an instant decision from the vendor. When using Four, you can customize their widget and checkout to match your brand’s theme to ensure your customers are purchasing from your business.

Four Standout Features and Integrations

Features include one-click checkout, a shopper portal, fast integration, a customizable interface, order and refund management, order tracking, customer spending analytics, and flexible payment processing.

Integrations include WooCommerce, Shopify, and Shopify Plus.

Four offers custom pricing upon request. Four offers a free demo to help you determine if the platform is right for you.

Pros and cons

Pros:

- Increased conversion rates.

- Simple Shopify integration.

- Easy order tracking.

Cons:

- Customer service needs improvement.

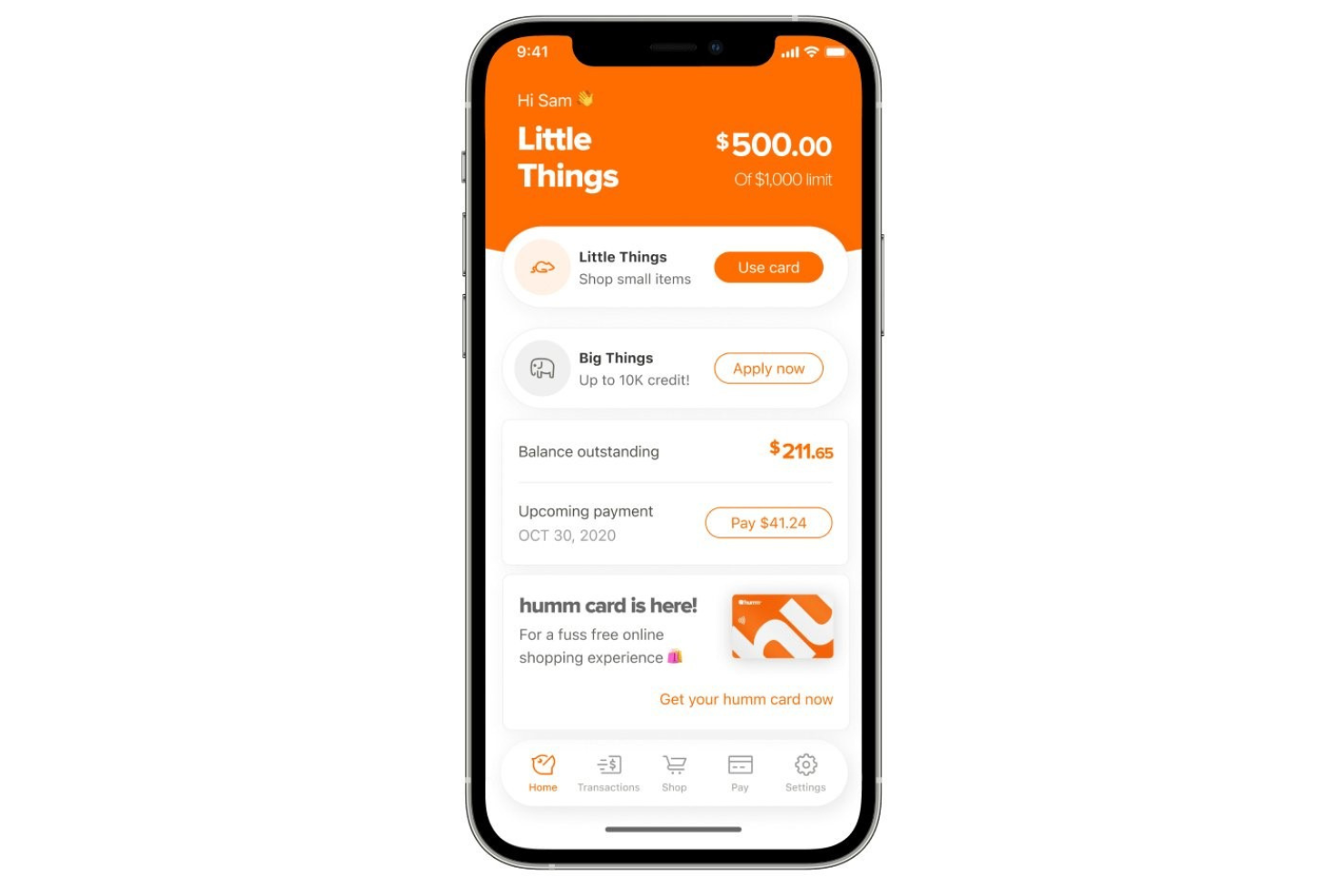

Humm is a BNPL platform that helps customers break up significantly large purchases.

Why I picked Humm: As it says on the Humm website, this BNPL helps your customers buy “big things.” They help break down any purchase up to $30,000! Your customers can spread these payments out over five or ten payments every two weeks or up to 60 months for more significant purchases.

Humm guarantees to settle their payment upfront with your business the next business day. This can be significant if you’re a smaller business that relies on these payments. Also, if a customer returns an item to your store, Humm will return their fee on the items.

Humm Standout Features and Integrations

Features include flexible repayments, soft credit checks, and online and in-store purchase processing.

Integrations include Salesforce, Shopify, WooCommerce, Magento, Striven POS, PrestaShop, OpenCart, Kitomba, Retail Directions, Shopify Plus, Intershop, and eStar.

Humm offers custom pricing upon request.

Pros and cons

Pros:

- Customers can make large purchases.

- Direct REST API.

- Simple sign-up process.

Cons:

- Customer support needs work.

- High customer fees.

