As someone deeply involved in payment solutions for various sectors like digital business, retail, platforms, and subscriptions, I understand the importance of choosing the right software. In this review, I'll share my insights on Adyen, a solution that has garnered attention in these fields.

My aim is to provide clear, factual information to help you decide if Adyen fits your needs. I'll cover all the crucial aspects, from features to user experience, to give you a comprehensive understanding of what Adyen offers.

Adyen Product Overview

Adyen is a global payment processing platform that simplifies transactions for businesses and their customers. It primarily serves enterprises and medium-sized businesses seeking a robust payment solution. The tool offers an efficient payment processor across multiple channels, enhancing customer experience.

Adyen addresses key pain points such as complex payment infrastructure and the need for a unified payment system across various markets. Its standout features include multi-channel payment processing, extensive global coverage, and advanced data insights.

Pros

- Global Reach: Adyen provides extensive international payment options, allowing businesses to accept payments in various currencies and methods. This feature is crucial for companies aiming to expand their market reach globally.

- Data Insights: The platform offers advanced analytics and reporting tools, giving businesses a deeper understanding of their transaction data. This insight helps in making informed decisions and optimizing payment strategies.

- Flexibility: Adyen's API integration allows for customization and scalability, catering to the specific needs of different businesses. This flexibility makes it suitable for a wide range of industries and business sizes.

Cons

- Complex Setup: Some users find the initial setup and integration process challenging, especially those with limited technical expertise.

- Cost Structure: The pricing can be higher compared to some competitors, which might be a concern for smaller businesses or startups.

- Limited Support: There are instances of delayed or insufficient customer support, which can be problematic for businesses requiring immediate assistance.

Expert Opinion

From my experience, Adyen stands out for its comprehensive global payment solutions and robust data analytics capabilities. While its pricing and complex setup might be a hurdle for some, its functionality, interface, and integrations make it a strong contender in the payment solution space.

Adyen excels in environments where businesses require a wide range of payment options and in-depth transaction insights. It's particularly well-suited for medium to large businesses looking to expand globally. In comparison to its competitors, Adyen offers a more extensive global reach but could improve in areas like user-friendly setup and responsive customer support.

Adyen: The Bottom Line

What sets Adyen apart is its remarkable global reach and multi-channel payment processing capabilities. Unlike many other tools, it offers in-depth data insights and analytics, aiding businesses in understanding their transaction patterns. The platform's flexibility in integration and customization is particularly beneficial for diverse business models.

Its most noteworthy features include its extensive omnichannel payment method options, real-time financial reporting, and the ability to handle complex, high-volume transactions efficiently. Adyen is a powerful choice for businesses prioritizing global expansion and data-driven decision-making in their payment processing strategy.

Adyen Deep Dive

In this deep dive, discover Adyen's features, functionalities, integrations and plugins, pricing, and more to provide a comprehensive understanding of what this payment solution offers.

Product Specifications

- Multi-currency support - Yes

- Mobile payment processing - Yes

- E-commerce integration - Yes

- POS (Point of Sale) systems - Yes

- Payment gateway integration - Yes

- Recurring billing - Yes

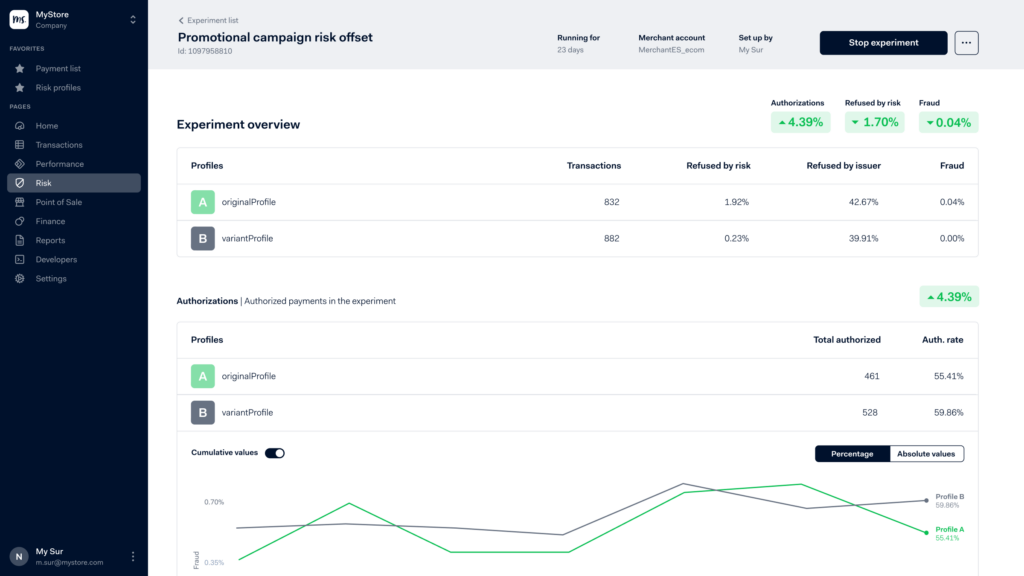

- Fraud prevention tools - Yes

- Real-time reporting and analytics - Yes

- API access - Yes

- Global payment options - Yes

- Multi-channel payment support - Yes

- Customizable checkout experience - Yes

- Secure data storage - Yes

- PCI DSS compliance - Yes

- Automated chargebacks - Yes

- Digital wallet payments - Yes

- In-app payments - Yes

- Subscription management - Yes

- Customer data management - Yes

- Payment reconciliation - Yes

- Risk management tools - Yes

- Customer support options - Yes

- Integration with accounting software - Yes

- Payment method variety (credit cards/debit cards, bank transfers, Apple Pay, ACH, payments through Mastercard and Visa etc.) - Yes

- Localization options (languages, local payment methods) - Yes

Feature Overview

- Multi-currency support: Adyen allows transactions in multiple currencies, crucial for global businesses.

