10 Best Payment Gateway Providers Shortlist

Here's my pick of the 10 best software from the 20 tools reviewed.

With so many different payment gateway providers available, figuring out which is right for you is tough. You know you want something that acts as a digital bridge, connecting merchant websites with financial entities like banks and credit card networks—but need to figure out which solution is best. I've got you! In this post, I'll help make your choice easy, sharing my personal experiences using dozens of different payment gateway systems with ecommerce stores of all sizes, with my picks of the best payment gateway providers overall.

What is a Payment Gateway Provider?

Payment gateway providers facilitate secure and efficient money transfers between customers and merchants. They act as a digital intermediary, ensuring that payment information, such as credit card details, is transmitted safely from the buyer to the seller, often via encryption. This process helps in verifying transactions, managing payment approvals, and maintaining overall transaction security. Their role is crucial in enabling ecommerce, allowing businesses to accept various forms of online payments while providing customers with confidence and ease in their digital purchases.

Overviews Of The 10 Best Payment Gateway Providers

Here are the top 10 payment gateway providers that I will outline in detail, including the best use case for each, key features, and pros/cons. I’ll follow up this list with a quick summary of my other picks, so keep reading even if you don’t find anything you love here.

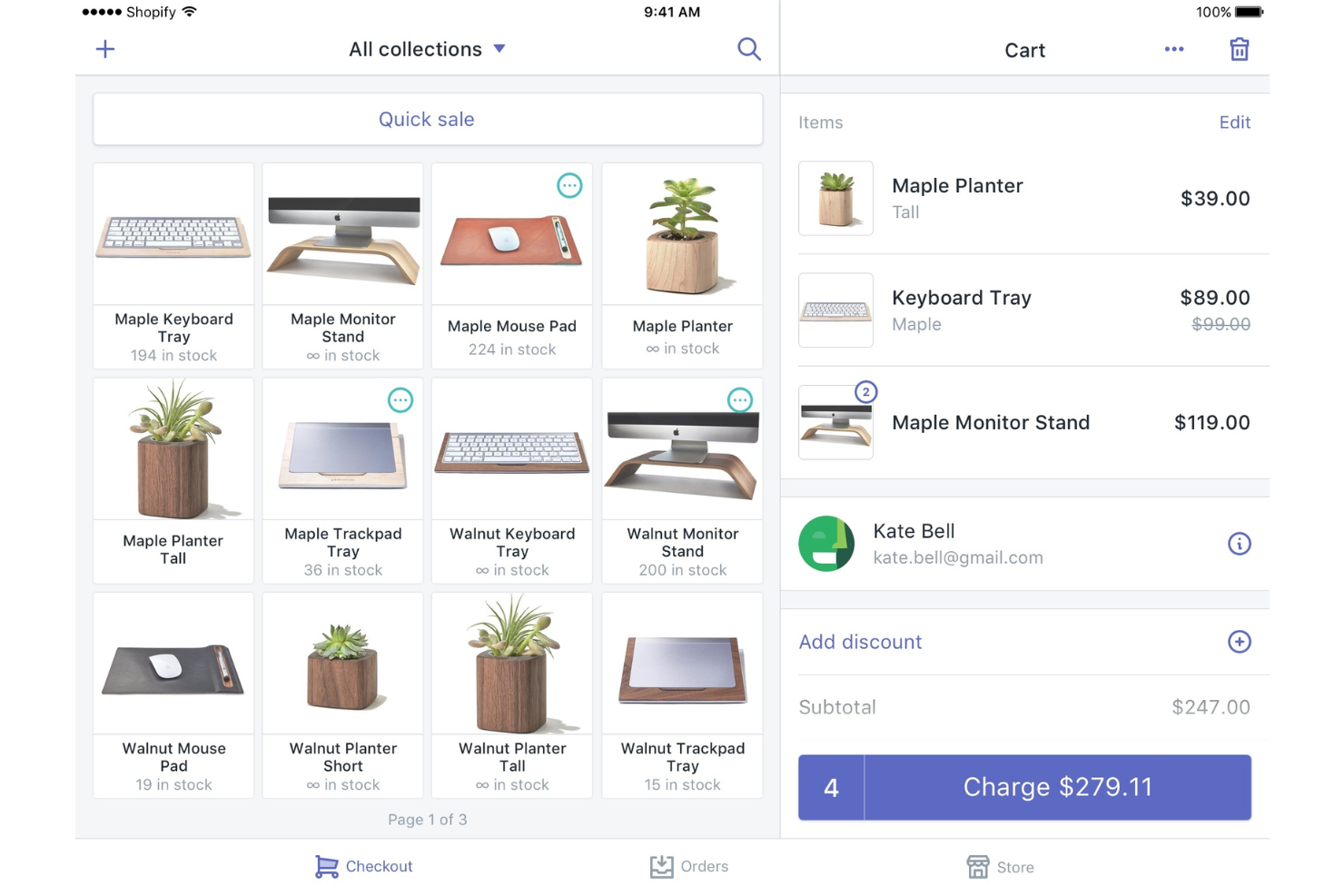

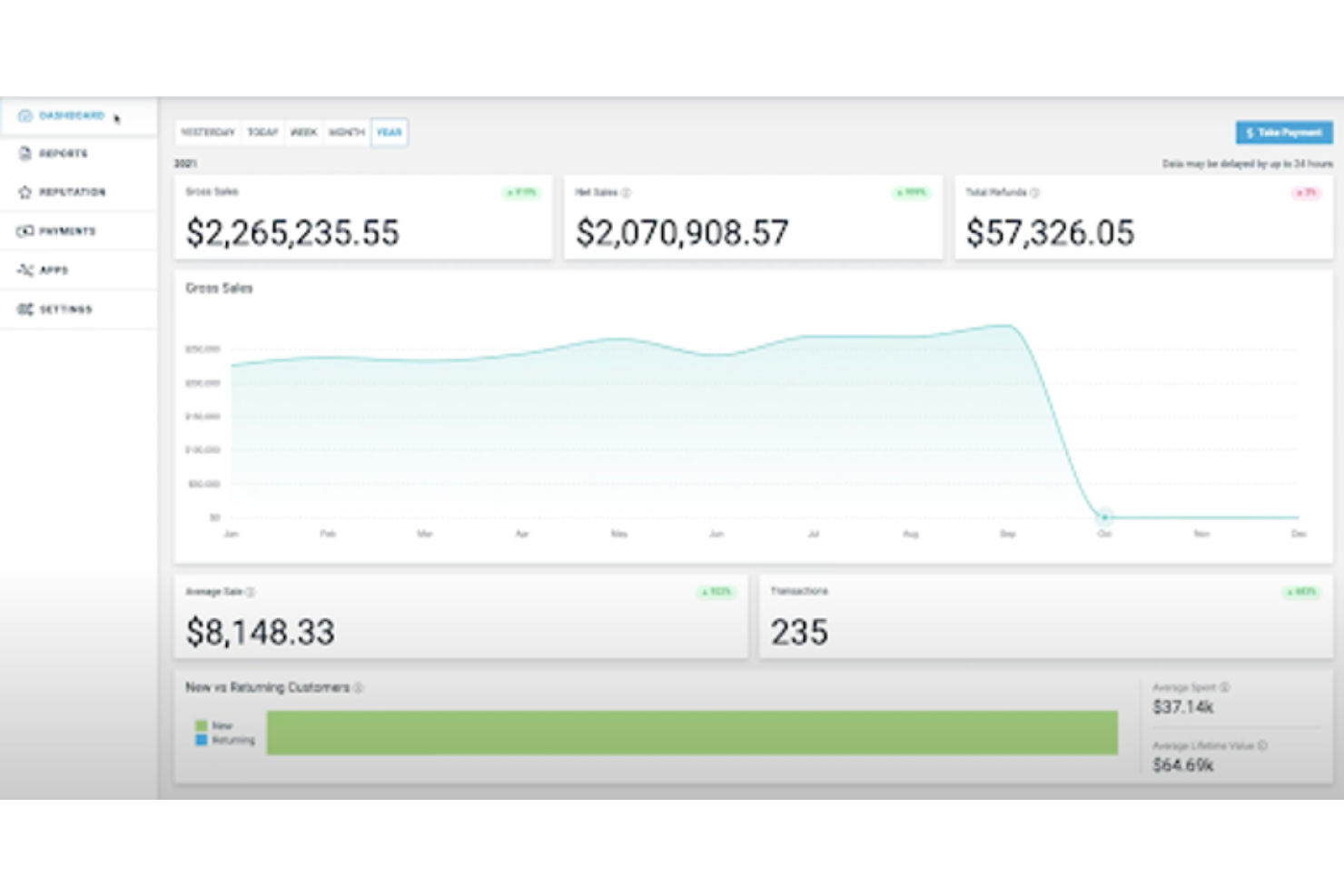

Shopify POS is a versatile point-of-sale system designed to integrate seamlessly with Shopify's ecommerce platform, empowering merchants to sell anywhere, anytime. It streamlines retail operations by syncing inventory, orders, and customer data across online and offline channels. With its user-friendly interface, Shopify POS facilitates smooth transactions, offers detailed analytics for informed decision-making, and supports various payment methods.

Shopify POS excels as an online payment processing system by offering robust, secure, and flexible solutions that cater to the diverse needs of businesses. It integrates seamlessly with Shopify's ecommerce platform, enabling merchants to manage both online and in-store sales through a single dashboard. This system supports a wide range of payment methods, ensuring customers can pay how they prefer, while providing advanced security features to protect sensitive information.

