As someone deeply versed in ecommerce technology, I understand the importance of choosing the right payment processing software. In this Stripe review, I'll share my insights and detailed analysis to help you determine if Stripe is the ideal choice for your business needs. With my experience in the field,

I'll cover every crucial aspect, from transaction fees to user experience, ensuring you have the essential information for an informed decision. Let's explore Stripe's features, performance, and overall value to see how it stands in the competitive world of ecommerce payment solutions.

Stripe Product Overview

Summary

Stripe is a comprehensive payment processing platform that enables businesses to accept and manage payments across various currencies and payment services. It caters primarily to online companies, offering tools to simplify ecommerce transactions. The software's benefits include streamlined payment processing, robust security, and support for various currencies, making it a versatile choice for global commerce.

Stripe addresses key pain points such as handling multiple payment methods, navigating currency conversions, and integrating payment services seamlessly into existing systems. Its standout features include support for various currencies, an intuitive interface, and advanced fraud protection.

Pros

- Multi-Currency Support: Stripe allows businesses to accept payments in numerous currencies. This feature enables companies to expand their reach globally, catering to customers in various countries without the hassle of currency conversion.

- User-Friendly Interface: The platform offers an intuitive and easy-to-navigate interface. This ensures that even users with limited technical expertise can manage their payment processing efficiently, reducing the learning curve and operational complexities.

- Advanced Security: With Stripe, businesses benefit from robust security measures. This includes advanced fraud detection and prevention tools, providing peace of mind and protecting the company and its customers from potential security threats.

Cons

- Complex Pricing: Stripe's pricing can be complicated and may need to be more straightforward for all users. This complexity can make it challenging for small businesses or individuals to understand the costs involved fully.

- Integration Effort: While Stripe offers powerful features, integrating them into existing systems can require significant effort. This might pose a challenge for businesses without dedicated technical resources.

- Limited Offline Support: Stripe primarily focuses on online payments, offering limited options for offline transactions. This can be a drawback for businesses that also operate brick-and-mortar stores or need to process payments offline.

Expert Opinion

In my professional assessment, Stripe stands out in payment processing software, particularly for its robust feature set, flexible pricing, and superior user interface. When comparing Stripe to other payment processors, its advanced security features and support for various currencies place it ahead in the global market. Stripe's interface is notably user-friendly, simplifying the complex nature of financial transactions. However, its pricing structure can be somewhat intricate, potentially posing challenges for smaller businesses or those new to ecommerce.

Stripe's impressive integration capabilities allow seamless connection with various ecommerce platforms and accounting software. This makes it a strong contender for businesses looking to streamline their financial operations. Conversely, the effort required for initial integration may be substantial, particularly for companies without in-house technical expertise.

Stripe is particularly well-suited for medium to large online businesses that require a reliable, scalable payment processor capable of handling a high volume of transactions across different currencies. Its efficiency in managing complex payment structures makes it ideal for businesses with a global customer base.

Stripe: The Bottom Line

What sets Stripe apart is its comprehensive approach to handling online payments. Unlike many competitors, Stripe offers extensive currency support and advanced fraud protection, which is critical for global businesses. Its platform is not just about processing payments; it's about enhancing the overall financial management of an ecommerce business.

The real strength of Stripe lies in its combination of ease of use and powerful features. The platform’s intuitive design simplifies the often complex world of payment processing, making it accessible to users with varying levels of technical expertise. The most noteworthy features include its multi-currency support, robust security measures, and seamless integrations with other business tools, making it a top choice for businesses looking to optimize their online payment systems.

Stripe Deep Dive

Product Specifications

- Credit card processing - Yes

- Debit card processing - Yes

- Multiple currency support - Yes

- Mobile payments - Yes

- Recurring billing - Yes

- Invoice management - Yes

- Fraud protection - Yes

- PCI compliance - Yes

- Integration with accounting software - Yes

- E-commerce integration - Yes

- POS (Point of Sale) capabilities - No

- Contactless payments - Yes

- Payment gateway - Yes

- Reporting and analytics - Yes

- Customer data management - Yes

- Multi-channel payment collection - Yes

- Customizable checkout experience - Yes

- Automated payment reminders - Yes

- Subscription management - Yes

- Refund processing - Yes

- Email receipts - Yes

- API for custom integrations - Yes

- Virtual terminal - Yes

- ACH payments (direct bank transfers) - Yes

- 3D Secure technology - Yes

Stripe Feature Overview

- Multiple Currency Support: Stripe's ability to handle transactions in numerous currencies stands out for global businesses. This feature removes barriers to international trade, allowing companies to cater to a diverse customer base.

