When it comes to doing business, YOLO is probably not the best philosophy. To succeed means thinking about long-term stability, gains, and how to be a sustainable company. Therefore, a better (and not so dated) acronym to look for is ESG. But what is ESG reporting?

ESG, which stands for environmental, social, and governance, is a three-pillared approach to future-proofing. The benchmark also aims to address societal challenges through business practices and has relevance to the ecommerce industry.

In this article, I’ll dig into what ESG is, the ins and outs of ESG, and how to carefully apply ESG in your ecommerce business. (Spoiler alert: It’s a road paved with a few obstacles.)

The History Of ESG

As a concept, sustainable investing is not new. The earliest iterations may have been religious groups investing according to moral parameters. In the 1960s and 70s, activism entered finance with the divesting from investments in industries involved in the war in Vietnam. Corporate social responsibility in investing was encouraged to disempower South Africa’s racial apartheid system.

ESG is not quite sustainable investing because of its structured nature and emphasis on risk management. The most recognized first formalized use of the term in ESG was in the United Nations report, Who Cares Wins, with recommendations for more responsible investing endorsed by 23 financial institutions, the IFC, and the World Bank.

What falls under each pillar? The definitions can be broad-reaching, and interpretations of ESG data range. For example, some companies may consider the social column to include only internal considerations, while others see this as a standard in community responsibility.

The Three Pillars Of ESG

Environmental: Concerned with the natural environment and corporate environmental impact, this pillar addresses issues such as carbon emissions, climate change, air pollution, biodiversity, deforestation, and rates of greenhouse gas emissions.

Organizations can take measures towards enhancing this aspect of their operations by:

- Tracking carbon and sustainability.

- Reducing pollution.

- Using renewable energy sources.

- Increasing recycling and waste reduction.

Social: Considers human rights and issues of gender and diversity inclusion, community relations, and mental health. Also concerned with data and transparency.

Organizations can make efforts to reduce harmful business practices by:

- Addressing child labor.

- Creating transparent supply chains.

- Improving data collection.

- Supporting DEI initiatives and human rights.

- Increasing community relations.

- Launching mental health initiatives.

Governance: Addresses the logistics and operations of running a business and is concerned with the diversity of boards of directors, compensation guidelines, political contributions and lobbying, and company practices such as hiring.

The “G” in ESG is the backbone of the process and is critical to implementing successful strategies to improve social and environmental metrics, as well as managing risks.

Incorporating all levels of the organization—especially the board—is important, given that ESG activities and programs span many areas.

“The board needs to make sure they have a window into how it’s operating. The organization needs to understand ESG’s impact,” said Alicia Williams, Associate with WATSON Advisors, a board advisory firm with over 15 years of experience in Canada.

ESG data and disclosures can be included in a company’s annual reports, and ESG performance can be tied to corporate governance.

This pillar can also include:

- Enhancing corporate transparency.

- Increasing pay equity.

- Creating executive compensation guidelines.

- Improving hiring practices.

The Ins and Outs of ESG

ESG is an interplay of updating and continually changing an organization’s purpose to meet societal demands, creating strategies to avoid eminent risks, and addressing customer demands.

Generally, the ESG framework aligns with socially responsible and responsive business operations. For example, shifts towards transparent supply chain practices are increasingly being demanded by consumers and enforced by anti-greenwashing laws in Europe and North America.

As we will explore more, the process of adopting sustainability practices for your ecommerce business has ESG principles baked right in. This can start with environmentally oriented business models or by adjusting operations to be more ecological. For example, online fashion reselling and clothing companies are recycling dead stock fabrics to avert waste from landfills.

To adhere to ESG is to adapt to a more data-driven and holistic approach to doing business. There are several factors to consider.

Controversy around ESG

While not quite popularized outside of business circles, recently, the term ESG has been gaining attention—both positive and negative. BlackRock CEO Larry Fink has been caught in the middle of a politicized debate around the benefits or drawbacks of ESG disclosures and sustainable investing as a strategy for major financial firms.

As the leader of a multinational investment company, Fink has based his executive decision-making on addressing climate change. The strategy is part of risk management in the primary interests of stakeholders and shareholders.

Critics claim the ESG framework approach harms profits since climate change may not be affecting bottom lines, sales, or company growth. But emerging evidence is showing otherwise. Extreme weather events are affecting the global economy, creating an estimated $313 billion in loss in 2022.

As Fink is quoted as saying: “More and more people do understand that climate risk is investment risk.” In other words, understanding ESG risks can help to avoid them.

The arguments for ESG

The argument for ESG expands when you look at broader trends.