Shopify POS offers a highly customizable smart grid that merchants can tailor to their specific operational needs, setting it apart from more rigid systems. This interface allows users to organize their most frequently used apps, products, and features for quick access during transactions. The ability to personalize the POS layout means that employees can process sales more efficiently.

Shopify POS natively integrates with a variety of tools, including Shopify Payments, Shopify Shipping, Shopify Email, QuickBooks, Xero, Klaviyo, Google Analytics, Oberlo, Printful, and Gift Cards & Loyalty Program by Smile.io.

QuickBooks Online is an accounting software designed specifically for small and medium-sized businesses. It can help you manage your finances, track expenses, create and send invoices, and process payments.

Why I picked QuickBooks Online: The software's payment processing system tracks transaction details to help you spot errors. This also supports you in accurate record keeping. You can connect your bank feeds to the platform, eliminating the need for manual data entry. The software also calculates sales tax automatically and allows you to charge clients and customers via invoice.

You can create professional, customizable invoices using the software, and send them either by email or by printing and mailing them. For regular clients, you can set up recurring invoices to alleviate your workload. The software's expense tracking feature lets you categorize and track your business expenses, helping you keep clean and up-to-date financial records for your business.

QuickBooks Online Standout Features and Integrations

Features include expense tracking, receipt management, invoicing, record keeping, automated sales tax calculations, recurring invoices, payroll management, tax filing, and reporting and analytics tools.

Integrations include over 450 business apps like Square, Stripe, Insightly CRM, Mailchimp, Shopify, eBay, BigCommerce, Magento, Squarespace, and Etsy.

Pros and cons

Pros:

- Payroll and accounting in the same software

- Caters specifically to small businesses

- Automates tax deductions and filings

Cons:

