10 Best Ecommerce Sales Tax Software List

Here's my pick of the 10 best software from the 15 tools reviewed.

Our one-on-one guidance will help you find the perfect fit.

There are seemingly countless ecommerce sales tax software solutions available, so figuring out which is best for you is tough. You want to automate and simplify the complex process of calculating, collecting, and filing sales tax for online transactions—but now need to figure out which tool is the best fit. I've got you! In this post, I make things simple, leveraging my experience managing managing online stores of all sizes and using dozens of different sales tax tools to bring you this shortlist of the best ecommerce sales tax software overall.

What Is Ecommerce Sales Tax Software?

Ecommerce sales tax software is a tool that automates the calculation, collection, and remittance of sales tax for online sales. It integrates with ecommerce platforms, identifying and applying the correct tax rates based on the product type and buyer's location. This software keeps track of varying tax laws and rates across different regions, ensuring compliance with local tax regulations.

The purpose is to reduce the administrative burden on businesses, minimize errors, and help maintain compliance with tax laws, making the process of managing sales tax more efficient and less prone to error.

Overviews Of The 10 Best Ecommerce Sales Tax Software

Here’s a brief description of each of the ecommerce sales tax software on my list.

TaxCloud excels as a sales tax software by offering a comprehensive and highly accurate sales tax calculation and compliance solution. It stands out for its ability to seamlessly integrate with various e-commerce platforms, making it easy for businesses to automate sales tax calculations and reporting.

Why I Picked TaxCloud: TaxCloud's vast database of up-to-date tax rates and rules, along with its robust exemption certificate management, ensures precise tax calculations and compliance across a multitude of jurisdictions. Additionally, its no-cost service for businesses, which includes the handling of all state and local sales tax filings and remittances, makes it an attractive choice for small to medium-sized enterprises looking to streamline sales tax compliance without incurring significant expenses.

TaxCloud Standout Features & Integrations

Key features include sales tax filing and remittance services for businesses. This unique feature further reduces the compliance burden on businesses by automating the often complex and time-consuming process of filing sales tax returns and remitting tax payments to state authorities. TaxCloud takes care of the entire filing process, from preparing the returns to submitting them to the appropriate tax jurisdictions, which can save businesses significant time and resources.

Integrations include Ability Commerce, BigCommerce, Quickbooks, Square, Stripe, Shopify, WooCommerce, Odoo, Volusion, Cart.com, Oracle NetSuite, Acumatica, Sage, and Magento.

Pros and cons

Pros:

- Database of up-to-date sales tax rates and rules

- Integrations with a variety of ecommerce tools

- Collect sales tax automatically

Cons:

- May be too basic for larger enterprises

- Transaction volume limitations on lower plans

LOVAT streamlines tax compliance for businesses by automating the submission of tax reports and declarations, providing online accounting, and downloading sales information from multiple sources. With coverage in 57 countries worldwide, LOVAT also offers tax education, real-time support from professionals, and an extensive list of tracking tools.

Why I Picked LOVAT: LOVAT promises to solve the problem of tax reporting within minutes. LOVAT is light and fast, while still being robust enough to serve as an all-in-one solution for global VAT liabilities. Unless you are feeling generous, I highly recommend their VAT calculation system that makes sure you never overpay. LOVAT distinguishes itself through its AI-powered predictive tax compliance feature, which goes beyond basic tax calculations. This feature leverages machine learning algorithms to analyze a business's historical sales data, transaction patterns, and tax compliance history. It then uses this information to provide proactive recommendations and alerts to help businesses stay compliant with local sales tax laws.

LOVAT Standout Features & Integrations

Key features include real-time geolocation and jurisdictional accuracy feature that enables businesses to precisely determine the applicable sales tax rates and regulations for each transaction. Unlike many other sales tax software solutions that rely on zip codes or approximate locations, LOVAT leverages advanced geolocation technology, including GPS data and IP address analysis, to pinpoint the exact location of a customer. This ensures that businesses can calculate and apply the correct sales tax rates down to the specific city or even street level, reducing the risk of errors or audits.

Integrations include Shopify, Fulfillment by Amazon, eBay, Magento, WooCommerce, and Etsy.

Pros and cons

Pros:

- Customizable and scalable

- AI-powered predictive insights

- Highly accurate tax calculations

Cons:

- Slight learning curve

- Limited integration with other systems

Vertex is a leading provider of enterprise tax software solutions, including sales and use tax calculation, returns, and exemption certificate management. The software is designed to automate the sales tax calculation process, and provides real-time sales tax rates and rules for all US states and Canadian provinces.