- Ecommerce integration: Seamless integration with various ecommerce platforms enhances online, in-store, and in-person sales processes.

- POS systems: Adyen offers robust POS solutions, essential for retail environments.

- Payment gateway integration: This feature simplifies online payments, providing a secure and efficient checkout process.

- Recurring billing: Adyen's recurring billing capabilities are vital for subscription-based services.

- Fraud prevention tools: These tools protect businesses and customers from fraudulent activities.

- Real-time reporting and analytics: Adyen provides insightful analytics, helping businesses understand transaction trends.

- API access: The customizable API allows for tailored payment solutions.

- Global payment options: Adyen's vast array of payment methods meets diverse customer preferences.

- Multi-channel payment support: This feature ensures a unified payment experience across various channels.

Standout Functionality

- Advanced Data Insights: Adyen’s in-depth analytics differentiate it from competitors, offering valuable business insights.

- Comprehensive Global Coverage: Its wide range of international payment methods sets it apart in the market.

- Customizable API: The flexibility of Adyen's API is more advanced than many competitors, offering unique customization options.

Integrations

- Adyen offers native integrations with popular ecommerce software, enhancing payment processes for online stores.

- The API provides extensive features for custom integration, allowing for tailored payment solutions.

- Adyen supports various add-ons to extend its capabilities, including risk management and localized payment options.

Pricing

The monthly fees are given upon request.

Ease of Use

Adyen offers a sophisticated interface, which can be complex for beginners. The onboarding process is comprehensive, ensuring users understand the platform's full capabilities.

Customer Support

Adyen provides quality customer support, including documentation and live chat. However, some users report delays in response times, which can be frustrating.

Adyen Use Case

Who would be a good fit for Adyen?

Adyen is ideal for medium to large businesses with global operations or aspirations to expand internationally. It's especially useful for sectors like ecommerce, retail, and hospitality, where multi-currency and international payment methods are crucial.

The payment service provider suits companies needing detailed analytics and customizable payment solutions via API access. However, it might not be the nice for smaller businesses with simple payment needs or limited budgets.

Who would be a bad fit for Adyen?

Small businesses or startups might find Adyen's sophisticated features and pricing overwhelming. It's less suitable for companies operating solely in local markets or those without the need for extensive international payment options. The complexity of its setup and integration could also pose challenges for organizations with limited technical resources. Additionally, businesses requiring immediate, extensive customer support may find Adyen's services less responsive than needed.

Adyen FAQs

What payment methods does Adyen support?

Adyen supports a wide range of methods to process payment, including credit/debit cards, bank transfers, and digital wallets.

Can Adyen support in-store retail payments?

Yes, Adyen provides solutions for in-store retail payments, including POS systems and integrated payment terminals, catering to the needs of physical retail stores.

Is Adyen suitable for digital payment processing?

Absolutely, Adyen excels in digital payment processing, offering seamless integration with ecommerce platforms and mobile payment solutions for online businesses.

How does Adyen handle subscription payments?

Adyen supports recurring billing and subscription management, making it ideal for businesses with subscription-based models, providing efficient and automated payment solutions.

Can Adyen be used for platform payments?

Yes, Adyen is well-equipped for platform payments, offering multi-channel payment support and API integration, which is essential for platforms requiring flexible and diverse payment options.

Does Adyen offer fraud prevention tools?

Yes, Adyen provides robust fraud prevention tools to protect transactions.

What payment methods does Adyen support?

Adyen supports a wide range of payment methods, including credit/debit cards, bank transfers, and digital wallets.

Does Adyen offer fraud prevention tools?

Yes, Adyen provides robust fraud prevention tools to protect transactions.

Can Adyen handle multi-currency transactions?

Yes, Adyen supports transactions in multiple currencies, catering to global business needs.

Is Adyen suitable for mobile payment processing?

Absolutely, Adyen offers mobile payment solutions, making it a versatile choice for businesses on-the-go.

Does Adyen integrate with ecommerce platforms?

Yes, Adyen offers seamless integration with various ecommerce platforms, enhancing online sales processes.

How does Adyen's API access benefit businesses?

Adyen's API allows for customization and scalability, providing businesses with tailored payment solutions.

Are there any additional costs to consider with Adyen?

Adyen's pricing is based on usage and the specific needs of a business, so additional costs may vary depending on these factors.

Does Adyen provide customer support and resources?

Yes, Adyen offers customer support through various channels, including documentation, webinars, live chat, and tutorials.

Alternatives to Adyen

- Stripe: Known for its developer-friendly interface and extensive customization options.

- PayPal: Popular for its user-friendly experience and widespread recognition.

- Square: Ideal for small businesses and individual users, with simple setup and usage.

Adyen Company Overview & History

Adyen, established in 2006 in Amsterdam, Netherlands, is a technology company that specializes in providing a global payment platform for businesses ranging from startups to large enterprises. As a publicly traded company, Adyen has made a significant impact in the payment solutions sector, known for its innovative approach to simplifying and accelerating global payments.

Over the years, the company has seen rapid growth and expansion, marked by notable milestones in technology development and global market reach. Its mission, to revolutionize the payment process for businesses worldwide, is supported by a team that includes founders and technology experts, making Adyen a key player in the payment solution landscape.

Summary

In conclusion, Adyen stands out as a comprehensive payment solution, especially suited for businesses with global reach and complex payment needs. Its strengths lie in its wide range of payment options, advanced analytics, and customizable API.

Keep up with other ecommerce software reviews, news, and tips by subscribing to the Ecomm Manager newsletter.