- Not available globally

- No free-forever plan available

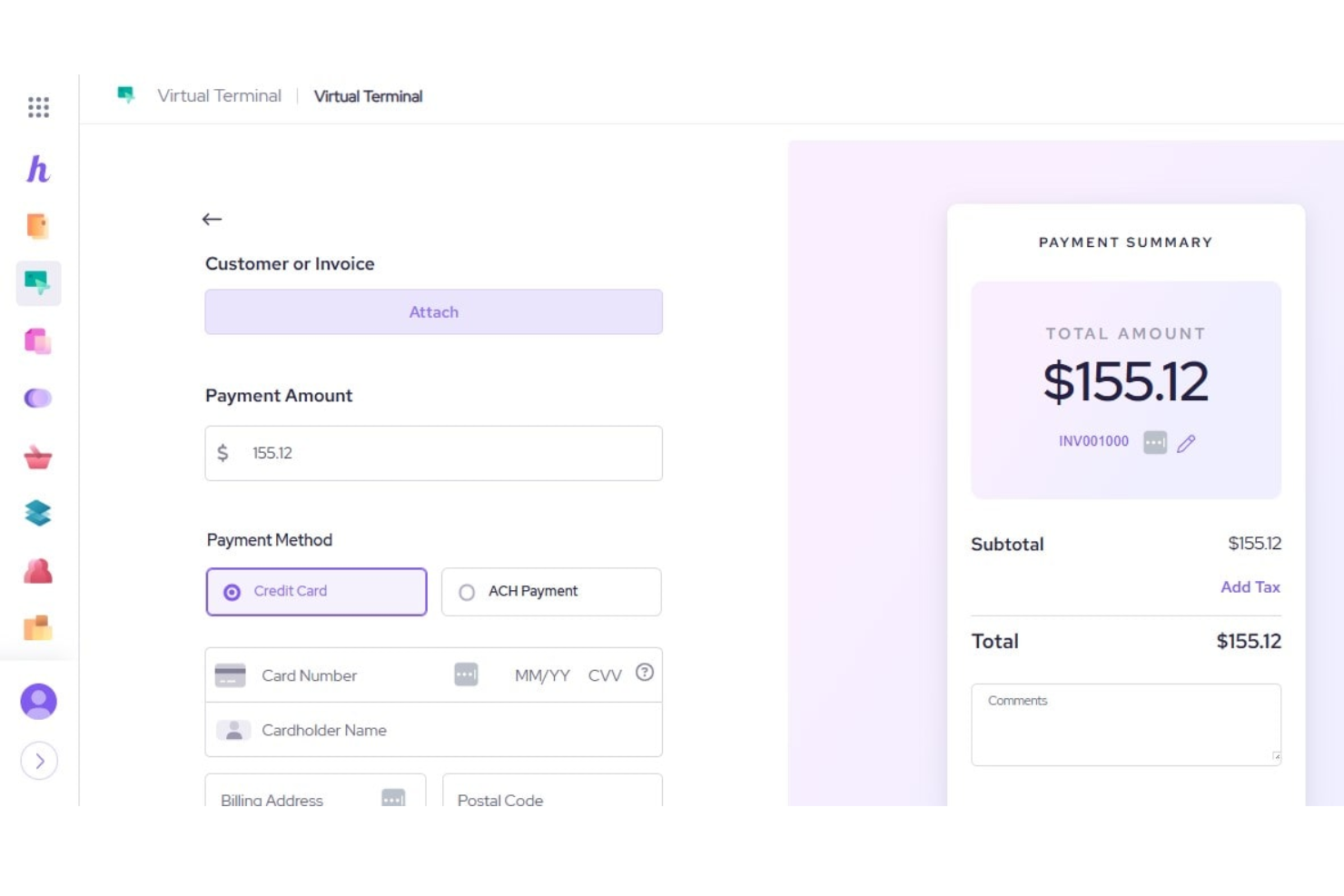

Helcim is a payment solution tool that offers transparent and affordable options for small and medium businesses accepting credit card payments in-person or online. With its emphasis on low processing rates and complete transparency, Helcim stands out as the best tool for businesses seeking a reliable and affordable payment processing solution.

I chose Helcim as a payment gateway provider because of its commitment to affordability and transparency in payment processing. What makes Helcim different is its Interchange Plus pricing model, which can lead to significant savings for businesses by offering lower processing rates. Additionally, the Helcim Fee Saver program presents an opportunity for free credit card processing, which is a unique offering in the market.

Beyond just payment processing, Helcim provides a full suite of integrated services, including a comprehensive merchant platform that supports a wide range of functionalities such as invoicing, customer management, and inventory management. This all-in-one platform approach enables businesses to manage various aspects of their operations seamlessly within one ecosystem, enhancing efficiency and streamlining workflows.

Features include merchant accounts for accepting credit and debit card payments, a mobile app for iOS and Android for on-the-go payment acceptance, virtual terminals for processing transactions over the phone or via other non-direct methods, and payment gateways for integrating payments into business websites with features like hosted payment pages, QR codes, and recurring payment plans.

Integrations include Xero, Quickbooks, WooCommerce, Foxy.io, and Great Exposure.