Why I Picked Vertex: Vertex integrates with multiple enterprise resource planning (ERP) systems, enabling businesses to manage their tax compliance across multiple jurisdictions from a single platform. The software also offers audit defense support, tax research, and global tax solutions. Vertex is known for its accuracy, scalability, and comprehensive coverage of complex tax regulations, making it a preferred choice for large enterprises and multinational corporations.

Vertex Standout Features & Integrations

Key features include integrated automated returns and filing service that simplifies the sales tax return filing process for your ecommerce business. This feature allows businesses to automate the generation and filing of sales tax returns directly from the platform. It supports e-filing and integrates with various tax authorities, saving businesses significant time and effort compared to manual filing.

Integrations include Accumatica, Adobe Commerce, BigCommerce, ChargeBee, commercetools, Elastic Path, IBM Cognos, Intuit, Kibo Commerce, Microsoft Dynamics 365, NetSuite, and dozens more in the areas of ERP, ecommerce, procurement, and point-of-sale.

Pros and cons

Pros:

- Comprehensive sales tax automation capabilities

- Extensive global tax content and expertise

- All-in-one enterprise accounting solution

Cons:

- Complex initial implementation

- Pricing not appropriate for small biz

Quaderno excels as a sales tax software by simplifying the often complex process of sales tax compliance for e-commerce businesses. It offers robust automation features that enable accurate tax calculation and reporting for businesses operating globally.

Why I Picked Quaderno: Quaderno stands out for its seamless integration with various e-commerce platforms and payment gateways, ensuring that sales tax obligations are automatically managed during the customer transaction process. Its ability to handle multi-currency and multi-language transactions, coupled with its real-time tax rate updates, makes it a valuable tool for international sales, helping businesses navigate intricate sales tax regulations effortlessly. Quaderno also offers detailed tax reports and insights, facilitating transparency and ease of compliance for businesses of all sizes.

Quaderno Standout Features & Integrations

Key features include robust support for multi-currency and multi-language transactions, making it a standout choice for businesses with a global customer base. It can automatically convert transaction amounts to the customer's preferred currency, and invoices and receipts can be generated in multiple languages. This feature enhances the customer experience and helps businesses reach a broader audience while maintaining accurate tax compliance. Quaderno's multi-currency and multi-language capabilities are especially beneficial for ecommerce businesses that operate in diverse markets worldwide.

Integrations include Braintree, GoCardless, Paypal, Square, Stripe, Shopify, CheckoutJoy, WooCommerce, Amazon FBA, Sendowl, Clickfunnels, Mighty Networks, Xero, and others. You can unlock more using Zapier, but this requires a separate account and may incur additional costs.

Pros and cons

Pros:

- Seamless ecommerce integration

- Multi-currency and multi-language support

- Real-time tax rate updates

Cons:

- Doesn't include every US tax code

- Reporting could be more robust

DAVO Sales Tax is a sales tax automation software designed for small businesses that operate in the United States. It automatically collects, files, and pays sales tax on behalf of businesses, simplifying the complex sales tax compliance process.

Why I Picked DAVO: DAVO Sales Tax integrates with a wide range of point of sale (POS) systems, accounting software, and payment processors, allowing businesses to automatically set aside sales tax from their daily sales and remit it to the appropriate state tax authority. The software also provides real-time sales tax rates and rules for all US states and territories, making it easier for businesses to stay compliant with changing tax laws.

Standout Features & Integrations

Key features include a daily sales tax collection feature that sets it apart from many competitors. Instead of waiting until the end of the tax reporting period to collect and set aside sales tax funds, DAVO helps businesses collect sales tax daily. It automatically transfers the collected tax amounts to a secure DAVO-held account, ensuring that businesses have the funds readily available when it's time to remit taxes to tax authorities.

Integrations include QuickBooks online, Clover, Square, Revel, and all the other major POS software.

Pros and cons

Pros:

- Integration with point-of-sale systems

- Daily sales tax collection feature

- Fully automated sales tax filing and payment solution

Cons:

- Limited customization options

- Dependency on 3rd-party payment processors

QuickBooks Commerce is an inventory and order management software designed to help businesses efficiently manage their inventory, sales, and order fulfillment processes. It offers a comprehensive suite of tools to streamline inventory tracking, sales order processing, and multi-channel sales management. It works with the base QuickBooks software to create a complete ecommerce sales tax and inventory solution.

