Cash or Card? More!: Ecommerce payment processing is essential for capturing customer transactions online, involving various methods like credit cards, digital wallets, and even cryptocurrency, ensuring businesses meet customer preferences.

The Wizard Behind the Curtain: The seemingly straightforward online transaction is backed by a complex system involving payment processors, gateways, and merchant accounts, ensuring secure and fast processing from customer's bank to merchant's account.

Smooth Sailing Shopping: Optimizing the checkout process by making it mobile-friendly, uncluttered, and offering multiple payment methods can significantly reduce cart abandonment and enhance customer experience.

Taxing Times: Ecommerce stores must navigate the complex web of sales tax collection, which varies by country and region, and understand the tax implications of payment processing fees to remain compliant.

The Perfect Match: Choosing the right payment processor involves considering the types of payments accepted, customer support quality, international payment capabilities, security measures like PCI compliance and tokenization, and how well it integrates with existing software.

How you get customers to transfer their cash into your account is one of the most important aspects of running an ecommerce store.

Ecommerce payment processing is both simple and complex. Simple, because we all do it without thinking about it. Complex, because there’s a ton going on to make it happen.

And, beyond the technical complexity, how you manage payments on your store is a major customer experience factor.

Too few payment options? Don’t accept Apple Pay? Too many form fields? Abandoned carts galore.

It doesn’t have to be that way, though. You control the fate of your online sales.

That’s why we have this big ol’ guide to payment processing for you. In it, we’ve packed in the high level view, the perspective from close-up, how to optimize your payments, how taxes figure in, and the best payment processors to use (in our humble opinion).

What is Ecommerce Payment Processing?

Ecommerce payment processing is one of those terms that defines itself—the system online stores use to accept payments from their adoring customers.

Now, this requires a lot more than I’m letting on here, which we’ll go into, but from the detached view, it is just about getting that money from your customer’s bank to your bank in the easiest way possible.

And, it works!

Millions of people shell out their cash digitally every day for some DTC ware and nothing bad happens (except when what they bought wasn’t really what they wanted and they have to return it...).

And, it doesn’t just encompass sales that happen online, but also sales from a connected in-person POS (point of sale) or card reader.

There’s a ton of money pouring through this system, with nearly $6 trillion ecommerce sales in 2023 growing steadily to a projected $8.1 trillion in 2026. This accounts for nearly 23% of everything humans buy or sell today.

But, let’s go from bird’s eye to close-up to learn the little details.

Ecommerce payment processors are systems used to facilitate secure online payments between customers and your company.

Payment processors allow you to take various popular online payment methods, such as:

- Credit cards and debit cards

- Digital wallets like Apple Pay, Google Pay, Amazon Pay, and PayPal

- Buy Now Pay Later (BNPL) services like Klarna, Affirm, and Afterpay

- Direct bank transfer and ACH payments

- Cryptocurrency payments (rare but accepted on platforms like Shopify)

A few well-known examples of payment processors are:

- Stripe

- Square

- Shopify Payments

- Helcim

But, we’ll get into top payment processors later on in the post. Let’s keep learning about how this thing works.

Elements of ecommerce payment processing

Behind each seemingly simple online transaction is a fair bit of complex invisible happenings.

Your customer visits your ecommerce store, fills their cart, taps in their card details, a bunch of stuff happens, and they get a confirmation seconds later.

This ‘bunch of stuff’ is a series of super fast communications between certain components of the process. Those components are:

- The payment processor: A financial institution or service provider that acts as an intermediary between you (the merchant) and banks/card networks. It facilitates the secure transfer of transaction data and funds between your merchant account and the customer's bank or credit card company.

- Payment gateway: A platform that securely connects your online store to the payment processor's systems. It encrypts and transmits sensitive payment information (such as credit card details) from the customer to the payment processor for authorization. It serves as a bridge between your website and the payment processor.