- Advanced Fraud Protection: Stripe's sophisticated security measures, including fraud detection algorithms, offer businesses peace of mind, knowing that transactions are secure.

- Seamless E-commerce Integration: Stripe's compatibility with various e-commerce platforms enables businesses to efficiently integrate payment processing into their online stores.

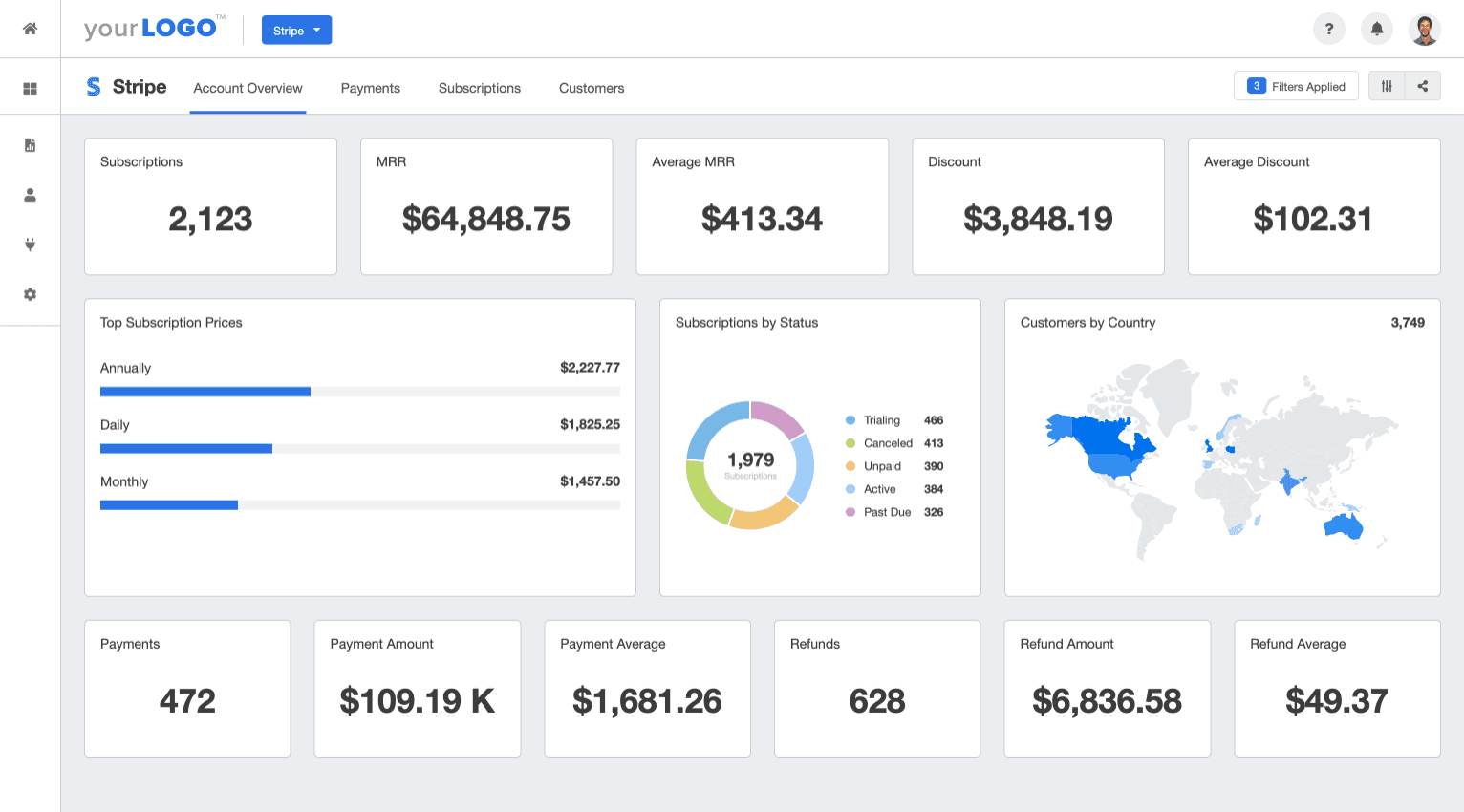

- Comprehensive Reporting and Analytics: Stripe provides detailed insights into transactions, helping businesses to make informed decisions based on data trends and customer behavior.

- Customizable Checkout Experience: This feature allows businesses to tailor the checkout process to match their brand, enhancing the customer experience.

- Subscription Management: Stripe simplifies managing recurring payments, which is essential for businesses offering subscription-based services.

- Automated Payment Reminders: This feature helps businesses reduce late payments, improving cash flow management.