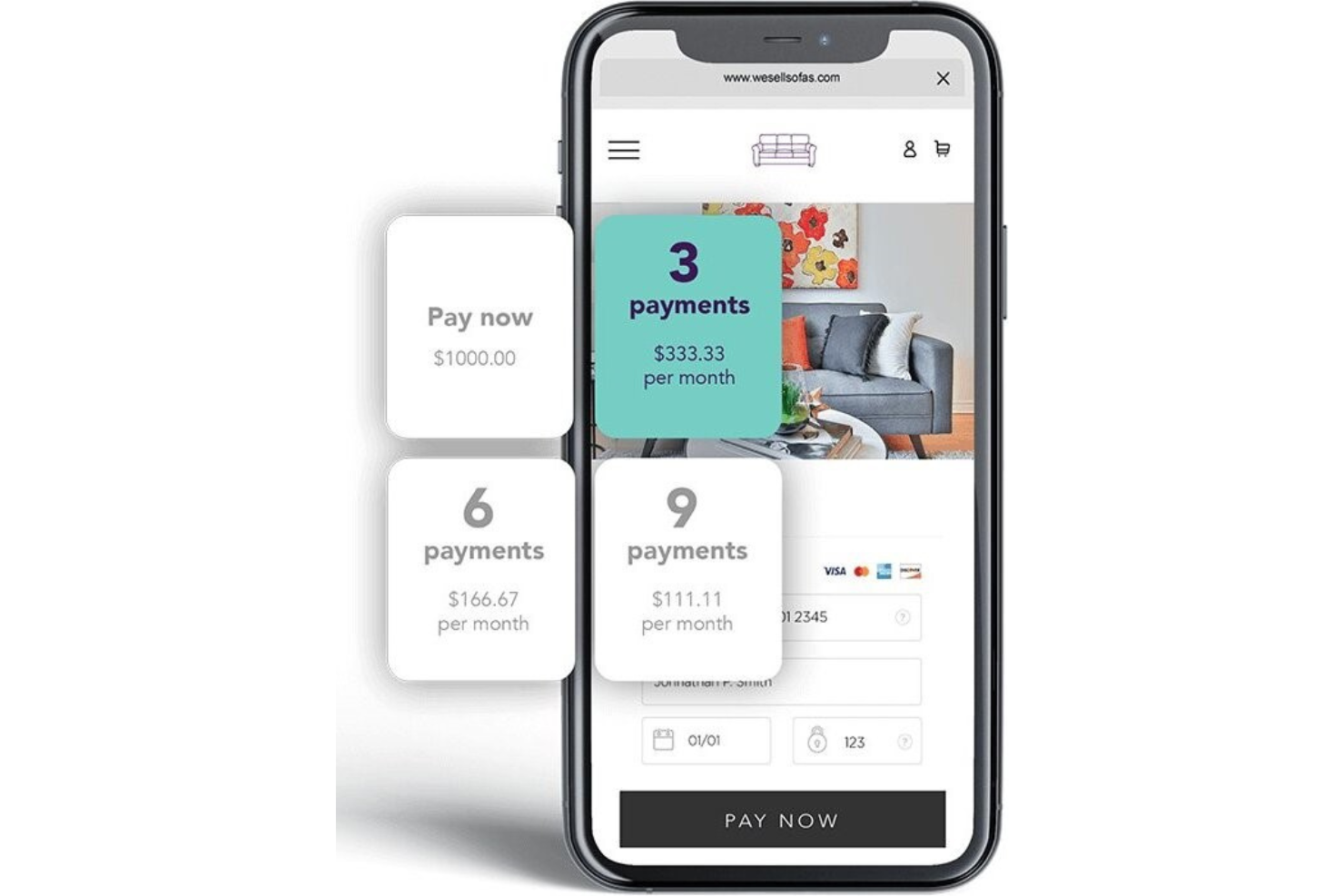

Splitit helps ecommerce businesses offer installment payments to customers from their own websites.

Why I picked Splitit: You can use the platform to take control of the entire purchase journey with its white-label features. It puts your brand at the center, allowing you to increase brand loyalty. The entire buy-now-pay-later process is embedded on your website.

Splitit doesn’t acquire your customers to cross-sell them - your customers remain your customers, not theirs. You can use the platform to customize your customers’ experience, including control over how often you want them to make payments and whether you require a down payment. Splitit authorizes the purchase’s full amount on your customer’s credit cards and reserves the balance from their card until they make the final payment.

Splitit Standout Features and Integrations

Features include PCI compliance, reporting and analytics, in-person payments, debit and credit card processing, and point of sale.

Integrations include Shopify, PayPal, WooCommerce, BlueSnap, Magento, BigCommerce, PrestaShop, Authorize.net, WorldPay, Adyen, and Wix.

Splitit costs from 1.5% of each transaction and an additional $1.50 per installment. They invoice your business every month.

Pros and cons

Pros:

- Low merchant fees.

- Intuitive set-up.

- Easy-to-use dashboard.

Cons:

- Customers need available credit before purchase.

- Issues with foreign banks.

Wisetack enables businesses to give customers transparent payment options for subscription-based products and services.

Why I picked Wisetack: The platform plugs into your current website and checkout process to enable your business to give customers payment installment options for services like subscription boxes or streaming services. Wisetack BNPL (Buy Now, Pay Later) is a financing solution that allows ecommerce businesses to offer their customers the option to pay for their purchases in installments instead of a lump sum payment. By integrating Wisetack BNPL into their ecommerce platform, businesses can offer their customers the flexibility to pay over time and potentially increase customer loyalty and sales.

Wisetack BNPL also offers various benefits to the businesses themselves, including reduced cart abandonment and improved cash flow, as customers are more likely to complete their purchase when given the option to pay in installments. Additionally, Wisetack BNPL provides businesses with valuable insights into their customers’ spending habits, helping them make informed decisions about inventory, marketing, and other business operations. Overall, Wisetack BNPL can be a valuable tool for ecommerce businesses looking to increase sales, retain customers, and improve their overall financial health.

Wisetack Standout Features and Integrations

Features include consumer financing, fast customer approvals, debit and credit card processing, and immediate payments.

Integrations include an API that integrates with your current systems.

Wisetack offers custom pricing upon request. Wisetack doesn’t have any free trial information.

Pros and cons

Pros:

- Excellent coordination with the vendor.

- Easy integrations.

- Payment term controls.

Cons:

- Fees can be high.

- Must wait to receive funds.