- Merchant account: A specialized bank account that allows you (the business) to accept and process electronic payments, such as credit and debit card transactions. Funds from approved transactions are deposited into this account by the payment processor after deducting applicable fees.

- Payment information tokenization: A security measure that replaces sensitive payment data (like credit card numbers) with a non-sensitive substitute, called a "token." This randomly generated alphanumeric code represents the original payment information without exposing the actual data, reducing the risk of data breaches and unauthorized access to your customers' payment details.What are ecommerce payment processors

How does ecommerce payment processing work?

OK, let’s look at a familiar scene: A customer is browsing your online store, and they've found the perfect item they want to buy (let’s say, an ugly Christmas cat sweater).

They proceed to checkout, ready to complete their purchase. Here's what happens next:

First, you present them with a list of payment options they can choose from—credit cards, digital wallets, BNPL services, and so on.

Once they select their preferred method, they'll be prompted to enter their payment details securely on your website or mobile app.

Now, the magic happens behind the scenes:

- Their encrypted payment information is sent to your payment processor through the payment gateway—that secure bridge between your store and the payment processor.

- Your payment processor reaches out to the customer's bank or credit card company to verify the transaction details and ensure there are sufficient funds available. This is a quick check-in to make sure everything is in order.

- Within seconds, the bank or card issuer responds with either an approval or denial for the transaction.

- The payment processor then relays this decision back to the payment gateway, which in turn communicates the outcome to your customer.

If the payment is approved:

- Your customer receives a confirmation, usually via email or on the checkout page, letting them know their order was successful.

- Simultaneously, the funds for their purchase are transferred from their account to your business's merchant account.

And there you have it. A seamless transaction made possible by the intricate dance between your store, the payment gateway, the payment processor, and the customer's bank or card.

Now, if you happen to have customers from around the globe, there's an extra step involved:

- During the payment processing, currencies will be automatically converted to ensure the funds reach your merchant account in the correct currency.

It's a complex process happening in the blink of an eye, but one that ensures a smooth and secure shopping experience for your customers, no matter where they're from or how they choose to pay.

How to Set Up Your Ecommerce Payment Processing

While all the above info may make it seem like a daunting task, it’s fairly straightforward with the right tools.

Let’s go through the steps to get you on your way.

- Choose your payment gateway wisely. Payment gateways are the connective tissue between your online store and the payment processor. They're responsible for transmitting your customers' sensitive payment information, so you'll want to choose carefully. A reliable payment gateway is crucial for preventing potential data breaches and ensuring a secure checkout experience.

- Apply for a merchant account. When you apply, the payment processor or third-party provider will need some basic information about your business. With a merchant account, you'll be able to accept those sweet online payments.

- Decide which payment options to accept. Take a look at the different payment methods your customers might prefer. Do you want to accept credit cards, debit cards, PayPal, Stripe, or maybe even some Buy Now Pay Later options? Make sure your chosen processor supports the payment options you want to offer.

- Configure that payment gateway. This part might vary slightly depending on your website host and the specific payment gateway you've selected. Generally, you'll either integrate or embed the gateway into your website. Don't worry; it's not as technical as it sounds.

- Stay compliant with PCI standards. The Payment Card Industry (PCI) has set standards to keep your customers' information safe during online transactions. If you’re accepting payments online (which obviously, you will), you'll need to ensure you comply with all their security standards. It's not just a formality; it's for the protection of your business and your customers.

6 Tips For Optimizing Your Ecommerce Payment Process

Conversion is everything in ecommerce.

That’s why you choose the best ecommerce platform, the coolest marketing automation platforms, and obviously, the most intuitive payment processor.

If you’ve got everything else wrapped up to get shoppers from your homepage to checkout, this last step is a big one. You don’t want to mess it up.

Abandoned carts are a bummer.

The culprit? Often, it's a clunky, confusing, or insecure checkout experience that scares customers away.

Put yourself in your customers’ shoes (well, not all of them at once). Go through your own checkout process and see where it’s no fun. What are the hiccups along the way?