Why I Picked QuickBooks Commerce: QuickBooks Commerce performs exceptionally well as an ecommerce sales tax software by providing businesses with robust and automated sales tax calculation and compliance features. It simplifies the complex task of sales tax management for online retailers by accurately calculating taxes based on various factors such as location, product type, and customer profiles. QuickBooks Commerce's integration with popular ecommerce platforms ensures that sales tax is automatically calculated during the checkout process, reducing the risk of errors and helping businesses maintain compliance effortlessly.

QuickBooks Commerce Standout Features & Integrations

Key features include a comprehensive solution for multi-channel sales tax automation. It not only calculates sales tax accurately but also integrates seamlessly with various ecommerce platforms, marketplaces, and sales channels. This unique capability allows businesses to centralize their sales tax calculations and compliance efforts across all their online sales channels, making it particularly valuable for ecommerce businesses with a diverse online presence.

Integrations include over 450 business apps like Square, Stripe, Insightly CRM, Mailchimp, Shopify, eBay, BigCommerce, Magento, Squarespace, and Etsy.

Pros and cons

Pros:

- User-friendly and intuitive interface

- Multi-currency and multi-location support

- Robust multi-channel sales management capabilities

Cons:

- Need base Quickbooks + QB Commerce

- Limited advanced analytics

Taxify is a cloud-based sales tax software designed to help businesses of all sizes automate their sales tax compliance. The software provides real-time sales tax rates and rules for all US states and territories, and integrates with a wide range of ecommerce platforms, shopping carts, and accounting software.

Why I Picked Taxify: Taxify is a product of the Sovos brand, one of the world’s leading voices in tax for the last 30 years. With over 14,000 tax jurisdictions spanning across 50 states, Taxify will keep the overburdened ecommerce sellers tension-free with accurate rates. It helps you automatically comply with tax changes and offers an easy way to auto-file tax returns. Also, it has readily available tax experts that will cater to your nuanced needs and questions.

Taxify Standout Features & Integrations

Key features include that it automates the sales tax calculation process, including tax exemptions and product taxability, and files sales tax returns on behalf of businesses. The software also offers sales tax audit support, providing businesses with the necessary documentation to respond to audit requests.

Integrations include Magento, Microsoft platforms, Oracle NetSuite, Quickbooks, SAP, and Shopify.

Pros and cons

Pros:

- Intuitive and user-friendly interface

- Robust ecommerce integration options

- Comprehensive sales tax coverage

Cons:

- Not cost-effective for small biz

- Limited international coverage

Thomson Reuters ONESOURCE is a tax compliance software that provides a range of tax solutions, including income tax, indirect tax, property tax, transfer pricing, and tax information reporting. ONESOURCE also offers a tax research database that provides users with up-to-date tax laws, regulations, and court cases from around the world.

Why I Picked ONESOURCE: Though it may sound like an old school news bureau, Thomas Reuters packs a massive punch in the world of ecommerce tax software. It uses the latest rules and rates to ascertain sales tax, use tax, VAT, and GST. It makes managing sales and use tax a breeze, with GST and VAT compliance done in a streamlined way through one system. The team also provides step by step sales tax guidance and answers, all in a single place.

ONESOURCE Standout Features & Integrations

Key features include that it is highly customizable and can be tailored to meet the specific tax compliance needs of each business, from small startups to large multinational corporations. With ONESOURCE, businesses can reduce the risk of tax errors, stay up-to-date with changing tax laws, and improve their overall tax compliance efficiency.

Integrations include Acumatica, BigCommerce, Braintree, Cavallo, Coupa, Epicor P21, and EFI solutions.

Pros and cons

Pros:

- Advanced reporting and analytics tools

- Integrates with various financial and ERP systems

- Comprehensive tax technology platform

Cons:

- Not for smaller businesses

- Can be complex to implement and use

TaxJar is a cloud-based sales tax software designed to help ecommerce businesses manage their sales tax compliance. The software integrates with multiple ecommerce platforms, shopping carts, and marketplaces, and provides real-time sales tax rates and rules for all US states and territories.

Why I Picked TaxJar: TaxJar automates the sales tax calculation process, including tax exemptions and product taxability, and files sales tax returns on behalf of businesses. The software also offers features such as nexus detection, customer address verification, and sales tax reporting. With TaxJar, businesses can reduce the risk of sales tax errors and penalties, save time and resources on tax compliance, and focus on growing their business.

TaxJar Standout Features & Integrations

Key features include insights into economic nexus thresholds for different states. It tracks the sales and transaction thresholds that trigger sales tax obligations in various jurisdictions, allowing businesses to proactively manage their compliance. TaxJar also sends threshold alerts to businesses when they are approaching or surpassing these thresholds, helping them stay compliant and avoid unexpected tax liabilities.