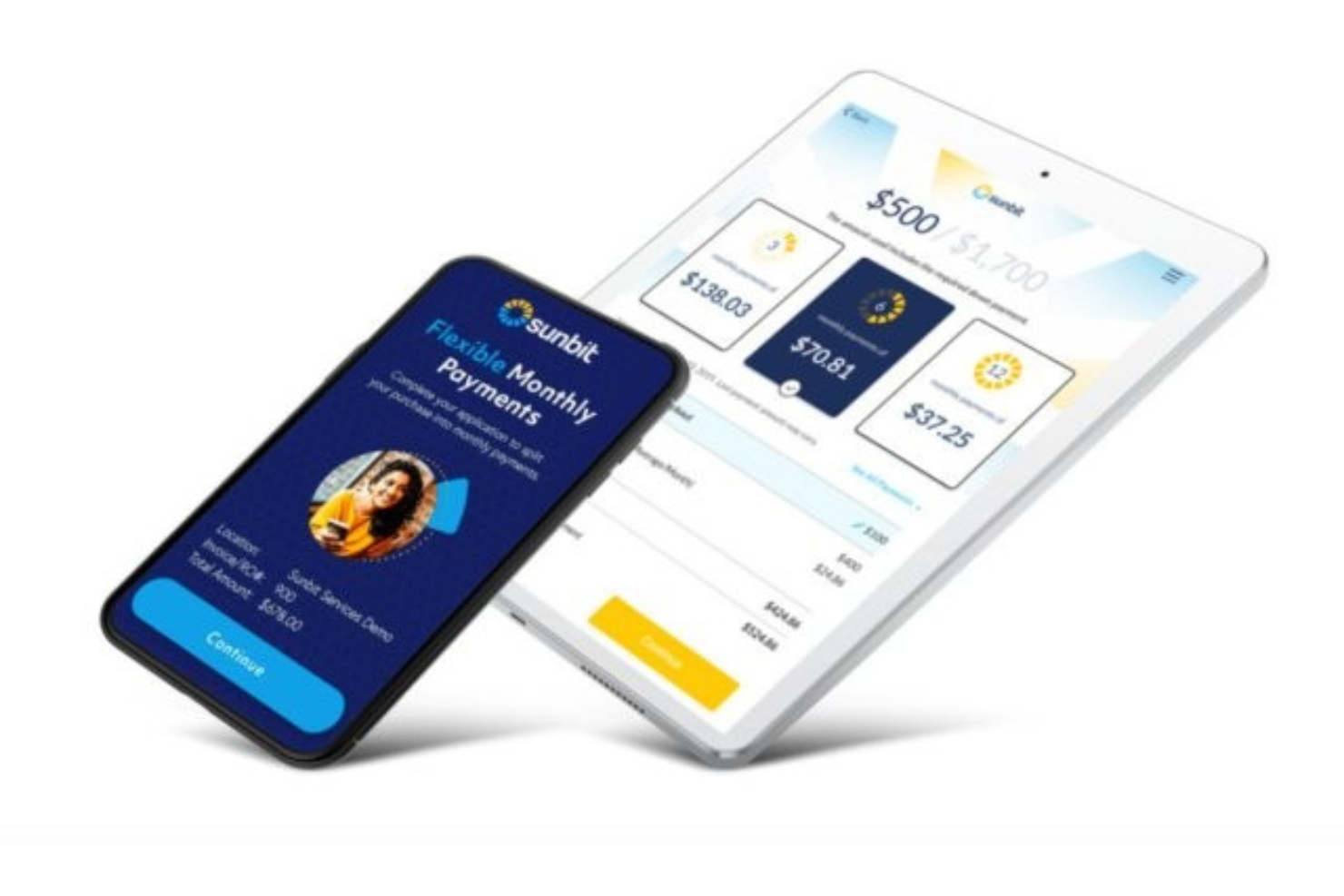

Sunbit helps you break down payments of your essential services for customers.

Why I picked Sunbit: Unlike other platforms that focus on merchants selling nonessential items, Sunbit sets itself apart by enabling businesses to offer installment options for in-person services, such as car repairs, eye doctor appointments, or veterinary care. It helps you soften the financial blow of your essential services for your customers. But, where it really shines is your business will now have a competitive because you can offer services to customers who might not have good credit.

Sunbit helps businesses that provide essential services to their customers and make them more affordable. With this platform, you can enable customers to pay for more of your services, up to $10,000, with a 3-to-12-month installment duration.

Sunbit Standout Features

Features include high approval rates, a quick application process, a partner success team, digital marketing resources, and actionable insights.

Sunbit offers custom pricing upon request. Sunbit offers a free demo.

Pros and cons

Pros:

- Easy to use.

- Caters to in-person businesses.

- Excellent omnichannel solution.

Cons:

- Must apply to discover costs.

- Requires a down payment.