To ensure a smooth, seamless, and secure payment processing experience that keeps those conversions rolling in, here are some tips to optimize your checkout flow:

1. Make it mobile-friendly

These days, chances are high that a good part of your sales are coming from mobile. These pocket computers can do it all!

Even if you think your customers mostly shopping on desktop, Google prefers mobile, too. In order to rank, you need to think mobile-first.

You don't want your potential customers to bounce just because your site wasn't playing nice with their tiny screens.

2. Use a clean, uncluttered design

Whether on mobile or desktop, nobody enjoys a cluttered, confusing interface.

Cramming too many widgets, buttons, and distractions onto the checkout page is a surefire way to derail your customers' focus and potentially lose the sale.

Instead, prioritize a clean, streamlined design that guides your customers smoothly through the payment process.

3. Resist the urge to ask for unnecessary information

While customer data can be valuable for marketing and analytics purposes, asking for too much personal information can quickly spook potential buyers, especially if they're new to your store.

Remember, building trust is key, so only request the essential details needed to complete the transaction.

4. Allow guest checkout

Not everyone wants to create an account just to buy a pair of socks or a small gadget.

Even your loyal customers might sometimes prefer a quick, hassle-free checkout experience. Offering a guest checkout option creates a fast lane for new and casual buyers, as well as returning customers in a hurry.

5. Offer multiple ways to pay

While keeping things simple is generally a good idea, make an exception when it comes to payment options.

Credit and debit cards are still king, but some customers might prefer the convenience of digital wallets like PayPal or Apple Pay. Catering to these preferences could mean the difference between a completed sale or an abandoned cart.

6. Don't surprise your customer with extra costs

Transparency is key when it comes to pricing.

Nothing frustrates online shoppers more than thinking they're getting a great deal, only to be hit with unexpected fees or charges at the last minute.

If you need to factor in sales tax, shipping costs, or any other additional fees, make sure these are clearly visible throughout the checkout process to avoid any unpleasant surprises.

Taxes and Ecommerce Payment Processing

When companies first started selling goods and services online in the US, they only had to collect sales tax if they had a physical presence, or nexus, in the customer’s state.

For example, if a company located in New York City sold something to a customer based in Syracuse, New York, it would be required to collect sales tax.

However, a 2018 Supreme Court decision made things a little murkier.

South Dakota sued Wayfair for its failure to collect sales tax from its residents. Wayfair’s attorneys argued that the company had no physical presence in South Dakota, so it wasn’t required to collect sales tax there.

In Canada, all existing tax laws that apply to brick-and-mortar businesses apply to your ecommerce business. If you have a website that generates income, you need to report it.

Again, ecommerce tax rules vary between countries and there’s rarely a one-size-fits-all answer.

You should set yourself up for success and avoid issues by working with experts who can guide you through your jurisdiction’s tax rules.

Payment processing fees: Are they taxable?

Whether you’re a small business or a giant corporation, you need to compensate your payment processor for its services. The good news is, these fees are often tax-deductible.

In the US, the IRS considers payment processing fees as a legitimate operating cost, so you can use them to reduce your taxable income.

This is also true in Canada, with the Canada Revenue Agency allowing you to deduct management and administration fees, including bank charges which include those for payment processing, incurred while operating your business.

Your payment processor will generally send you all the relevant tax documentation you need, which makes it a little easier to determine how much you should deduct.

However, it’s important to maintain your own records.

If the processor doesn’t send you your tax forms in time, or if there’s an error on the form, you can use your records to determine the correct deduction amount.

It’s also important to consider that tax laws vary between countries.

If you operate in the US, you should also know that every state has its own rules regarding the collection and remittance of sales tax.

Always refer to tax professionals and your country’s own guidelines. It goes without saying that the complexity, not to mention the variability, of tax laws is massive.

If you want some backup, regardless of where you’re operating out of, consider taking a look at our picks for the best ecommerce sales tax software to avoid making critical mistakes.

