10 Best Payment Processing Software Shortlist

Here's my pick of the 10 best software from the 20 tools reviewed.

Our one-on-one guidance will help you find the perfect fit.

There are seemingly countless payment processing software solutions available, so figuring out which is best for you is tough. You want to accept and process payments made through different methods, such as credit cards, debit cards, and digital wallets—but now need to figure out which tool is the best fit. I've got you! In this post, I make things simple, leveraging my experience managing online commerce businesses, and using dozens of different payment processing tools to bring you this shortlist of the best payment processing software overall.

Why Trust Our Payment Processing Software Reviews

We’ve been testing and reviewing ecommerce software since 2018. As ecommerce managers ourselves, we know how critical, and difficult it is to make the right decision when selecting software.

We invest in deep research to help our audience make better software purchasing decisions. We’ve tested more than 2,000 tools for different ecommerce use cases and written over 1,000 comprehensive software reviews. Learn how we stay transparent & our software review methodology.

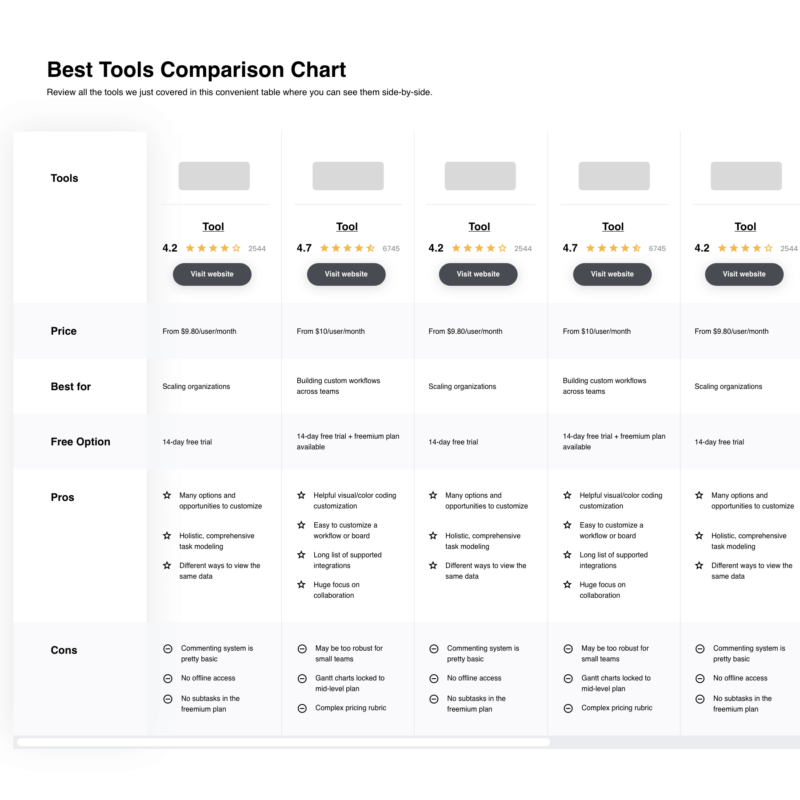

The Best Payment Processing Software Comparison Chart

Here are all the tools we just covered in a convenient table so you can compare them side by side.

| Tools | Price | |

|---|---|---|

| Shopify POS | Plans start at $31/month | Website |

| QuickBooks Online | from $22.50/month | Website |

| Hopscotch | Zero fee payment options | Website |

| Chargebee | From $249/month | Website |

| Helcim | From 0.50% + $0.25 per transaction | Website |

| Clover | From 2.3% + $0.1 per transaction | Website |

| Payment Depot | From $79/month | Website |

| Merchant One | From $13.95 plus 0.29% + 1.55% per transaction | Website |

| Freshbooks | $4.50/month | Website |

| Square | From $36/month plus 2.9% + $0.30 per transaction | Website |

Compare Software Specs Side by Side

Use our comparison chart to review and evaluate software specs side-by-side.

Compare SoftwareHow to Choose Payment Processing Software

With so many different payment processing software available, it can be challenging to make decisions on what payment processing software is going to be the best fit for your needs.

As you're shortlisting, trialing, and selecting payment processing software, consider the following:

- What problem are you trying to solve - Start by identifying the payment processing software feature gap you're trying to fill to clarify the features and functionality the payment processing software needs to provide.

- Who will need to use it - To evaluate cost and requirements, consider who'll be using the software and how many licenses you'll need. You'll need to evaluate if it'll just be the ecommerce team, or the whole organization that will require access. When that's clear, it's worth considering if you're prioritizing ease of use for all, or speed for your ecommerce software power users.