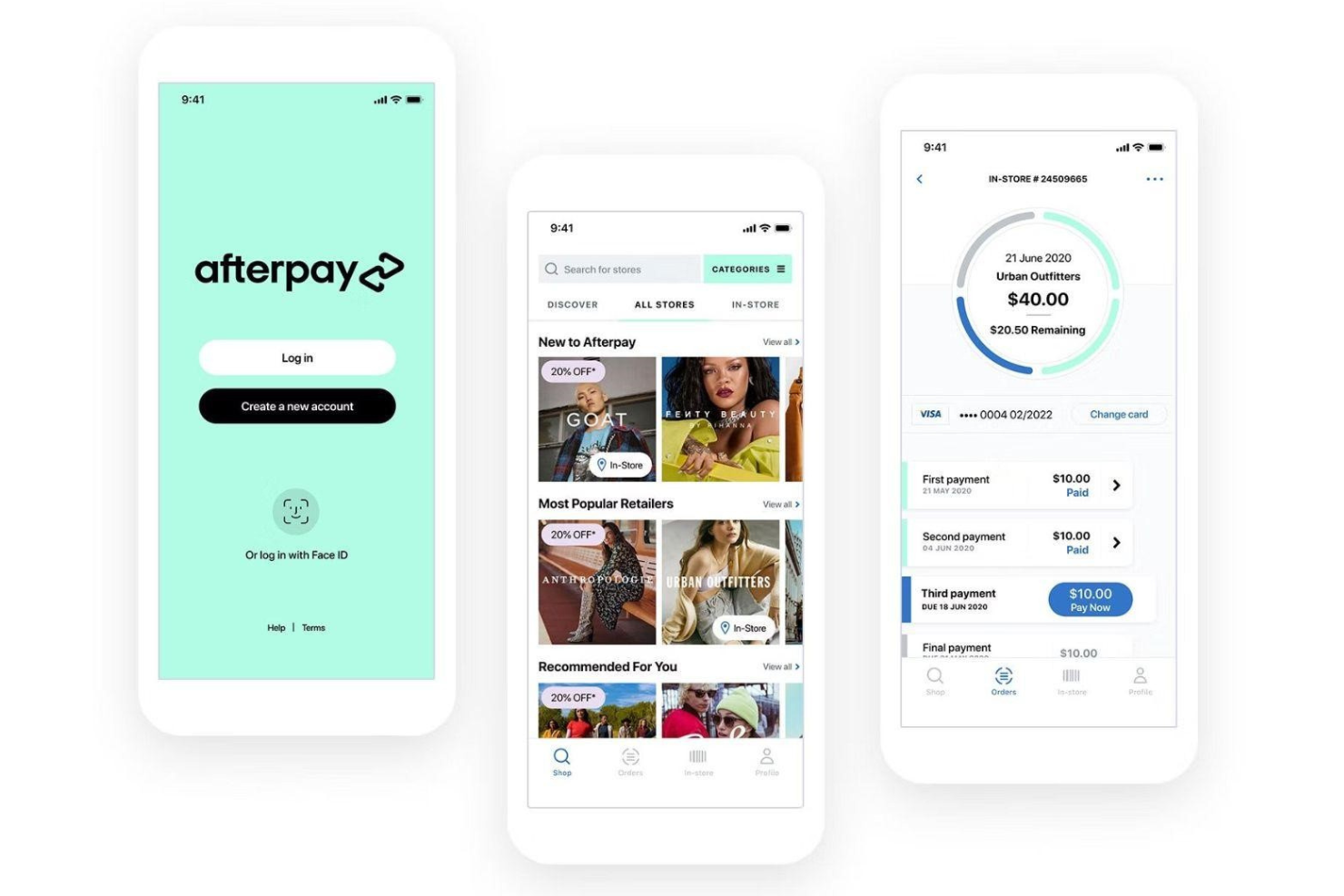

Afterpay provides a credit limit for your customers to make purchases on your ecommerce store and provides rewards for responsible spending.

Why I picked Afterpay: The platform sets sensible and transparent initial spending credit limits for those new to using Afterpay when buying products. This initial limit can increase when customers make their payments on time. The vendor also provides tips to help customers spend responsibly.

Afterpay works for retailers with online storefronts and in-store purchasing options. It has a simple, built-in integration with Square, which makes it easy to offer BNPL options from a Square POS system. You can also order a marketing kit from Afterpay to help you let your customers know you accept Afterpay as a payment option.

Afterpay Standout Features and Integrations

Features include ACH payment processing, fraud detection, electronic payments, data security, mobile payments, credit card processing, subscription billing, and transaction history.

Integrations include Ecwid, CS-Cart, Shopify, Wix, WooCommerce, Synder, Magento, BigCommerce, Cloud Funnels, Propeller, BridgerPay, and Salesforce Commerce Cloud.

Afterpay offers custom pricing upon request.

Pros and cons

Pros:

- Easy to use.

- No customer credit checks.

- Excellent support for merchants.

Cons:

- Some retailers can be denied.

- High interest on late payments.