Best customizable payment solutions tailored to specific business needs

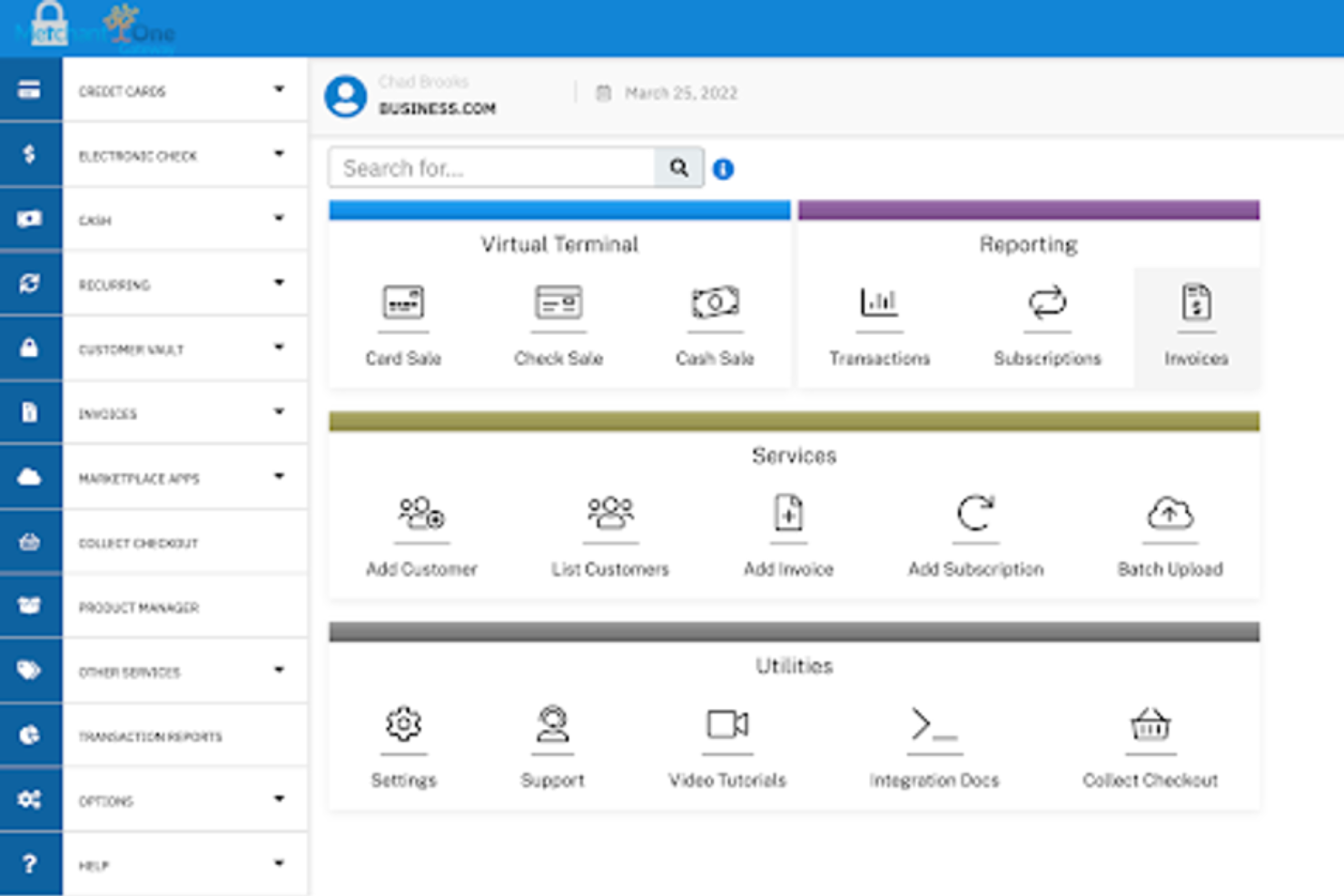

Merchant One is a credit card processing tool that caters to various business sectors, including retail, restaurants, hospitality, and ecommerce, by providing efficient payment processing solutions. With a focus on next-day funding and robust point of sale systems, Merchant One positions itself as a competitive choice for businesses seeking prompt financial transactions and reliable POS capabilities.

Merchant One serves as an efficient online payment gateway provider by offering seamless integration capabilities with a wide array of ecommerce platforms and websites. This ease of integration is crucial for online businesses looking to provide a smooth and secure checkout experience for their customers. Merchant One's platform is designed to handle a diverse range of payment methods, including credit and debit cards, mobile payments, and electronic checks, ensuring that businesses can cater to the varied preferences of their customer base.

Moreover, Merchant One distinguishes itself with its high approval rates for businesses across various industries, including those deemed high-risk. This inclusiveness allows a broader spectrum of online merchants to access reliable payment processing services, essential for facilitating online sales and scaling operations. The provision of dedicated account managers offers personalized support, guiding businesses through the setup process, optimizing payment processing configurations, and addressing any issues promptly.

Integrations include Authorize.net, Payeezy Gateway, Payflow Pro, Paytrace Gateway, USAePay, Aloha, Micros, Maitre’D, 1ShoppingCart, BigCommerce, ecwid, Fishbowl, Magento, PrestaShop, Salesforce, and dozens more ecommerce platforms, shopping cart solutions, and sales enablement tools.