Tips for complying with sales tax laws

To make tax compliance as painless as possible, follow these tips:

- Use ecommerce accounting software to keep track of how much tax you’re sending to relevant government agencies each year.

- Hire a tax professional to walk you through the requirements. Professional advice can help you avoid some costly mistakes.

- Make sure your ecommerce software integrates with your accounting software so you don’t have to spend time transferring data between the programs. Manual data entry takes up time and increases the risk of errors.

- Follow your country or state’s instructions for submitting your tax payments. If you don’t follow the rules, you may not receive credit for every payment, leaving your business struggling to catch up.

Questions to Ask When Finding The Best Payment Processor

No single ecommerce payment processor will fit every online business's needs. Consider the questions below when choosing a payment processor for you.

What types of payments do you accept (or plan to accept)?

Consider the types of payments your company utilizes and compare them to those a potential payment processing solution can handle. You'll want the two to match up.

A few examples of common types of payments you may accept include:

- PayPal

- Stripe

- Venmo

- CashApp

- eCheck payments

- Major credit cards and debit cards (including Visa, Mastercard, American Express, and Discover)

- Buy Now Pay Later (BNPL) services like Klarna and Afterpay

- Payments through digital wallets (like Apple Pay, Amazon Pay, or Google Pay)

- Cryptocurrency (rare but becoming more popular)

- International payment methods, if you are selling globally

You don't have to allow your customers to use all these methods for their online shopping. But customers do prefer having several payment options to choose from.

How robust is their customer support?

If you run into an issue with your payment processor, you need help ASAP. Even a few hours of downtime could spell big trouble for your sales, not to mention your customer experience.

Look for a payment processor that has 24/7 support with various ways to contact, like live chat, phone support, and email.

Will you need to handle international payments?

You won't have to worry about international payments if your company only handles domestic sales.

But more and more business owners are deciding to extend their company's reach globally. If this applies to you, verify with customer support that their payment systems can exchange foreign currencies.

Do you need to manage any recurring subscriptions?

Subscriptions hinge on great payment processing, since they require regular automated payments.

Some payment service providers have features that make managing recurring payments simpler. If you plan on offering recurring services, ensuring that your customer's payment details will be safe is even more crucial.

Is the payment processor PCI-compliant?

Ensuring your payment processor follows PCI compliance is a must. Customer trust depends on making sure they have secure payments every time.

PCI DSS are a set of guidelines, rules, and regulations are designed to make credit card processing as secure as possible. This lowers the risk of your customer's credit card information being accessed during a data breach.

Do they use tokenization?

This is another security-based question you'll want to ask. Ideally, all debit and credit card transactions will be processed as tokens rather than sharing the actual details.

Using tokenization can help your customers feel more confident about purchasing the items they have saved in their shopping carts.

If you store your customer's payment information directly, it could cause serious problems in the event of a data breach.

The hacking entity would have access to sensitive data and financial information that could be used to steal someone's identity or gain access to their hard-earned funds.

Payment tokenization is a safer alternative to direct information storage.

Instead of saving any credit card details, the website saves the data as a random alphanumeric code.

Each time your customer wants to use their saved information, the generated code (i.e., token) is used instead.

Do you have other software to integrate with your payment processor?

Software integration may not be a deal breaker, but it's a nice thing to have.

Integrating your regular tech stack with your payment processor is a time-saver because there are fewer applications you need to open during your workday.

For example, you may want to integrate your payment processor with your point-of-sale system (POS).

This is why merchants love something like Shopify Payments, which sits within the Shopify dashboard and has a physical POS system for your in-store customers.

What payment processing fees do they charge?

There are various methods that payment processors use to charge for their services. There may or may not be upfront costs in the form of setup fees.

Some payment processing services charge a monthly fee, while others only charge based on transactions.

Transaction fees can range but are usually charged as a percentage and flat rate.

For example, you may be charged a 25-cent fee plus 2% of the total payment amount per transaction.