- What other tools it needs to work with - Clarify what tools you're replacing, what tools are staying, and the tools you'll need to integrate with, such as accounting, CRM or HR software. You'll need to decide if the tools will need to integrate together, or alternatively, if you can replace multiple tools with one consolidated payment processing software.

- What outcomes are important - Consider the result that the software needs to deliver to be considered a success. Consider what capability you want to gain, or what you want to improve, and how you will be measuring success. For example, an outcome could be the ability to get greater visibility into performance. You could compare payment processing software features until you’re blue in the face but if you aren’t thinking about the outcomes you want to drive, you could be wasting a lot of valuable time.

- How it would work within your organization - Consider the software selection alongside your workflows and delivery methodology. Evaluate what's working well, and the areas that are causing issues that need to be addressed. Remember every business is different — don’t assume that because a tool is popular that it'll work in your organization.

Best Payment Processing Software Reviews

Here’s a brief description of each payment processing software to showcase what each tool does best, including screenshots to highlight some of the features.

Shopify POS is a versatile point-of-sale system designed to integrate seamlessly with Shopify's ecommerce platform, empowering merchants to sell anywhere, anytime. It streamlines retail operations by syncing inventory, orders, and customer data across online and offline channels. With its user-friendly interface, Shopify POS facilitates smooth transactions, offers detailed analytics for informed decision-making, and supports various payment methods.

Shopify POS excels as an online payment processing system by offering robust, secure, and flexible solutions that cater to the diverse needs of businesses. It integrates seamlessly with Shopify's ecommerce platform, enabling merchants to manage both online and in-store sales through a single dashboard. This system supports a wide range of payment methods, ensuring customers can pay how they prefer, while providing advanced security features to protect sensitive information.

Shopify POS offers a highly customizable smart grid that merchants can tailor to their specific operational needs, setting it apart from more rigid systems. This interface allows users to organize their most frequently used apps, products, and features for quick access during transactions. The ability to personalize the POS layout means that employees can process sales more efficiently.

Shopify POS natively integrates with a variety of tools, including Shopify Payments, Shopify Shipping, Shopify Email, QuickBooks, Xero, Klaviyo, Google Analytics, Oberlo, Printful, and Gift Cards & Loyalty Program by Smile.io.

Best payment processing, invoicing, and expense management

QuickBooks Online is a cloud-based accounting software that helps small and medium-sized businesses manage their finances, track expenses, and process payments. It offers a range of features to help streamline financial management, including invoicing, expense tracking, and reporting. The platform is hosted in the cloud, so you can access it from anywhere.

The software tracks transaction details to help you spot errors and keep clean, accurate records. You can also connect your bank feeds to eliminate the need for manual data entry. It calculates sales tax automatically and allows you to charge clients and customers via invoice.

The invoicing capabilities allow you to create professional, customizable invoices that can be sent via email or printed and mailed. You can also set up recurring invoices for regular clients, making it easy to stay on top of billing. The software also has an expense tracking feature that lets you categorize and track your business expenses. This saves you time come tax season, and helps you keep clean and up-to-date financial records for your business.

QuickBooks Online integrates with over 450 business apps like Square, Stripe, Insightly CRM, Mailchimp, Shopify, eBay, BigCommerce, Magento, Squarespace, and Etsy. Pricing starts from $30 per month, and a 30-day free trial is available.

Hopscotch is a free digital payment solution helping small businesses and freelancers pay and get paid. With Hopscotch, you can easily generate and send invoices, collect payments from clients, pay bills, and manage your cash flow. The all-in-one platform simplifies accounting workflows and offers fee-free payment options. Notably, vendors, contractors, and suppliers can receive payments without needing to create an account.

With Hopscotch, you have the ability to create and dispatch invoices. The platform enables you to incorporate essential details such as dates, payment terms, items, pricing, and tax information directly onto the invoice form. To expedite the process, Hopscotch provides basic invoice templates and allows businesses to add their own branding details such as colors, logos, and icons. Once generated, invoices can be shared via a link or email, and your client may submit payment using a bank transfer or a credit card without having to create an account. You can track the status of invoices, and stay updated on approaching due dates or overdue payments.

One standout feature is Hopscotch Flow. This service allows you to unlock revenue from unpaid invoices on-demand. Unlike a traditional business loan, Hopscotch Flow doesn’t impact your credit score. It’s also completely private, so your clients won’t be notified if you choose to get paid early. This feature can be especially useful for small businesses and freelancers who may have to cover upfront costs for projects. This product offers a layer of protection when it comes to weathering unexpected costs or gaps in cash flow.

Integrations include QuickBooks, Gmail, Outlook, AOL, and 1000+ banks.

Hopscotch is free to use and has premium plans launching soon.

Best subscription solution for high-growth ecommerce companies

Chargebee is a subscription management platform that lets you automate subscription box billing and management, streamline order management, provide add-ons and gift subscriptions, and derive insights with detailed analytics.