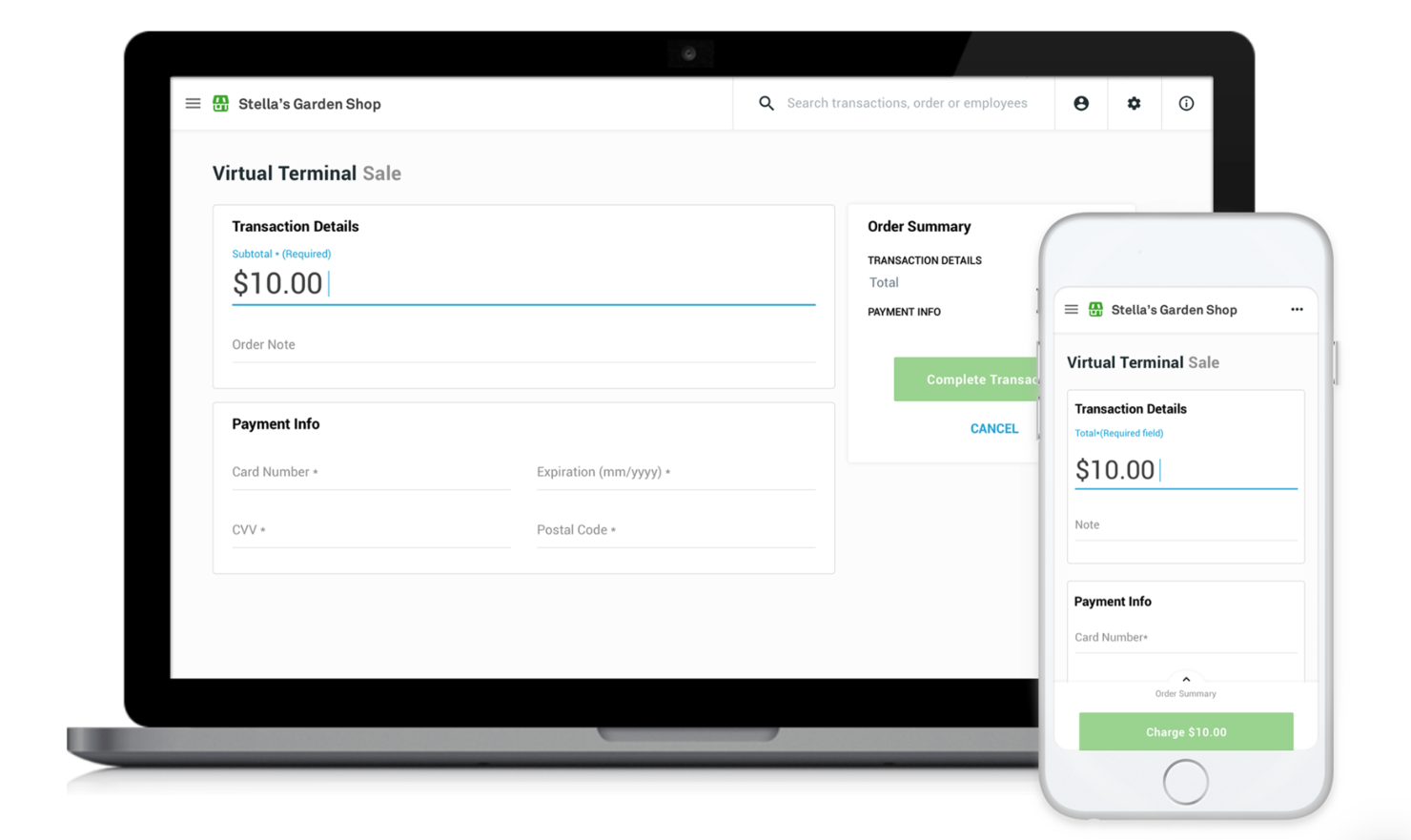

Clover is a comprehensive point-of-sale (POS) system designed to cater to the needs of small businesses through a comprehensive ecosystem that includes a robust suite of hardware and software solutions designed to cater to a wide range of business needs, from small retail setups to bustling restaurants.

Why I picked Clover: I chose Clover because it delivers a comprehensive POS system that supports a variety of payment methods, including credit, debit, gift cards, and contactless payments. This capability is critical in today's market, where consumers expect convenience and flexibility in payment options.

The system allows you to take payments from card readers, POS devices, and online platforms. It even has a virtual terminal you can use whenever you are away from a physical device. This will help you quickly process payments from any device with internet access, like your phone or personal computer.

Clover Standout Features & Integrations

Standout features include inventory tracking, staff management, app integration, and customer loyalty programs, which cater to the diverse needs of businesses. I would also highlight its security features, which include end-to-end encryption and compliance with PCI guidelines, offering businesses and their customers peace of mind regarding the security of their transactions.

Integrations include various third-party applications to support business operations, like Mailchimp for marketing automation, DocuSign for electronic signatures, Shopify for e-commerce, Gusto for payroll and HR, and Xero for accounting. These integrations facilitate a range of functions from marketing to financial management for businesses using Clover's system.

Pros and cons

Pros:

- 24/7 customer support

- Gift card options

- Modern design

Cons:

- Pricing can be difficult to understand

- Not suitable for all types of businesses

Payment Depot stands out as a compelling option for ecommerce businesses looking for a reliable payment gateway provider. The platform's subscription-based pricing model is particularly attractive, offering a cost-effective solution for businesses with high transaction volumes. This model allows merchants to pay a flat monthly fee plus a small per-transaction charge over wholesale rates, significantly reducing the cost per transaction compared to traditional percentage-based fee structures.

One of the key advantages of Payment Depot for ecommerce is its inclusion of a free payment gateway, which facilitates online transactions without additional costs for gateway services. This feature, coupled with virtual terminal capabilities through partnerships like SwipeSimple, enables businesses to process online, mobile, and over-the-phone payments seamlessly.

Payment Depot's commitment to transparency and simplicity extends to its fee structure, with no hidden fees and a clear, upfront disclosure of costs. This approach helps ecommerce businesses better predict their monthly expenses and manage their budgets more effectively. Moreover, Payment Depot's user-friendly interface and intuitive reporting dashboard make it easy for merchants to navigate their accounts, analyze sales data, and gain insights into their business performance, contributing to an overall streamlined management process.

Payment Depot's support for a variety of payment methods, including mobile wallets like Apple Pay and Google Pay, ensures that ecommerce businesses can cater to the preferences of a broad customer base. The platform's focus on providing comprehensive payment solutions, combined with dedicated customer support, positions Payment Depot as a highly competitive choice for ecommerce merchants seeking a reliable, cost-effective, and user-friendly payment gateway provider.

Integrations include OpenCart, PrestaShop, 3dCart, BigCommerce, WooCommerce, Magento, Zen Cart, NCR, Authorize.Net, PayTrace, and others.