- PCI Compliance: Ensuring secure handling of credit card data, Stripe maintains PCI compliance, relieving businesses from the complexities of managing these requirements themselves.

- API for Custom Integrations: The extensive API capabilities allow businesses to create custom integrations, adapting the payment processing system to their unique needs.

- 3D Secure Technology: Stripe employs this technology, adding an extra layer of security for online credit and debit card transactions, reducing the risk of unauthorized use.

Standout Functionality

- Advanced Multi-Currency Support: Unlike many competitors, Stripe provides extensive support for various currencies, making it ideal for businesses with a global customer base, enhancing their reach and simplifying international transactions.

- Sophisticated Fraud Protection Mechanisms: Stripe's advanced fraud protection sets it apart, employing cutting-edge algorithms and continuous monitoring to safeguard against fraudulent transactions, a feature crucial in today's digital payment landscape.

- Highly Customizable APIs: Stripe's API flexibility is unmatched, allowing businesses to tailor the payment processing system to their needs. This level of customization is a significant differentiator, allowing for more personalized and efficient payment solutions compared to other platforms.

Integrations

Stripe offers a range of integrations and APIs that enhance its capabilities and ease of use. Out-of-the-box, it integrates seamlessly with popular ecommerce platforms like Shopify, WooCommerce, and Magento, enabling businesses to add payment processing to their online stores easily. These native integrations simplify transactions, inventory management, and customer data synchronization.

Stripe also provides an extensive API, allowing custom integrations and adaptations to unique business needs. The API features include payment processing, subscription management, and automated reconciliation. This level of customization is a significant advantage for businesses requiring specific payment workflows or data integration with other systems.

In addition to these integrations, Stripe supports various add-ons and extensions. These add-ons extend the platform's capabilities, including advanced analytics tools, additional security features, and specialized payment options like ACH transfers or localized payment methods. This flexibility allows businesses to tailor the Stripe platform to their specific operational requirements.

Stripe Pricing

Stripe's pricing is competitive and aligns well with its feature set compared to similar payment processing tools. The pricing is typically structured as a percentage of each transaction plus a fixed fee. This model is standard in the industry, making it easier for businesses to understand and anticipate costs. No monthly fees or hidden charges make it accessible for companies of all sizes.

- Pay-as-you-go Plan: This plan charges a fee per transaction, typically around 2.9% + $0.30 per successful card charge. No monthly fees make it ideal for businesses with variable transaction volumes.

- Customized Pricing: Stripe offers customized pricing for businesses with larger payment volumes or unique needs. This is tailored to the business’s requirements, considering transaction volume and average transaction size. Pricing for this tier is upon request.

Additional costs include fees for international cards, currency conversion, and additional services like dispute handling. Stripe's transparent pricing model ensures businesses can clearly understand and budget other payment processing costs.

Ease of Use

Its user interface intuitively evaluates Stripe for ease of use, especially for online payment processing. The well-organized dashboard makes it straightforward for users to navigate various features, from managing customers’ payments to analyzing transaction data. The onboarding process is efficient, with clear guidance and resources to set up and start processing online and in-person payments.

However, some complexities arise when dealing with more advanced features or custom integrations. Users without a technical background might find it challenging to navigate through the API documentation or to customize the payment processing workflows to their specific needs. Additionally, while the essential functions are user-friendly, the tool's extensive feature set can initially overwhelm new users, especially those new to payment processing software.

Customer Support

Assessing the customer support of Stripe, I note that they offer a range of support options, including documentation, webinars, and tutorials. These comprehensive resources provide valuable insights for everyday use and troubleshooting. Their response times are generally acceptable, and the availability of live chat adds a convenient channel for immediate assistance.

Stripe customers find the level of personalized support frustrating, especially for complex or urgent issues. More than self-service resources may be needed for specific queries or technical challenges, leading to longer resolution times. Direct support for less tech-savvy users could also be improved.

Stripe Use Case

Who Would Be A Good Fit For Stripe?

I believe Stripe is particularly well-suited for startups and small business owners who operate primarily online. Its ease of setting up and managing online payments makes it an attractive option for businesses with limited technical resources. The tool's scalability and support for multiple currencies benefit companies looking to expand their market reach globally.

Stripe’s most loyal and avid customers tend to be those in the ecommerce, software as a service (SaaS), and digital goods industries. These sectors benefit significantly from Stripe's robust payment processing capabilities, fraud protection, and ability to handle a variety of payment methods. Businesses with small to medium-sized teams find Stripe’s interface and integrations efficient for their workflows, allowing them to manage financial transactions without needing large finance teams.

Who Would Be A Bad Fit For Stripe?