Ecommerce managers can empower freedom of choice through customer self-serve portals. You can offer personalized options like customizable shipping and billing frequency for subscribe-and-save as well as box and membership subscriptions. You can easily add to your product line, and increase customer loyalty and lifetime value by intelligently bundling subscriptions with add-ons, accepting localized payments, offering promotions, gift subscriptions, resend/refund options, and more.

Chargebee integrates with tools for ERP, sales, finance, ecommerce, reporting analytics, marketing, collaboration, and customer support and success.

Chargebee costs from $249/month for 10 users and offers a free plan for up to 3 users. Chargebee also offers a free trial.

Helcim helps you accept credit cards easily from your device. With the Helcim virtual terminal, you can convert your computer, mobile, or tablet into a credit card processor. It lets you accept all major credit cards like Visa and Mastercard. It also enables the authorization of payments in seconds, with all the credit card information securely stored in its vault.

There is a feature for recurring payments where you can bill repeat customers with customized recurring payment plans. You can also directly sync the information with Quickbooks online. You can request payments via email or SMS and also send automated reminders. Helcim integrates with apps like Quickbooks, Magento, and WooCommerce.

For in-person payments, the pricing is 0.30% of the transaction amount + $0.08. For manually keyed transactions and online transactions, the rates are 0.50% + $0.25.

Clover is a point-of-sale (POS) system that provides businesses with a combination of hardware and software to facilitate sales transactions and manage day-to-day operations. Additional functionalities include inventory management, employee management, and customer engagement tools. The system is designed to serve the needs of various business types, including retail stores, restaurants, and service providers, by providing a centralized solution for processing payments, tracking sales, and managing business activities.

Clover provides offers a range of hardware and software that allows businesses to accept various forms of payment, both online and in-person. The system is designed to accept credit cards, debit cards, and contactless payments, which includes mobile wallets like Apple Pay and Google Pay. The platform also offers tools for managing transactions, tracking sales, and generating reports, which can help businesses keep track of their online sales and customer purchasing trends.

For e-commerce specifically, Clover integrates with online shopping carts and platforms, enabling merchants to process transactions securely on their websites. Clover additionally features an app market, allowing businesses to extend the functionality of their POS system with third-party applications tailored to their specific operational needs.

Clover integrates with Mailchimp, DocuSign, Shopify, Xero, Gusto, WooCommerce, Deputy, Paychex Flex, Adobe Commerce, and Homebase.

Pricing starts from 2.3% + $0.1 per transaction. A free demo is available for interested users.

Payment Depot stands out as a payment processing software due to its unique subscription-based pricing model, which is designed to offer a more cost-effective solution for businesses with high transaction volumes. This model allows merchants to pay a flat monthly fee along with a small per-transaction charge over the wholesale rate, eliminating the common percentage-based markups found in traditional processing fee structures. Such a model can lead to significant savings for businesses, making Payment Depot particularly appealing to those with a high volume of transactions.

One of the defining features of Payment Depot is its comprehensive suite of services that cater to the needs of modern businesses. It provides a free payment gateway and virtual terminal through its partnership with SwipeSimple, allowing for the processing of online, mobile, and over-the-phone payments without additional costs. Furthermore, Payment Depot's software is compatible with various POS systems, including Clover and Vital Select, enhancing its versatility.

Ease of use is another critical aspect where Payment Depot excels. The platform's user interface is straightforward and intuitive, offering a logical layout that simplifies the management of sales data and financial transactions. This user-friendly design is complemented by an intuitive reporting dashboard that provides merchants with a quick overview of their sales data, enabling them to drill down into more detailed information effortlessly.

Payment Depot's focus on transparency and customer support further enhances its appeal as a payment processing software. The absence of hidden fees and the clear, upfront disclosure of all costs help build trust with merchants, establishing Payment Depot as a reliable partner for managing payment processing. Additionally, dedicated customer support ensures that businesses receive the assistance they need to navigate any challenges they might encounter.

Integrations include OpenCart, PrestaShop, 3dCart, BigCommerce, WooCommerce, Magento, Zen Cart, NCR, Authorize.Net, PayTrace, and others.

Best customizable payment solutions tailored to specific business needs

Merchant One shines as an online payment processing tool by offering a robust and flexible platform that caters to a wide variety of businesses, including those considered high-risk. Its high approval rates are particularly beneficial for online retailers, ecommerce startups, and niche marketplaces that might struggle to obtain payment processing services from other providers.

The customizable nature of Merchant One's payment solutions is a standout feature for online businesses. Unlike one-size-fits-all approaches, Merchant One works closely with each business to tailor payment processing solutions that align with their specific operational needs and customer preferences. This could mean integrating with specific ecommerce platforms, setting up recurring billing for subscription-based services, or providing mobile-friendly payment options.