It’s also important to know how they deal with things like chargebacks, which can have steep per-transaction costs.

The Best Ecommerce Payment Processors

There are numerous payment processing solutions you could choose for your company, each with its strengths and downsides.

Choosing a payment processor isn’t a one-size-fits-all endeavor, so you’ll want to take time choosing an option that best fits the needs of your ecommerce platform.

Here are a few popular ecommerce payment processing solutions that you should check out:

And here is a breakdown of the pricing for each:

| Tools | Price | |

|---|---|---|

| Stax Pay | From $99/month | Website |

| Shopify POS | Plans start at $31/month | Website |

| QuickBooks Online | From $22.50/month | Website |

| Hopscotch | Zero fee payment options | Website |

| Helcim | From 0.50% + $0.25 per transaction | Website |

| Clover | From 2.3% + $0.1 per transaction | Website |

| Merchant One | From $13.95 plus 0.29% + 1.55% per transaction | Website |

| Freshbooks | From $9.50/user/month (billed monthly) | Website |

| Chargebee | From $249/month | Website |

| Square | From $36/month plus 2.9% + $0.30 per transaction | Website |

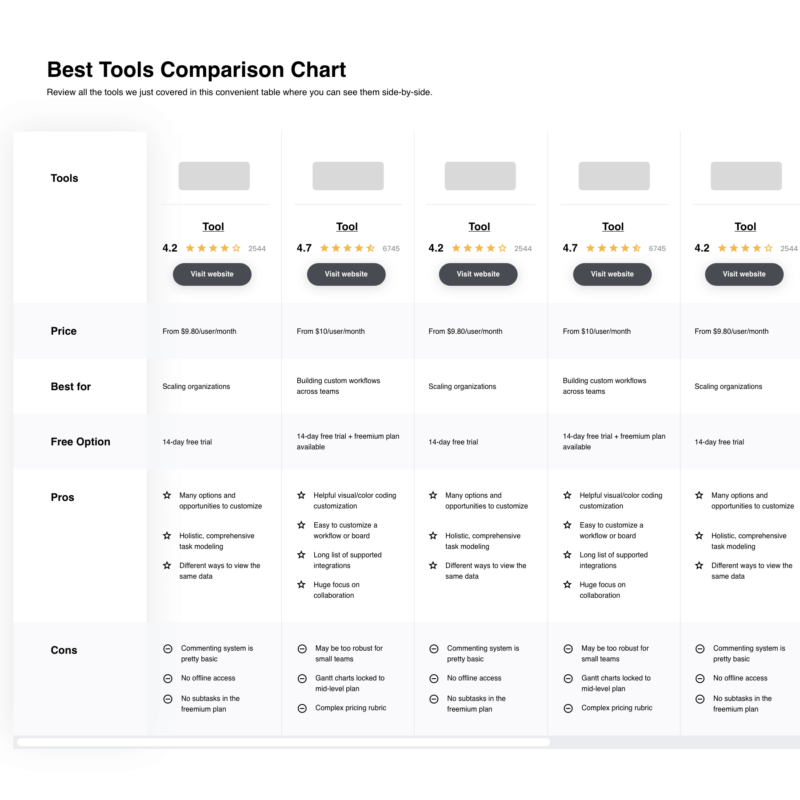

Compare Software Specs Side by Side

Use our comparison chart to review and evaluate software specs side-by-side.

Compare SoftwareGet Your Payments In Order, Get Paid

As you can see, a lot goes into how your payments are processed.

The payment options you offer, the smoothness of your checkout flow, the tools you use to make it all happen—they don’t all have simple answers. How you design your payment experience depends on your brand’s needs and your customers’ preferences.

Whatever you need, there’s a great payment tool to help you provide the best customer experience possible while keeping your costs at a minimum.

The world of ecommerce moves fast—and so do you. Subscribe to our newsletter with the latest insights for ecommerce managers from leading experts in ecomm.