Conversely, Stripe might not be the best fit for businesses requiring in-person point-of-sale payment solutions or operating in industries where digital payments are not the norm. Traditional brick-and-mortar stores or businesses in sectors like manufacturing or wholesale, which rely heavily on direct bank transfers or physical payment methods, may find Stripe less aligned with their needs.

Businesses looking for the simplest, most basic payment processing tools, or those without international currency support, may also find Stripe's extensive features and capabilities more than they require.

Larger enterprises with highly complex payment processing needs or those requiring extensive customization beyond what Stripe's API and integrations offer might also be less satisfied with the platform. These businesses require more specialized or industry-specific payment solutions.

Stripe FAQs

How does Stripe compare to PayPal and Square in terms of accepting payments?

Stripe, PayPal, and Square are all reputable payment platforms, but they cater to different needs. Stripe excels in online payment processing, developer tools, and global currency support, making it ideal for e-commerce and international transactions.

PayPal is known for its widespread consumer use and wallet services, while Square is preferred for its POS systems and physical card readers, which are suitable for in-person transactions.

What are Stripe's policies regarding high-risk merchant accounts?

Stripe evaluates high-risk merchant accounts on a case-by-case basis. They assess the risk associated with the business type, industry, and transaction patterns. Stripe may implement additional fraud prevention measures or restrictions for these accounts.

Are there any additional fees for chargebacks or disputed payments with Stripe?

Yes, Stripe charges a fee for processing chargebacks or disputes. This fee covers the cost of handling the dispute process and is in addition to any funds that might be returned to the customer.

How quickly are payouts transferred to bank accounts from a Stripe account?

Payouts from a Stripe account to a linked bank account typically occur within a few business days, depending on the bank’s processing times and the country in which the business operates.

Can non-profits use Stripe as their payment service provider?

Yes, non-profits can use Stripe as their payment service provider. Stripe supports a variety of payment types and offers tools and integrations useful for non-profits, such as recurring donations and integration with platforms like WordPress.

Does Stripe offer mobile payment options for Android and iPhone?

Yes, Stripe supports mobile payments on both Android and iPhone. This includes integrating Stripe Checkout into mobile apps and accepting payments via digital wallets like Apple Pay and Google Pay.

What developer tools does Stripe provide for custom integrations?

Stripe offers a range of developer tools, including APIs, SDKs for various platforms, and extensive documentation. These tools enable custom integrations with websites, mobile apps, and other software systems.

How does Stripe use machine learning in its platform?

Stripe employs machine learning for fraud prevention and to optimize payment processing. This includes analyzing transaction patterns to detect and prevent fraudulent activity and improving the efficiency of payment processing and authorization.

Alternatives to Stripe

- Square: Best for businesses that require a blend of online and in-person payment solutions. Square offers robust POS systems and physical card readers, making it ideal for retail and restaurant industries.

- PayPal: Preferred for its consumer recognition and ease of use. PayPal is particularly advantageous for businesses looking for a simple, widely accepted online payment solution with a strong focus on consumer wallet services.

- Adyen: Suitable for businesses looking for a global payment solution with extensive currency and payment method support. Adyen excels in handling complex, multi-market payment scenarios.

Stripe Company Overview & History

Stripe is a technology company that provides a payment processing solution for internet businesses of all sizes. It offers a suite of payment APIs that powers commerce for online and in-person retailers, subscription businesses, software platforms and marketplaces, and everything in between.

The company is known for handling billions of dollars in transactions each year for forward-thinking businesses around the world, including large companies like Amazon, Google, and Shopify. Founded in 2010 by brothers Patrick and John Collison, Stripe is a private company. Its headquarters are located in San Francisco, California.

The Collison brothers are notable figures in the company, recognized for their innovation in e-commerce and payments. Stripe aims to boost the internet's GDP by offering robust e-commerce tools. It has achieved significant growth and success since its inception. These include expanding its services to various countries.

Introducing new products like Stripe Atlas for startup incorporation, and acquiring other companies to broaden its capabilities in areas such as fraud prevention and credit card payments. Stripe has become a key player in the online payments and merchant services sector, continually evolving to meet the needs of modern businesses.

Summary

Stripe stands out as a robust and versatile payment processing solution, especially for online businesses and startups. Its ease of use, extensive integrations, and capabilities to handle various payment types and currencies make it a compelling choice for companies looking to streamline their payment processes.

While there are some complexities in pricing and technical integration, its benefits and features, particularly in fraud prevention and global transaction support, are significant.

Keep up with other ecommerce software reviews, news, and tips by subscribing to the Ecomm Manager newsletter.