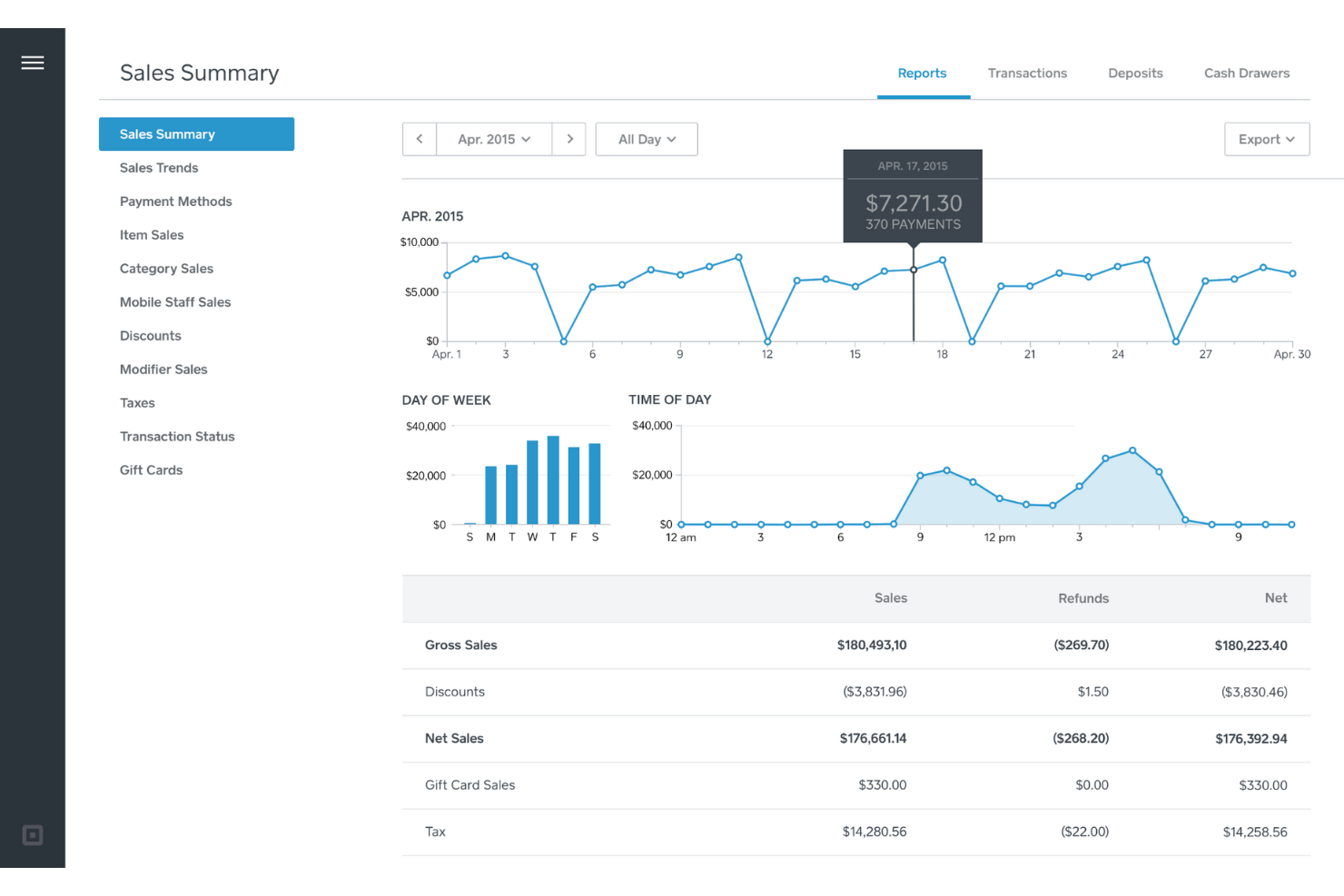

Square is a payment gateway provider that offers payment solutions to businesses of all sizes. The company's hardware and software products include a credit card processing system that allows businesses to accept payments using a smartphone or tablet, a point-of-sale system for managing inventory and customer data, and an online store builder.

However, its affordable fee structure makes it an ideal payment gateway solution for small business owners.

Why I picked Square: What stands out about Square is its simple setup, affordable pricing, and versatile features. Its point-of-sale system, online store, and invoicing tools are all designed to make payment processing easy and hassle-free for small business owners. The fact that there are no monthly fees and low transaction fees also makes it an attractive option for businesses with limited budgets.

The primary use case for Square is small business payment processing. Its standout features include the ability to accept payments in-person, online, and through invoices and integration with other Square tools like payroll and marketing. With its focus on serving the needs of small businesses, Square is an excellent choice for entrepreneurs and small business owners who want a simple yet cost-effective payment processing solution.

Square Standout Features and Integrations

Features include reporting or analytics, SSL security, payment fraud prevention, payment processing, Point of Sale (POS), receipt management, recurring or subscription billing, electronic signature, fraud detection, and debit or credit card processing.

Integrations include Acuity Scheduling, Ecwid, FreshBooks, Google Forms, Mailchimp, Paymo, Poptin, Weebly, WooCommerce, Zoho Invoice, and other software options.

Pros and cons

Pros:

- Offers free POS app

- Easy to use

- No monthly fees

Cons:

- Limited global coverage

- Lacks phone support

Stripe

Best payment gateway provider for handling recurring transactions

Stripe is an online payment processing platform that provides tools and services that enable businesses of all sizes to quickly and securely accept payments online, including credit and debit cards, digital wallets, and bank transfers. Businesses use Stripe's flexible payment processing solutions in various industries, including ecommerce, subscription services, and on-demand marketplaces.

Why I picked Stripe: Stripe's intuitive user interface, developer-friendly API, and in-depth documentation make it easy for teams to get started with payment processing quickly. What sets Stripe apart is its ability to handle recurring transactions with ease, allowing businesses with subscription-based models to automate payment processing and reduce payment failures.

Stripe is ideal for startups and developers who want to incorporate payment processing into their web or mobile applications. Its standout features include a wide range of payment options, including credit and debit cards, digital wallets, bank transfers, and support for more than 135 currencies.

Stripe's developer-friendly API and comprehensive documentation make it easy for teams to get started with payment processing quickly. Additionally, Stripe's robust subscription management features, including automatic billing, make it easy for businesses with subscription-based revenue models to easily handle recurring transactions.

Stripe Standout Features and Integrations

Features include ACH payment processing, billing and invoicing, credit card payment management, fraud detection, in-person payments, 135+ currency support, and iOS and Android mobile apps.

Integrations include DocuSign, FreshBooks, Gmail, Google Pay, Mailchimp, Microsoft Excel, monday.com, Rippling, Shopify, Slack, WordPress, and other software options. You can also connect Stripe to a paid Zapier account to unlock additional integrations, if needed.

Pros and cons

Pros:

- Supports 135+ currencies

- Uses advanced fraud detection tools

- Easy-to-use software

Cons:

- Limited phone support

- High chargeback fees

Braintree is a payment gateway service founded in 2007 and acquired by PayPal in 2013. It provides businesses with merchant services and a platform to accept online payments in over 130 currencies.

Why I picked Braintree: Braintree stands out with its advanced fraud protection features that help prevent chargebacks, making it a reliable and secure payment gateway provider. Its unique customization options also allow businesses to create a branded checkout experience that enhances customer trust and loyalty, making it ideal for ecommerce businesses.

It also offers developer-friendly API, allowing businesses to integrate the platform into their existing infrastructure quickly and efficiently. It also integrates with popular ecommerce platforms like Shopify and WooCommerce, making it easy for businesses to get up and running with their payment processing.