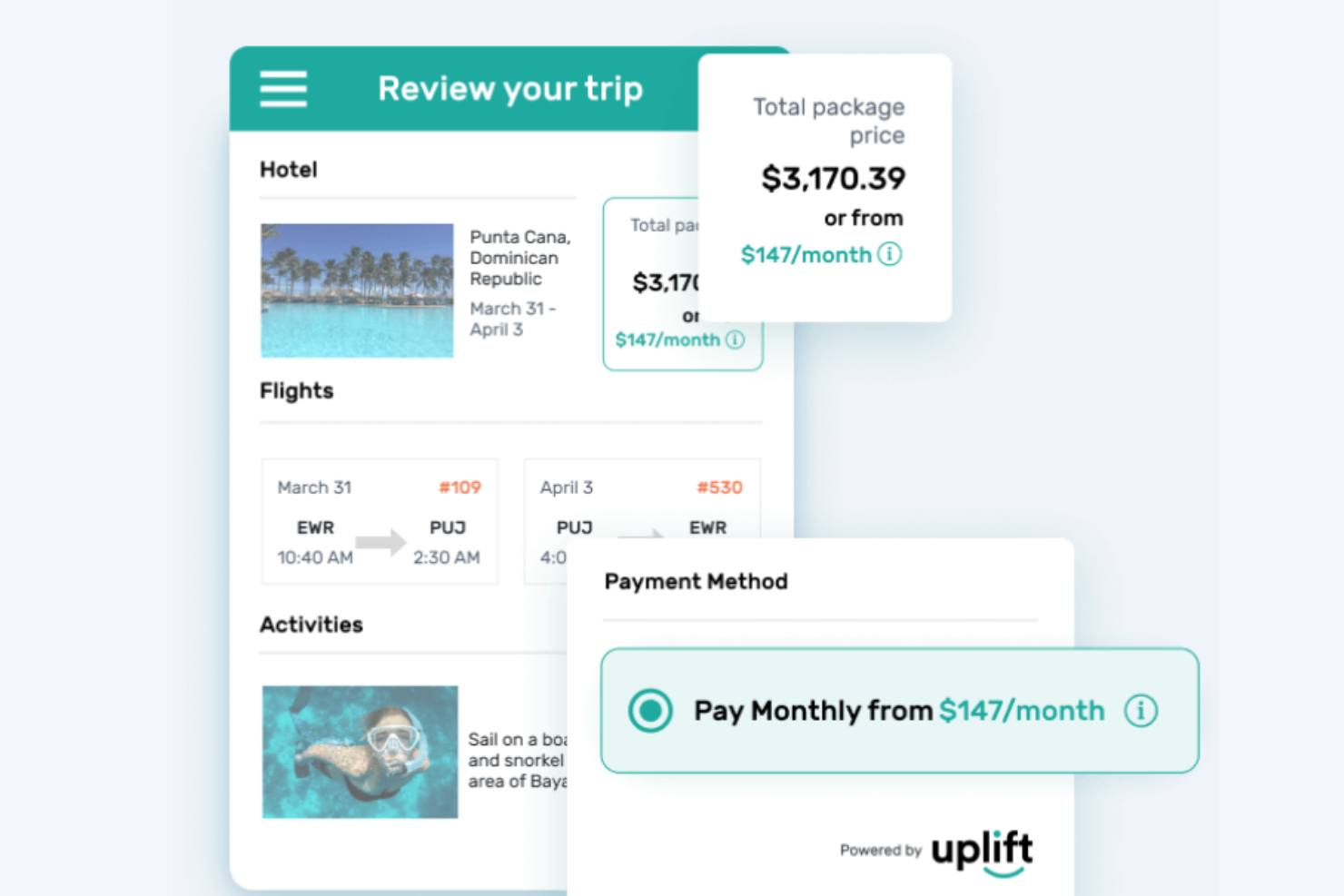

Uplift enables businesses to offer payment transactions within the travel industry.

Why I picked Uplift: If your ecommerce business operates in the travel industry, Uplift can help you reach more customers by offering installment options. You can provide transaction payments for totals as large as $25,000 with terms between six weeks to 24 months. Every transaction happens directly in your purchase workflow, so there’s no need to redirect the customer to another webpage to make a payment.

Uplift allows you to offer your customers a simple way to book travel plans immediately and make payments over time. They also don’t charge any late fees or pre-payment penalties, allowing your customers to book more trips while you reap the benefits. Thanks to the Uplift platform, your customers can even gift their family and friends a trip through your website.

Uplift Standout Features and Integrations

Features include fast approval process, installment loans, payment processing, and an API.

Integrations include an API that allows you to connect the platform to your current systems.

Uplift offers custom pricing upon request.

Pros and cons

Pros:

- Straightforward application process for customers.

- Increases flight bookings.

- No fees ever.

Cons:

- Poor customer service.

- Issues with customer refunds.

Sezzle provides transparent services that can help you empower your customer to make wiser purchasing decisions and build credit.

Why I picked Sezzle: It provides customers with transparency and financial education to help you empower your target audience. It helps you give customers opportunities to avoid late fees and allows younger shoppers to build credit using the Sezzle Up program. Sezzle will report their on-time installment payments to credit bureaus when your customers sign up for this program.

Sezzle offers a straightforward BNPL solution to your customers. There’s only one payment plan available; the 4 pay plan, which includes a 25% down payment when your customers make an order and three other payments. Your customers are required to complete all their payments within six weeks.

Sezzle Standout Features and Integrations

Features include credit and debit card processing, reporting to credit bureaus, payment rescheduling, and interest-bearing saving accounts.

Integrations include Shopify, CommentSold, WooCommerce, Magento, BigCommerce, Littledata, 3dcart, ResponseCRM, Cybersource, BuyItLive, and Salesforce Commerce Cloud.

Sezzle offers custom pricing upon request.

Pros and cons

Pros:

- Helps attract customers.

- Easy to set up.

- High customer approval rate.

Cons:

- Customer support issues.

- Fees can be high.

