From the Benz Patent Motor Car to the Ford Model T to the Tesla Model S, cars have evolved a lot over the last 100+ years.

As the vehicles themselves make the switch to electricity, one of the driving trends in the automotive retail space is a shift to ecommerce platforms as a significant sales channel.

More of the buyer journey is taking place online and this can’t be solely attributed to the COVID-19 pandemic. The industry was moving in this direction beforehand, in no small part due to Millenials maturing into a major car-buying demographic.

Here are three ecommerce automotive trends to keep an eye on in the months and years to come.

1. More Consumers are Buying Online

This is the most powerful trend in the automotive industry, with a growing number of consumers realizing they don’t have to visit a local dealership to make a purchase.

Go back in time five to ten years and buying a car online was in its infancy. Most consumers used the internet solely for requesting quotes, comparing models, and booking a test drive.

It’s still possible to do all that, but the act of finalizing a purchase online is what we’re talking about here. Companies such as Carvana, Carmax, CarGurus, and eBay Motors are leading the way.These statistics from IBISWorld will open your eyes:

- The market size of U.S. online car dealers is expected to reach $36.2 billion in 2021.

- Market size growth is estimated at 5.4 percent over 2020.

- From 2016 - 2021, U.S. online car dealers experienced an annualized market size growth of 4.3 percent.

Carvana, a leading online used car retailer, sold approximately 244,000 vehicles online in 2020. That’s good for a 37 percent increase year over year.

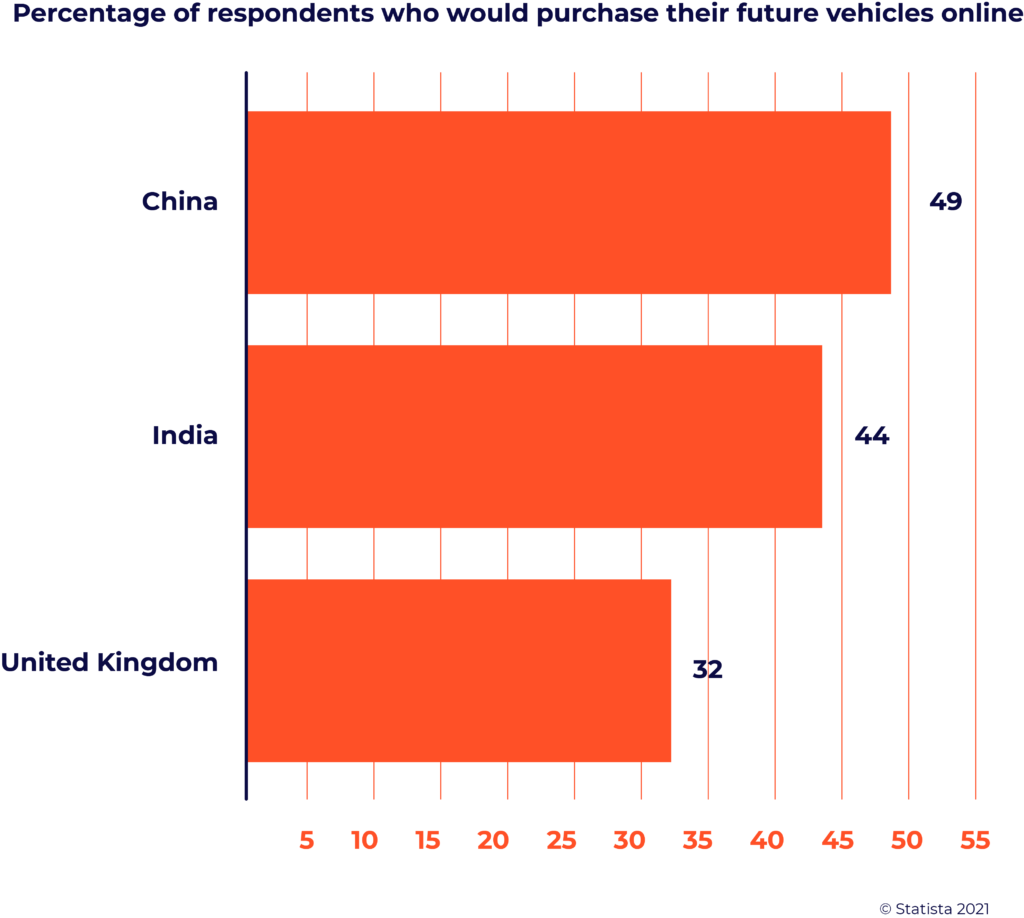

Also, the U.S. market isn’t the only one in which car shoppers are migrating online. According to Statista, consumers in the United Kingdom, India, and China are more receptive than ever to buying vehicles online.