Braintree Standout Features and Integrations

Features include ACH payment processing, API, billing and invoicing, debit or credit card processing, in-person payments, mobile payments, multiple payment options, payment fraud prevention, and reporting and statistics.

Integrations include 3dcart, BigCommerce, Demandware, Magento, NetSuite, Primer, Salesforce, SAP, WooCommerce, Yodle, and other software options.

Pros and cons

Pros:

- Offers transparent pricing

- No setup or monthly fees

- Excellent customer support

Cons:

- Some users reported integration complexities

- The dispute resolution process can be lengthy

Payoneer enables businesses and professionals to send and receive payments globally, including via local bank transfers, e-wallets, and prepaid Mastercards. Payoneer is used by freelancers, online sellers, and businesses of all sizes to manage their cross-border payments easily and efficiently.

Why I picked Payoneer: One thing that's particularly cool about Payoneer is its global reach and ability to facilitate payments in multiple currencies. Unlike many other payment gateways with limited coverage, Payoneer supports payments in over 150 currencies across more than 200 countries and territories. This makes it an ideal solution for freelancers, online sellers, and businesses operating globally or with clients and partners in different parts of the world.

Additionally, Payoneer offers competitive exchange rates and low fees, making it a cost-effective option for cross-border payments. It doesn't charge a monthly or setup fee, but if your account is inactive for 12 months, it charges a $29.95 annual fee.

With Payoneer, you can send payments at no cost, and usually, the amount will reach the recipient's bank within 24 hours. You can also request payments from a client who can pay you through a Payoneer account, bank account, or credit card. Lastly, the platform also provides a mobile app, debit card, and security features.

Payoneer Standout Features and Integrations

Features include global payments, invoices, prepaid debit card, mobile app, tax administration, and security.

Integrations include Avaza, ChannelAdvisor, Deel, Exigo, Freightos, Hubstaff, MarketPowerPRO, Time Doctor, Xero, and Zentail.

Pros and cons

Pros:

- Worldwide acceptance

- Low currency conversion rates

- Good mobile app

Cons:

- Risk of account freezes and terminations

- Slow customer support

The Best Payment Gateway Providers Summary

| Tools | Price | |

|---|---|---|

| Shopify POS | Plans start at $31/month | Website |

| QuickBooks Online | from $22.50/month | Website |

| Helcim | From 0.50% + $0.25 per transaction | Website |

| Merchant One | From $13.95 plus 0.29% + 1.55% per transaction | Website |

| Clover | From 2.3% + $0.1 per transaction | Website |

| Payment Depot | From $79/month | Website |

| Square | From $36/month plus 2.9% + $0.30 per transaction | Website |

| Stripe | From 2.9% + 0.30 per transaction | Website |

| Braintree | Plans start at 2.9% + $0.30 per transaction | Website |

| Payoneer | From 3% fee for credit card transactions | Website |

Compare Software Specs Side by Side

Use our comparison chart to review and evaluate software specs side-by-side.

Compare SoftwareOther Payment Gateway Options

I didn’t have the space to include full reviews for each of these additional payment gateway providers but they offer some cool features and functionality that could be exactly what you need. Presented for your consideration:

- Skrill

Best payment gateway provider for secure and fast transactions

- WePay

Best payment gateway provider for WePay platform partners

- Authorize.net

Best payment gateway provider for an all-in-one plan

- BlueSnap

Best payment gateway provider for cross-border transactions

- Shift4

Best payment gateway provider for businesses of all sizes

- 2Checkout

Best payment gateway provider for subscription-based businesses

- AlliedWallet

Best payment gateway provider for businesses that require advanced fraud protection

- Dwolla

Best payment gateway provider for ACH transfers

- Payline Data

Best payment gateway provider for chargeback management

- BitPay

Best payment gateway provider for accepting cryptocurrency payments

How I Selected the Best Payment Gateway Providers

To develop this list of the best payment gateway providers, I used a rigorous selection process. I started by researching and comparing a wide range of payment gateway providers that have positive user ratings and reviews. From there, I used the following selection criteria to evaluate each platform and determine which ones stood out from the rest.

Key Features

A payment gateway provider offers a service that processes credit card payments for e-commerce sites and traditional brick-and-mortar stores. The key features of a payment gateway provider typically include:

- Multiple Payment Methods: Supporting a variety of payment methods, including credit cards, debit cards, e-wallets, and sometimes even cryptocurrencies, to cater to a wide range of customers.

- Fraud Detection and Prevention: Advanced fraud detection tools to identify and prevent fraudulent transactions. This includes features like CVV verification, address verification systems (AVS), and sophisticated algorithms to detect unusual purchasing patterns.

- Integration Capabilities: Easy integration with e-commerce platforms, shopping carts, and accounting software. This often involves providing APIs (Application Programming Interfaces) and SDKs (Software Development Kits) for seamless integration.

- User-Friendly Interface: A simple and intuitive interface for both merchants and customers. This includes a straightforward checkout process for customers and an easy-to-navigate merchant dashboard.

- Mobile Compatibility: Ensuring the payment gateway is optimized for mobile devices, considering the increasing prevalence of mobile commerce.

- International Transactions: Capability to handle international payments, including support for multiple currencies and compliance with various international regulations.

- Reporting and Analytics: Providing detailed reports and analytics to merchants, helping them track sales, understand customer behaviors, and manage finances.

- Customer Support: Offering robust customer support to resolve issues related to transactions, integration, or any other aspect of the payment process.

- Recurring Billing: For businesses that operate on a subscription model, the ability to handle recurring payments is essential.

- Customization and Scalability: The ability to customize the payment process to fit the specific needs of a business and scale as the business grows.

- Speed of Processing: Ensuring fast processing of transactions, as delays can lead to cart abandonment in e-commerce settings.

- Chargeback Management: Assistance in handling chargebacks and disputes, which is crucial for maintaining good customer relations and financial health.

Security & Compliance

Ensuring the security of transactions is paramount. This includes compliance with the Payment Card Industry Data Security Standard (PCI DSS) and using encryption methods like SSL (Secure Socket Layer) to protect sensitive information.