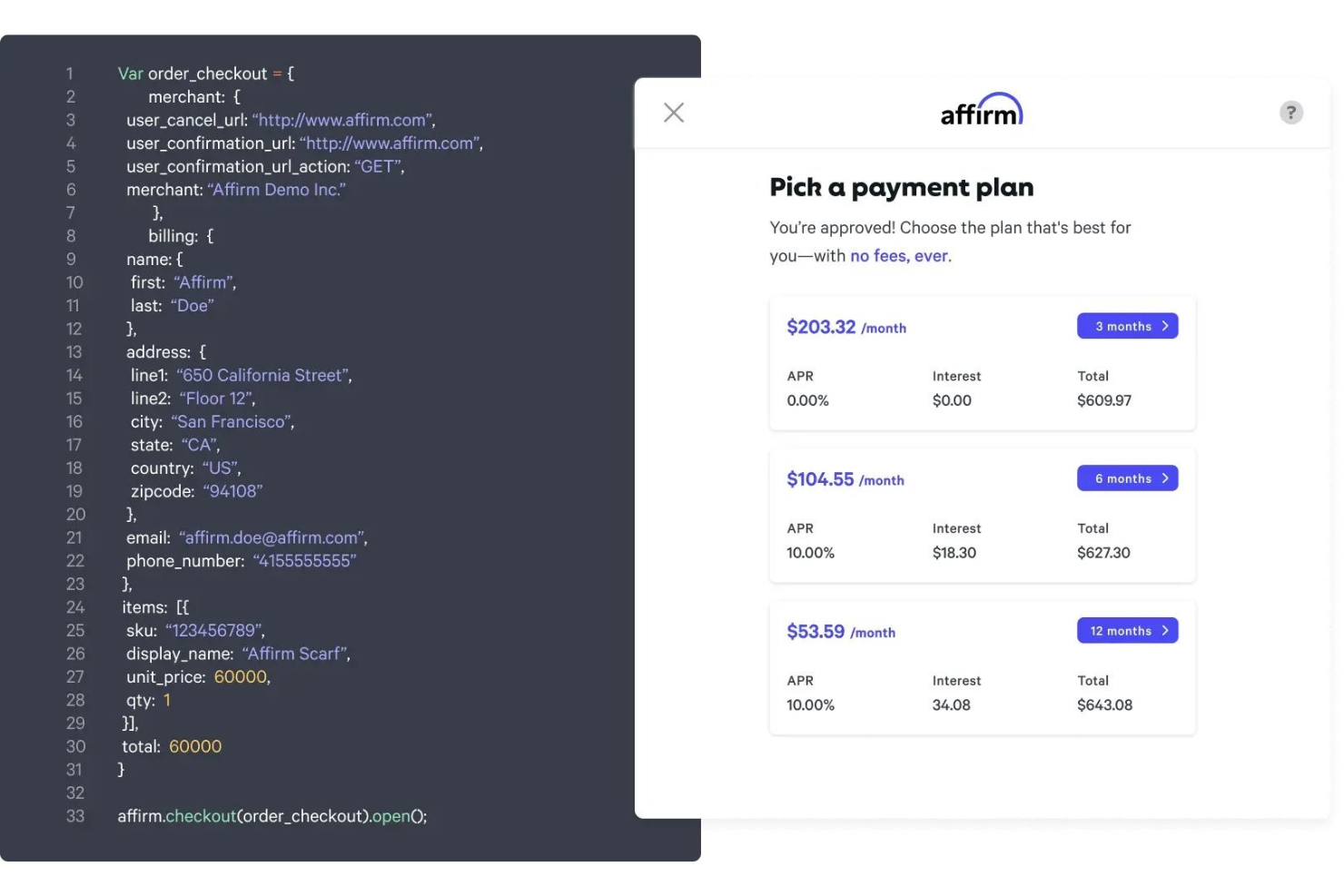

Affirm helps your business provide flexible payment options wherever your customers shop for your products.

Why I picked Affirm: The platform is beneficial for ecommerce, in-store, and telesales transactions. They are Amazon’s choice for BNPL solutions. Affirm enables businesses to integrate buy-now-pay-later options for customers, no matter where they’re buying. You can use Affirm to show your customers flexible payment terms throughout your ecommerce site, including every product page and checkout, to make it easy for them to buy.

Affirm gives retailers complete control over the minimum amount customers spend to qualify for installments. You can choose whether to offer customers a 0% interest loan financing, where to show Affirm’s payment messaging, and how long your customers have to make payments. The platform also has a tool called Adaptive Checkout. This unique solution can update your customer’s loan repayment options when they add items to their cart, allowing them to see their purchase amount in personalized installment payments throughout your site.

Affirm Standout Features and Integrations

Features include business portal, credit card processing, ACH payment processing, activity dashboard, mobile payments, billing and invoicing, mobile app, and real-time analytics.

Integrations include Wix, Shopify, WooCommerce, Magento, BigCommerce, OpenCart, 3dcart, NetSuite SuiteCommerce, AmeriCommerce, Volusion, Web Shop Manager, PlanetScale, and Lightspeed eCommerce.

Affirm offers custom pricing upon request.

Pros and cons

Pros:

- No customer late fees.

- Large customer purchase limits.

- Intuitive dashboard.

Cons:

- Competition might get better rates.

- Only works in the USA.

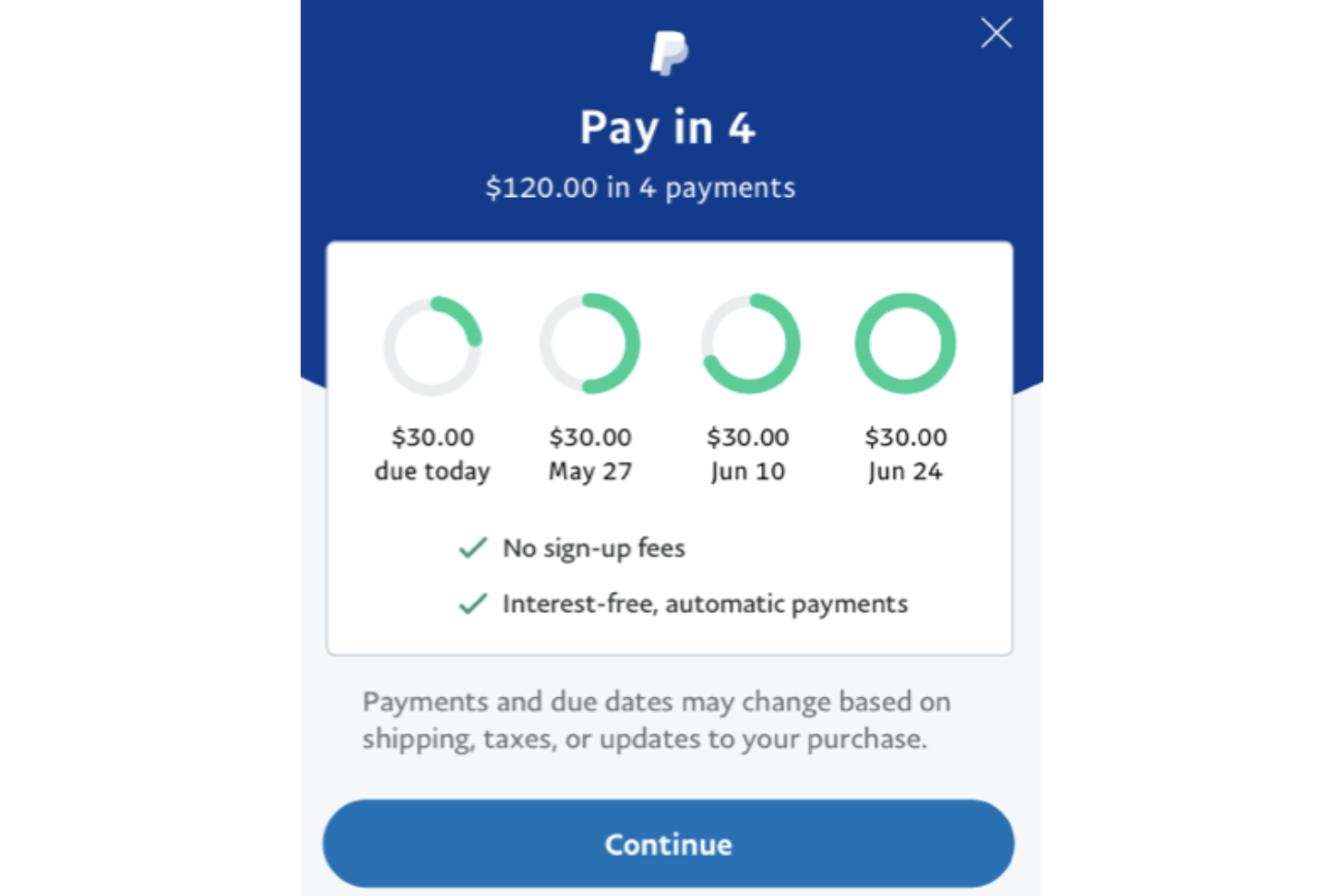

PayPal’s “Pay-in-Four” BNPL platform provides merchants who already use PayPal Pay with capabilities to give customers alternative payment options.