As online car dealers continue to refine their processes post-pandemic, expect these numbers to grow even higher during the 2020s.

2. It’s Faster Than Ever to Buy a Car Online

Gone are the days of spending hours in a dealership with hopes of hashing out a deal. The consumers of today are more interested in an Amazon-like experience rooted in speed and efficiency.

According to Kelley Blue Book, “consumers spent about 7 hours and 14 minutes shopping online for a car in 2020.”

That sounds like a lot, but there are two things to keep in mind:

- It’s a decrease from 9 hours and 29 minutes in 2019

- In contrast to visiting a dealership, it’s not necessarily continuous shopping time

Backing up the claim that speed is more important than ever, check out this passage from the same Kelley Blue Book article:

Many heavy digital users cut down the actual time spent at dealerships buying a car to just 2 hours. This is a big shift, considering that car buying was mostly done at the dealership in the past. In the survey, time spent at dealerships hit a record low, while satisfaction with the process hit a record high.

So, even consumers who do visit a showroom are doing so with speed in mind.

3. Online Shoppers are in Control

Traditionally, buying a new car in North America entails visiting a local dealership (or several dealerships), selecting a car, and negotiating face to face.

Some consumers will always head down this path, but as the numbers above show, online car buying is picking up steam.

One of the primary reasons for this is control over the process. Here’s what this means:

- You can move at your own pace, without a pushy salesperson breathing down your neck.

- You can step away from the process without explanation.

- You can use your own car buying tools — such as a payment calculator — as opposed to the dealers.

- You can comparison shop multiple makes, models, and years from the comfort of your home or office.

- You have access to a larger selection.

For example, online shopping through Carvana means using filters to sift through tens of thousands of cars for sale.

This screenshot shows just how much control you have when shopping online:

You can shop for an SUV one minute and a sedan the next — and that’s just the start. Furthermore, there are filters for year, make, model, price, and features.

That’s the type of control you want when shopping for and buying a car.

E-commerce Automotive Aftermarket Trends

Ecommerce automotive trends expand into other areas, too, such as auto parts. For example, DIY car projects leaped forward in 2020.

According to The NPD Group, “do-it-yourself (DIY) and discretionary categories tied to at-home car projects were at the top of the performance chart and the primary contributors to the automotive aftermarket’s 4% dollar sales growth in the first six months of 2020.”

The report also outlined the discretionary spending categories that experienced the biggest growth in 2020:

- Paint: 33 percent

- Body repair: 27 percent

- Light duty shop equipment: 24 percent

- Appearance accessories: 19 percent

- Chemicals: 16 percent

Conversely, with people driving fewer miles as the result of the pandemic, some automotive parts took a dive last year, such as motor oil, wiper blades, and washer fluid.

In regards to auto parts, here are some additional trends to keep an eye on in 2021:

- Amazon, Alibaba, and other leading online stores will continue to pick up market share.

- OEMs (original equipment manufacturer) parts will remain in high demand (this goes along with the uptick in DIY projects).

- Pricing will remain competitive as online retailers adjust their approach and new business models are implemented.

- Customer experience, in cooperation with competitive pricing, will dictate which online retailers lead the charge.

Final Thoughts on E-commerce Market Automotive Trends

The internet has accelerated the growth of the automotive industry, with consumers using it to buy cars and replacement parts, conduct market research and compare retailers and dealerships.

The above ecommerce automotive trends provide a clear overview of where the market stands today, as well as what to expect for the rest of 2021 and beyond.

Automakers, and the automotive aftermarket industry, are embracing digitization to keep up with the shift in consumer behavior. Swedish carmaker, Volvo, for example, is investing heavily in its online sales channels and will sell its range of electric vehicles exclusively online.

It’s a change on many fronts. It’s also a change that can help every party win big.