Integrations include Amazon, BigCommerce, eBay, Ecwid, Etsy, Magento, Paypal, Quickbooks, Salesforce, Shopify, Square, Squarespace, Walmart, and WooCommerce.

Pros and cons

Pros:

- Detailed reports and dashboards

- Economic Nexus insights

- Highly accurate sales tax calculations

Cons:

- Customer support sometimes slow to respond

- Limited international support

Avalara is a cloud-based sales tax software designed to help businesses of all sizes automate their sales tax compliance. The software provides real-time sales tax rates and rules for all US states and territories, as well as VAT and GST for international jurisdictions.

Why I Picked Avalara: Avalara’s Avatax removes the no.1 pain point of accounting overwhelm by supplying sales tax calculations and rules based on geolocation and product classification. It offers more than 700 integrations. Use it to manage your data across various apps connected with your ecommerce platform. Apart from that, it removes tax from exempt sales and skillfully manages and organizes exempt documentation.

Avalara Standout Features & Integrations

Key features include its Cross-Border feature, which is a standout offering that addresses the complexities of international sales tax and cross-border ecommerce. This feature is particularly valuable for businesses involved in global trade or selling products and services internationally. AvaTax Cross-Border includes a vast database of international tax rules, rates, and regulations, covering more than 200 countries.

Integrations include WooCommerce, Shopify, Quickbooks, Stripe, Magento, NetSuite, Sage, Infor, Amazon, BigCommerce, eBay, SAP, Amazon, and other systems and tools.

Pros and cons

Pros:

- Seamless integration with numerous systems

- Scalable solutions for businesses of all sizes

- Automates the sales tax calculation process

Cons:

- Customer support sometimes slow to respond

- Costs based on the volume of transactions

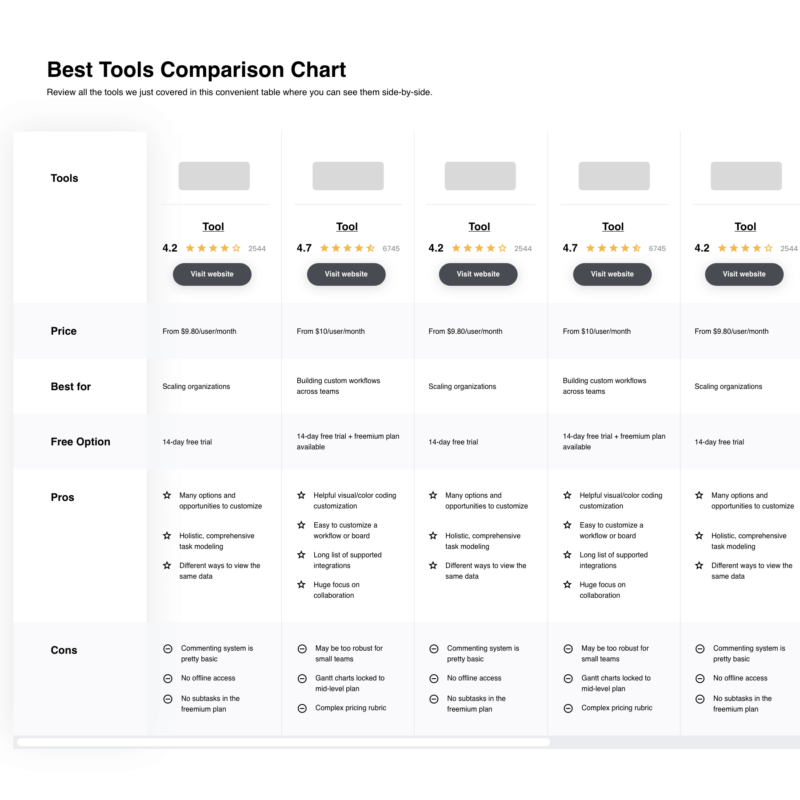

The Best Ecommerce Sales Tax Software Comparison Chart

| Tools | Price | |

|---|---|---|

| TaxCloud | From $9/month | Website |

| Lovat | From $43(35€)/month | Website |

| Vertex Cloud | Pricing upon request | Website |

| Quaderno | From $53/ month | Website |

| DAVO | From $39.99/month | Website |

| QuickBooks Commerce | From $30/month | Website |

| Taxify | From $47/month | Website |

| Thomas Reuters ONESOURCE | Pricing upon request | Website |

| TaxJar | From $19/month | Website |

| Avalara | From $19/month | Website |

Compare Software Specs Side by Side

Use our comparison chart to review and evaluate software specs side-by-side.

Compare SoftwareOther Ecommerce Sales Tax Software Options

Here are a few more that didn’t make the top list.