Why I picked PayPal’s “Pay-in-Four”: The PayPal platform is the most popular, secure payment system, and they brought their capabilities to the BNPL atmosphere. They have a level of trust worldwide that can help you turn potential, unconvinced individuals into paying customers. Merchants who already accept PayPal as a payment option for customers can easily implement the Pay-in-Four system.

PayPal’s “Pay-in-Four” platform can scale with any business and help you provide various financing options to your customers. All you have to do is add a Pay Later button as another payment option on your checkout system. Afterwards, customers with an existing PayPal account can apply for the Pay-in-Four financing if their purchase is between $30 and $1,500.

PayPal’s “Pay-in-Four” Standout Features and Integrations

Features include business insights, reporting, automatic updates, debit and credit card processing, POS system, recurring payment, purchase protection, invoice management, and online checkout.

Integrations include BigCommerce, Wix, WooCommerce, GoDaddy, Adobe, Shift4Shop, XCart, Miva, Volusion, OpenCart, Cart.com, and Vortx.

PayPal’s “Pay-in-Four” is a free add-on for current PayPal merchants. When using the platform, you’ll only pay the regular 3.49% + $0.49/transaction.

Pros and cons

Pros:

- No additional costs.

- Easy to use.

- Simple organization.

Cons:

- Takes customers off your website.

- High customer interest rates.

Related Ecommerce Software Reviews

If you still haven't found what you're looking for here, check out these related ecommerce tools that we've tested and evaluated.

- Ecommerce Platforms

- Inventory Management Software

- Payment Processing Software

- Shopping Cart Solutions

- Order Management Systems

- Warehouse Management Software

Selection Criteria for BNPL Platforms

Selecting the right BNPL platforms involves a careful evaluation of what they have to offer. Through extensive personal trials and research, I've developed criteria to guide software buyers towards making an informed decision.

Core Functionality: 25% of total weighting score

- Seamless integration with online and physical stores

- Instant credit approval process

- Flexible payment plan options

- Transparent fee structure for both merchants and consumers

- Secure and compliant transaction processing

Additional Standout Features: 25% of total weighting score

- Features that elevate a platform include unique payment customization options, such as the ability to adjust payment plans according to consumer behavior or seasonal trends.

- Another distinguishing feature is the integration of loyalty and rewards programs, enhancing customer retention.

- I explore platforms offering these innovative functionalities by setting up scenarios to test these features' execution and effectiveness.

Usability: 10% of total weighting score

- I evaluate the balance between powerful functionality and ease of use, with a focus on intuitive navigation and a clean interface that simplifies the checkout process.

- The design should facilitate a quick understanding and execution of payment plans both for merchants and end-users.

Onboarding: 10% of total weighting score

- Effective onboarding tools such as detailed guides, tutorial videos, and responsive chatbots are essential for a smooth transition to the BNPL service.

- I assess the availability of resources that enable merchants to quickly integrate the platform into their existing systems and for consumers to easily understand how to use the service.

Customer Support: 10% of total weighting score

- Exceptional customer support is evaluated based on response times, availability of multiple support channels (e.g., live chat, email, phone), and the quality of assistance provided.

Value For Money: 10% of total weighting score

- Pricing structures are compared to ensure they align with the features offered, looking for transparency in fees with no hidden costs to either merchants or consumers.

Customer Reviews: 10% of total weighting score

- Customer feedback is crucial; I look for patterns in reviews that highlight strengths and areas for improvement, focusing on reliability, user satisfaction, and problem resolution efficiency.

Choosing a BNPL platform involves weighing these criteria to find a solution that not only meets the basic requirement of facilitating purchases but also adds value through additional features, ease of use, supportive onboarding, responsive customer support, reasonable pricing, and positive user feedback.

Trends in BNPL Platforms for 2024

Here are some trends I’ve noticed for buy-now-pay-now technology, plus what they might mean for the future of the ecommerce industry. I sourced countless product updates, press releases, and release logs to tease out the most important insights.

- Mobile-First Approaches: With the ongoing shift towards mobile commerce, BNPL platforms are optimizing their services for mobile devices to ensure a frictionless experience.

- Expansion into New Markets: BNPL services are broadening their horizons beyond retail to include services like healthcare, travel, and education, addressing a wider range of consumer needs.

- Increased Transparency: As regulatory scrutiny increases, features that provide clear information on fees, penalties, and terms are becoming more critical.

- AI and Machine Learning for Credit Assessment: The use of artificial intelligence and machine learning for real-time credit risk assessment is becoming more sophisticated, allowing for instant approvals without traditional credit checks.

- Integration of Cryptocurrency Payments: A novel trend is the integration of cryptocurrency as a payment option within BNPL services, catering to the crypto-savvy consumer base.

- Global Expansion with Local Adaptations: BNPL platforms are focusing on global expansion while adapting to local regulations, currencies, and consumer preferences.

These trends indicate a focus on improving accessibility, flexibility, and security in financial transactions, making it easier for consumers to manage their finances without traditional constraints. BNPL platforms are not just evolving in terms of technology but are also becoming more aligned with consumer values such as sustainability and personalization.

What is a Buy-Now-Pay-Later Platform?

Buy-now-pay-later platforms are financial tools that allow consumers to purchase items immediately and pay for them over time through installments. This method helps buyers manage their budget by spreading the cost of a product, often without interest. The purpose is to make larger purchases more accessible and encourage increased spending by easing immediate financial burdens.

Features of BNPL Platforms

Buy Now, Pay Later (BNPL) platforms are revolutionizing the way consumers shop and manage their finances. Here are the key features that define BNPL services:

- Instant Credit Approval: Provides customers with immediate access to credit without the lengthy application process typical of traditional loans or credit cards.

- Flexible Payment Plans: Offers various repayment options, allowing customers to spread the cost of their purchases over time, typically without interest if payments are made as agreed.