Beyond immediate, tangible impacts on business, new and potential regulations could bring liability risks. The Sustainability Accounting Standards Board (SASB) found in 2021 that 89% of the market capitalization of the S&P Global 1200—a total of 68 out of 77 industries—is “significantly affected in some way by climate risk.”

Certain sectors are more susceptible to climate shifts, such as agriculture and outdoors or leisure industries (think: ski resorts).

Notably, for the ecommerce and retail industries, shipping is vulnerable due to increases in adverse weather events such as typhoons and hurricanes. Since shipping is one of the leading emitters of carbon, the industry is also going to be affected by new regulations to curb emissions.

As many already have, ecommerce companies can consider aspects like sourcing local materials and using more sustainable or recyclable packaging to help reduce environmental impacts. Creating transparent supply chains is also a valuable step.

ESG rules and regulations

Several jurisdictions are making legislative efforts to decrease greenwashing, and the same intentions are extending to ESG. In 2021, the European Union established ESG ratings with the Sustainable Finance Disclosure Regulation (SFDR). At the highest level (Article 9), funds must make ESG an “objective.”

In the United States, the Securities and Exchange Commission (SEC) in 2022 proposed “sweeping” new rules around ESG reporting through disclosures. These haven’t come into force, but SEC Commissioner Caroline Crenshaw has called the proposal a “long-awaited step forward.”

The SEC’s stance on ESG takes into account solutions created by the Task Force on Climate-Related Financial Disclosures (TCFD) and the Greenhouse Gas (GHG) Protocol. It would require the disclosure of climate-related risks and impacts. For example, companies would need to disclose their greenhouse gas emissions.

Consumer demand

As businesses transition towards more ecological forms of production or adjust their business models and missions entirely, companies could get left behind by consumer demand.

The tide is shifting. Many consumers (and company leaders) are looking for sustainable ways to consume and purchase products. At the same time, capital market investment in ESG is increasing at a rapid pace.

According to PwC’s Asset and Wealth Management Revolution 2022 report, ESG assets are on pace to make up 21.5% of total global assets under management (meaning the market value of investments managed on behalf of clients) in under five years. On a global scale, asset managers are predicted to increase ESG-related assets under management to $33.9 trillion by 2026 from $18.4 trillion in 2021.

Similar to how consumers are often willing to pay more for sustainable products, investors are willing to accept higher fees for ESG investing due to compliance costs. The promise of improved returns is the draw.

One thing muddying the debate is confusion around what constitutes ESG investing and how it is measured, regulated, and reported.

The range of standards

A “fragmented” system of ESG ratings, organizations, and frameworks has likely led to a lack of clarity on what exactly ESG can achieve. Streamlining is happening alongside movements toward further integration, but these can be hard to track and navigate.

Unraveling the network of ESG organizations can make your head spin.

Here we go: In 2021, the International Financial Reporting Standards (IFRS) Foundation Trustees established the International Sustainability Standards Board (ISSB), to collaborate with the International Accounting Standards Board (IASB) in developing the IFRS Sustainability Disclosure Standards. Currently, the IASB sets IFRS Accounting Standards, and the ISSB (which is itself a consolidation of two other organizations) sets IFRS Sustainability Disclosure Standards.

Some of the other organizations in the field include:

- The Task Force on Climate-Related Financial Disclosures: Released climate-related financial disclosure recommendations in 2017 that are currently influencing legislation in the US and Canada.

- The World Economic Forum: Published a set of 21 core and 24 expanded Stakeholder Capitalism Metrics in 2020 based on input and consultations with global stock exchanges, regulators, nonprofits, and the European Commission.

- The Global Reporting Initiative, or GRI: The first and most widely used global standard for non-financial or sustainability reporting. Started by non-profits in the early 1990s, the initiative aims to help companies gather and share ESG information.