- FastSpring

Best tax software for subscription services

- CCH Axcess Tax

Best for a variety of sales software & services

- TaxCalc

Best for self-employed individuals

- 123 Sheets

Best to file HMRC VAT returns

- Utility Software

Best basic return-filing software

How I Selected The Best Ecommerce Sales Tax Software

In coming up with this list, I researched which were the most popular sales tax software on the market based on user ratings and reviews. Then, I narrowed down my choices weighing a variety of factors that make software a good option for filing taxes.

Selection Criteria

Here are my selection criteria for the best ecommerce sales tax software.

Core Functionality:

Each ecommerce sales tax software will have its own flavor, but in order to be considered for placement on this list it must cover the following functionality basics.

- Manage sales tax compliance and tax calculations per sale, preferably with regional (state, country) specificities in mind

- Integrate with ecommerce platforms and online payment processing systems

Key Features:

Here are some key features of ecommerce sales tax software:

- Real-time tax rates and rules: Ecommerce sales tax software provides up-to-date sales tax rates and rules for different jurisdictions, including state, county, and municipal levels.

- Tax calculation automation: The software automates the sales tax calculation process, including tax exemptions, product taxability, and rounding rules.

- Sales tax reporting: The software generates detailed sales tax reports, including transaction-level data, tax collected, and exempt sales, to simplify sales tax reporting.

- Filing automation: The software automates the sales tax filing process, including the generation of tax forms and payment reminders, and can file tax returns directly with tax authorities.

- Exemption certificate management: The software helps businesses manage tax exemption certificates from customers, including automatic validation and expiration reminders.

- Nexus and taxability analysis: The software can help businesses determine their sales tax nexus (i.e., the states and jurisdictions where they have tax obligations) and analyze taxability rules for different products and services.

- Customer support: The software offers customer support, including technical assistance and guidance on tax compliance issues.

Usability:

Is it easy to learn and master? Does the company offer good tech support, user support, tutorials, and training? Is it easy to launch and update sales details and compute taxes quickly?

Software Integrations:

Is it easy to connect with other tools? I look at all the ways in which these cloud-based tools connect to other providers to expand their functionality. Therefore, I include details on API information that will help you create custom integrations, pre-built options, and third-party software. Is it easy to connect with various Point of Sale software, ecommerce CRM software, or other ecommerce tools, like Shopify?

Value for Price:

I research these tools and find relevant information regarding their pricing. Small businesses are particularly price-sensitive, which makes this an important criterion. I lay out details on pricing per month on monthly plans, free trials, free versions, and more.

People Also Ask

I wanted to leave some space to discuss some of the most frequently asked questions related to ecommerce sales tax software.

How Does Ecommerce Sales Tax work?

A sales tax is a consumption tax that is charged as a percentage of the sale of a taxable product.

Typically, you need to charge sales tax in states or regions where your business has a physical presence or significant connection.

The general rule for ecommerce sellers when collecting sales tax is:

- If your business has a nexus in a state (legal jargon for significant connection), you are obligated to collect sales tax from online customers in that state.

- If your business does not have a significant connection or physical presence, you typically do not have to collect sales tax for online sales.

Having said that, a US Supreme Court ruling in June 2018 has made it easier for states to make it obligatory for all businesses, regardless of physical presence, to collect sales tax.

Also, through some business activities (especially in cases of ecommerce business), a nexus is often created outside your home state too. This might include a location, inventory, affiliates, personnel, a dropshipping relationship, or an economic nexus where the sale exceeds the transaction amount set by the state.

Do I Need To Charge Sales Tax When Shipping Out Of State?

In the US, most states collect sales tax based on destination. In other words, each sale is considered to occur at the place where the product is ultimately being used.

How Do I Charge Sales Tax For Online Sales?

With all these legal intricacies, collecting sales tax can feel a bit overwhelming. Do not fret. You can use sales tax software that will automatically calculate the right sales tax rates based on rules and rates of different jurisdictions.

Other Types of Ecommerce Software

If you are looking for ecommerce sales tax software, I assume you are building out your online payment processing toolkit. Here are some additional resources you should check out:

- Payment Processing Software

- Buy-Now-Pay-Later (BNPL) Platforms

- Ecommerce Subscription Software

- Shopping Cart Solutions

What's Next?

These are my top picks to help you solve your tax-filing needs once and for all. If you use Magento, you might benefit from knowing how to add VAT in Magento 2.

To get the latest updates on other cutting-edge ecommerce tools, and insights from top thinkers to grow your eCommerce business, subscribe to The Ecomm Manager Newsletter.