- Seamless Integration: Easily integrates with e-commerce platforms, providing a smooth checkout experience for online shoppers.

- No Upfront Costs: Customers can make purchases without any initial payment, encouraging more spontaneous and significant purchases.

- Soft Credit Checks: Uses soft credit checks that don't impact the customer's credit score for eligibility assessment, making it more accessible than traditional credit.

- Automatic Payments: Automates the repayment process by scheduling deductions from the customer's bank account or credit card.

- Transparent Fees and Charges: Clearly outlines any fees or charges associated with late payments, providing transparency and building trust with users.

- Mobile Optimization: Offers a user-friendly mobile interface or app, reflecting the growing trend of mobile commerce.

- Real-Time Decisioning: Leverages advanced algorithms for real-time credit decisioning, offering immediate feedback on credit approval.

- Merchant Analytics: Provides merchants with insights and analytics on customer purchases and payment behavior, helping businesses optimize their sales strategies.

These features make BNPL platforms an attractive option for both consumers looking for flexibility in their financial planning and merchants aiming to increase sales and customer loyalty.

Benefits of BNPL Platforms

Buy Now, Pay Later (BNPL) platforms are reshaping the landscape of online shopping and financial management, offering a myriad of benefits for both consumers and businesses. Here's how these platforms benefit users and organizations:

- Increased Purchasing Power: BNPL services empower customers to make purchases they may otherwise defer, by spreading the cost over time. This flexibility can enhance the shopping experience and encourage larger purchases.

- Improved Cash Flow Management: For businesses, offering BNPL options can lead to faster sales cycles and improved cash flow, as customers are more inclined to complete purchases with flexible payment options.

- Access to New Customer Segments: BNPL platforms can attract customers who are wary of traditional credit options or those without extensive credit history, broadening the market reach for businesses.

- Enhanced Customer Satisfaction and Loyalty: The convenience and flexibility of BNPL can lead to higher customer satisfaction rates. Satisfied customers are more likely to return, fostering long-term loyalty and repeat business.

- Reduced Financial Stress: For users, BNPL offers a less intimidating way to manage finances by providing clear terms and the absence of compounded interest, reducing financial stress and making budgeting easier.

BNPL platforms are not just changing how people shop; they're also influencing the broader dynamics of consumer finance and retail strategy. By offering a win-win scenario for both shoppers and retailers, BNPL solutions are poised to become a staple in the ecommerce and financial services sectors, providing a bridge between immediate gratification and financial prudence.

Cost & Pricing for BNPL Platforms

Buy Now, Pay Later (BNPL) platforms offer a variety of plans and pricing options designed to cater to the diverse needs of merchants looking to integrate these services into their ecommerce or physical retail operations. Below is a generalized overview of the typical plans you might encounter, aimed at providing potential software buyers with a clear starting point for consideration.

Plan Comparison Table for BNPL Platforms

| Plan Type | Average Price | Common Features Included |

|---|---|---|

| Starter | Free - Low monthly fee | Basic BNPL functionality, limited monthly transactions |

| Standard | Percentage of sales | Full BNPL functionality, higher transaction volume, custom branding |

| Premium | Custom pricing | Advanced features, unlimited transactions, dedicated support |

| Free Option | $0 | Limited functionality, designed for very small merchants or trials |

When selecting a BNPL platform, consider the transaction fees, monthly charges, and the features each plan offers in relation to your business size, sales volume, and specific needs. The right plan should balance cost-efficiency with the functionality required to enhance your sales and customer experience.

Frequently Asked Questions

Here are some common questions about buy-now-pay-now platforms, how they work, and how to get the most out of them.

What are the most popular BNPL providers?

The most popular Buy Now, Pay Later (BNPL) providers have been growing and diversifying, reaching consumers and merchants worldwide with innovative payment solutions. Leading the charge globally are names like Afterpay, Klarna, Affirm, PayPal, and Zip. Each of these platforms has carved out significant market share by catering to consumer demand for flexible payment options that allow for purchasing goods and services immediately while spreading the cost over time without the need for traditional credit checks or incurring upfront interest.

Where is BNPL most popular?

Buy Now, Pay Later (BNPL) services have seen a surge in popularity across the globe, with notable traction in regions like North America, Europe, and Asia-Pacific. In the United States and the United Kingdom, BNPL options have become increasingly common among both online and physical retailers, catering to consumers seeking flexible payment solutions. Australia has also witnessed a significant uptake of BNPL services, with companies like Afterpay leading the charge. In Asia, markets such as India and Southeast Asia have seen a rapid adoption of BNPL, driven by a young, tech-savvy population and a growing e-commerce sector.

Are there any credit checks involved when using BNPL services?

The approach to credit checks varies among BNPL providers. Some platforms may conduct a soft credit check, which doesn't impact a consumer's credit score, to assess the risk before approving the transaction. Other services might not require a credit check at all, making BNPL accessible to a broader audience, including those with limited credit history or lower credit scores.

What happens if a customer misses a payment on a BNPL plan?

If a payment is missed, most BNPL services will charge a late fee and may restrict the consumer's ability to use the service for future purchases until the overdue payments are settled. The specifics of these penalties can vary widely between platforms, with some offering a grace period or the ability to reschedule payments to avoid fees. Consumers are encouraged to understand the terms and conditions related to missed payments for their specific BNPL provider.

Additional Ecommerce Payment Software Reviews

If you are looking for BNPL software, you might be interested in these related software reviews, as well. They all focus on ecommerce finances, payments, or tax management.

- Point-of-Sale (POS) Software

- Mobile Payment Solutions

- Ecommerce Sales Tax Software

- Ecommerce Fraud Prevention Software

Conclusion

Digital financing options will continue to grow in a world that relies on technology. Using a BNPL platform in your business can draw in new audiences and provide them with a straightforward experience. BNPL platforms are highly effective for your business’s growth as more and more customers welcome this trend. For businesses who want to keep up with this trend and meet the needs of a changing customer base, using a BNPL app will benefit your company.

If you’re considering using other tools along with these BNPL platforms, sign up for our newsletter. Here, you’ll receive new details regarding the top tools in the ecommerce industry and some advice from the top leaders in this sector.