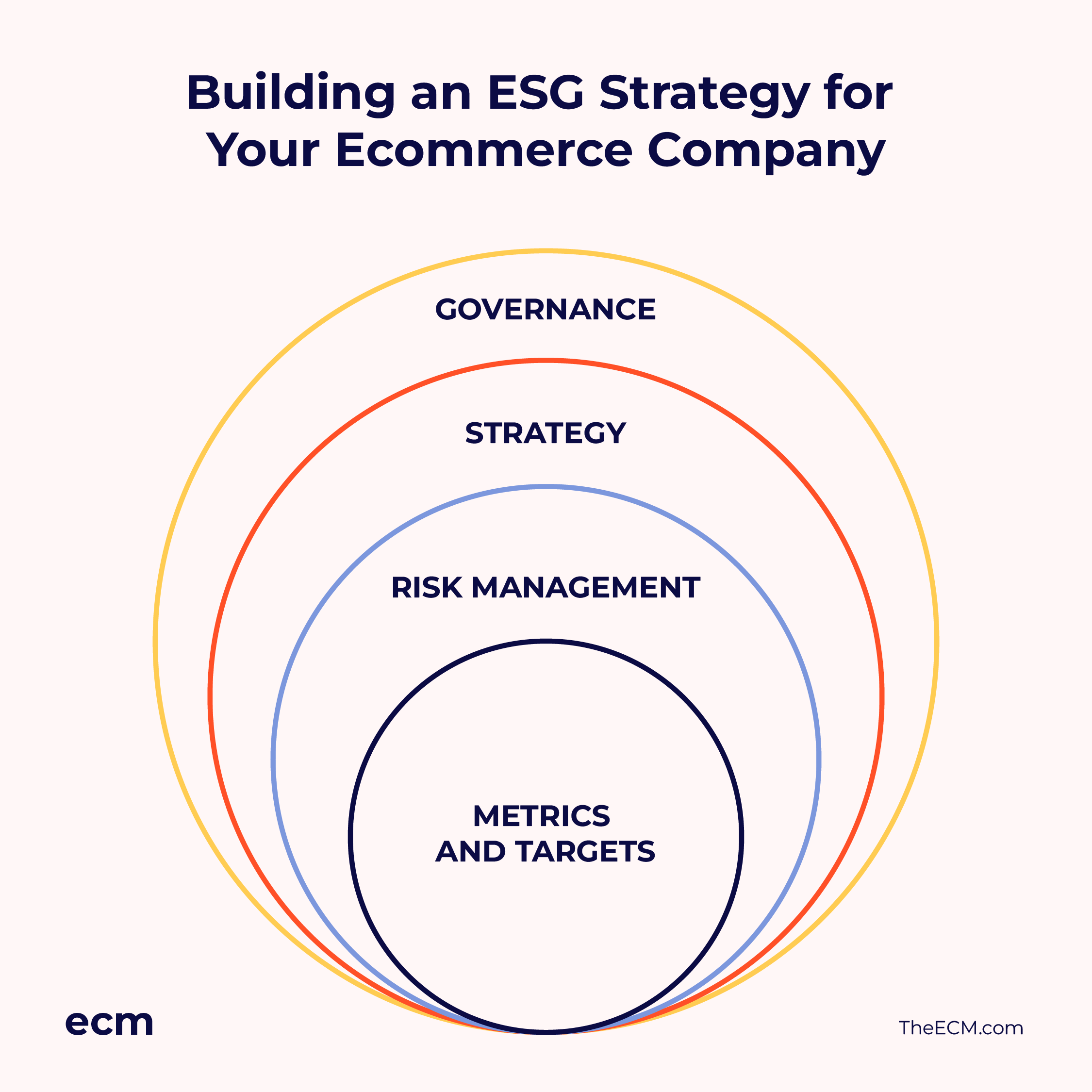

Building an ESG Strategy for Your Ecommerce Company

According to Williams, choosing a standard for your company should be based on the level you want to achieve, the areas you are focused on, and what you feel comfortable with. “Generally, start small,” said Williams. “Choose a standard that supports you the best as an organization, thinking about those perhaps that are more heavily used.”

ESG addresses three cases for change, said Williams: moral, business, and compliance.

The [companies] that don’t give up [on ESG] lean a bit more on the moral side. They believe it’s the best for the business, but also for society.

Alicia Williams, Associate with WATSON Advisors

ESG may not be straightforward, but the initiative towards more environmentally conscious ways of doing business is not likely to go away anytime soon, said Williams.

Changes to your company that come with adopting, measuring, and reporting ESG principles are intended to add value to your bottom line while avoiding future risks. And if you have ambitions to grow into a major company, starting on ESG compliance now can set you ahead in terms of regulatory compliance.

ESG Isn’t The Only Tool For Change For Your Business

The era when considering social, ethical, or environmental issues over profit was thought of as bad business is practically over. Of course, the road to more diligent corporate practices will take time to refine.

If you would like to learn more about sustainable business practices, download The Ecomm Manager’s free Sustainable Ecommerce Handbook.

And don’t miss out on news and updates related to ecommerce—subscribe to The Ecomm Manager newsletter today!

More great ECM content:

- How Recommerce Helps Make A Difference For Your Brand And Customers

- The Sustainable Ecommerce Guide To Dead Stock

- 7 Examples Of Sustainable Ecommerce Packaging & Eco-Friendly Materials

- Why Your Business Needs A Transparent Supply Chain (Benefits & Solutions)

- From Green To Mainstream: 6 Steps To Making Your Brand More Sustainable

- 10 Best Sustainable Packaging Manufacturers