Software Integrations

I considered how well each payment gateway integrates with other software and platforms commonly used by businesses, such as ecommerce platforms and order management software.

People Also Ask

As you continue learning about payment gateway providers, you may encounter some common questions. Here are a few of the most frequently asked questions.

How much do payment gateway providers cost?

Payment gateway providers will most likely charge on a per-transaction basis or revenue-value basis. That means, the bigger your business, the more you pay. Costs may increase for advanced features, like a reporting suite or third-party integrations. From my in-depth research, standard pricing may range from 1.4% to 2% card transaction on the low end to $36/month plus 2.9% + $0.30 per transaction on the higher end.

How to get the most ROI out of any payment gateway provider?

To maximize the Return on Investment (ROI) from a payment gateway provider, businesses should consider the following tips:

- Choose the Right Provider: Select a payment gateway that aligns with your business needs. Consider factors like transaction fees, security features, ease of integration, supported payment methods, and customer service quality. A provider that matches your specific requirements can offer better value for money.

- Negotiate Fees and Rates: Don’t hesitate to negotiate transaction fees, especially if your business processes a high volume of transactions. Lower fees can significantly reduce your costs over time.

- Optimize for Mobile Transactions: Ensure that your payment gateway is optimized for mobile users. With the increasing trend of mobile shopping, a mobile-friendly payment process can enhance customer experience and potentially increase sales.

- Utilize Fraud Prevention Tools: Take full advantage of the fraud prevention tools offered by your payment gateway. Reducing fraudulent transactions can save a significant amount of money in chargebacks and associated fees.

- Analyze Transaction Data: Use the analytics and reporting tools provided by the payment gateway to gain insights into customer behavior and preferences. This data can help in making informed decisions that can improve sales and customer satisfaction.

- Streamline the Checkout Process: A simplified and efficient checkout process can reduce cart abandonment rates. Ensure that the payment process is as straightforward and quick as possible.

- Offer Multiple Payment Options: Cater to a broader customer base by offering various payment methods, including credit cards, debit cards, digital wallets, and even local payment options, depending on your market.

- Regularly Update and Maintain Integration: Keep the payment gateway integration updated to ensure smooth operation and take advantage of any new features or improvements that could enhance efficiency or security.

- Train Your Staff: Ensure that your staff is well-trained in using the payment gateway, understanding its features, and troubleshooting common issues. This can improve efficiency and customer service.

- Monitor Chargebacks and Disputes: Keep a close eye on chargebacks and disputes. Understanding why they occur can help you take preventive measures, reducing their frequency and associated costs.

- Leverage Recurring Billing if Applicable: If your business model includes subscriptions or recurring payments, utilize the recurring billing features of your payment gateway to automate and streamline these processes.

- Ensure PCI Compliance: While most payment gateways are PCI compliant, ensure that your business practices also adhere to these standards to avoid costly fines and protect customer data.

- Evaluate and Adapt: Regularly assess the performance of your payment gateway and be open to making changes or upgrades as your business needs evolve.

What are the benefits of payment gateway providers?

Payment gateway providers offer several benefits to businesses, particularly those operating in the e-commerce space. These benefits include:

- Secure Transactions: Payment gateways use advanced encryption and security protocols to ensure that customer payment information is transmitted securely. This helps in reducing the risk of fraud and data breaches, providing peace of mind for both the business and its customers.

- Broadened Customer Base: By accepting a variety of payment methods, including credit card processing, debit cards, and digital wallets, businesses can cater to a wider audience. This inclusivity can lead to increased sales and customer satisfaction.

- Enhanced Customer Convenience: Payment gateways offer a smooth and quick checkout process, which is crucial for enhancing customer experience. A streamlined payment process can reduce cart abandonment and increase conversion rates.

- Compliance with PCI DSS: Payment gateway providers are typically compliant with the Payment Card Industry Data Security Standard (PCI DSS), which means businesses don’t have to manage this complex compliance process on their own.

- International Sales: Many payment gateways support multi-currency transactions, allowing businesses to easily sell to customers around the world. This capability is essential for businesses looking to expand their market reach globally.

- Automated and Efficient Processing: Payment gateways automate the transaction process, which reduces the manpower needed for manual processing. This automation can lead to more efficient operations and reduced errors.

- Recurring Billing Support: For businesses that operate on a subscription model, payment gateways can automate recurring payments, making it easier to manage subscriptions and maintain steady cash flow.

- Real-Time Processing: Payment gateways process payments in real-time, providing immediate feedback on the transaction status. This immediacy is beneficial for both the customer and the business in managing orders and inventory.

- Detailed Reporting and Analytics: They provide valuable insights through detailed reports and analytics on transactions. This data can help businesses in making informed decisions and understanding customer purchasing patterns.

- Reduced Risk of Chargebacks: With advanced fraud detection mechanisms, payment gateways can reduce the incidence of chargebacks, which can be costly and time-consuming for businesses to manage.

- Scalability: Payment gateways can scale with the growth of a business, accommodating increased transaction volumes and additional functionalities as needed.

- Customer Support: They often offer robust customer support to assist with any issues related to transactions, technical integrations, or other aspects of the payment process.

Other Payment Software Reviews

These software review lists may complement your search for payment gateway software. I focused on software reviews for payment or payment-adjacent technologies, like fraud prevention or BNPL.

- Buy-Now-Pay-Later (BNPL) Platforms: Let your customers pay for high ticket items in installments, making for a much more user-friendly experience.

- Ecommerce Fraud Prevention Software: Make sure every transaction on your store website is legitimate; protect yourself and your customers!

- Ecommerce Accounting Software: Make sure you have access to a complete accounting system for collecting payments and tracking taxes.

The Takeaway

Selecting the right payment gateway provider is crucial for any business that wants to process online transactions securely and efficiently. Choosing the wrong provider could lead to issues with payment processing, security breaches, and unsatisfied customers. On the other hand, selecting the right payment gateway provider can ensure that transactions are processed smoothly, securely, and with minimal downtime.

I hope you enjoyed reading this list, and if you'd like to learn about related topics around payment processing tech and security, be sure to subscribe to the Ecom Manager newsletter.