Merchant One's provision of dedicated account managers adds a layer of personalized support that is invaluable for online businesses navigating the complexities of payment processing. These account managers offer guidance on optimizing payment solutions, advice on security and compliance matters, and assistance with any issues that arise. This level of support is crucial for maintaining the reliability of online payment systems and can be particularly reassuring for businesses that are new to ecommerce or expanding their online operations.

The security and compliance features of Merchant One provide peace of mind for online businesses and their customers. In an era where data breaches and online fraud are significant concerns, Merchant One's commitment to secure transaction processing and adherence to industry standards, such as PCI DSS compliance, is essential. By safeguarding customer payment information and providing a secure online payment environment, Merchant One helps businesses build and maintain a reputation for reliability and trustworthiness.

Integrations include Authorize.net, Payeezy Gateway, Payflow Pro, Paytrace Gateway, USAePay, Aloha, Micros, Maitre’D, 1ShoppingCart, BigCommerce, ecwid, Fishbowl, Magento, PrestaShop, Salesforce, and dozens more ecommerce platforms, shopping cart solutions, and sales enablement tools.

Best payment processing with incremental/upfront/partial payment options

FreshBooks is an online payment processing system that helps businesses simplify invoicing customers, tracking payments, and managing expenses. It integrates with other popular tools, such as QuickBooks and Xero, to make it easy to sync data across multiple platforms. It offers a range of customizable invoice templates that make it easy to create professional-looking invoices and allows users to set up recurring invoices so that customers can be automatically billed on a regular basis. FreshBooks helps businesses manage expenses by allowing them to quickly enter bills and attach digital copies of supporting documents like receipts and invoices. This makes it easier to keep track of spending and ensure that everything is accounted for come tax time.

FreshBooks has built-in reminders that let users know when an invoice is past due, or a customer hasn’t paid yet. It provides insights into customer behavior, so users can better understand their spending habits. FreshBooks allows users to accept payments through their invoices via major credit cards or PayPal accounts. This makes it much easier for customers to pay quickly without waiting for a check in the mail or setting up additional bank transfers. The platform also offers automatic deposits so that any payments processed through their invoices are deposited directly into bank accounts.

FreshBooks includes detailed reporting tools that make it easier for business owners to manage their finances. Various reports are available for tracking revenue by customer or product and reports on expenses, taxes, and sales trends. The comprehensive reports help businesses stay organized by providing detailed insights into their finances to easily track how much money they're making or losing in any given period. FreshBooks also offers numerous security measures to protect users’ data and funds. All sensitive information is encrypted using industry-standard encryption technology, ensuring that all transactions are safe and secure.

FreshBooks costs from $15/month and offers a 30-day free trial.

Square features a simple credit card reader that lets you accept payment from all major credit cards (Visa, Mastercard, Discover, etc.), and also from mobile payments like Apple Pay and Google Pay. You can store credit cards to charge repeat customers via recurring billing. You can also create custom invoices from your POS on your mobile or laptop and email them directly to your customers. Square has a virtual terminal feature that lets you bill customers remotely or by entering their details over the phone.

Square uses machine learning to conduct fraud detection, protection, and monitoring. Square has level 1 PCI data security standards that encrypt customer information that’s submitted to Square servers securely. It complies with the Payment Card Industry Data Security Standard (PCI DSS) so individual validation of compliance is not required. Square works out of the box with QuickBooks, WordPress, Squarespace, and similar apps.

For card-present payments, the fee is 2.6% + $0.10 per transaction. For card-not-present payments (where you have to manually key the details) the fee is 3.5% + $0.15.

Other Payment Processing Software

Here are a few more that didn’t make the top list but are still worth looking into if you need more options.

- Stripe

Best for online retail businesses

- FTNI

Best payment processing software for financial institutions

- Venmo for Business

Best for startups & freelancers

- Elavon

Best payment processing software for restaurants

- Fiserv

Best payment processing platform for Asia-Pacific enterprises

- KIS Payments

Best for loyalty programs

- Adyen

Best for performance analytics

- Recurly

Best payment processing system for subscription-based businesses

- Podium

Best text-to-pay software

- Tipalti

Best payment processing software for PO matching

Related Ecommerce Software Reviews

If you still haven't found what you're looking for here, check out these tools related to ecommerce that we've tested and evaluated.

- Ecommerce Platforms

- Inventory Management Software

- Shopping Cart Solutions

- Order Management Systems

- Warehouse Management Software

Selection Criteria for Payment Processing Software

Selecting the right payment processing software is a pivotal decision for e-commerce merchants, directly impacting their ability to efficiently process online payments, enhance customer experience, and secure transaction data. These criteria are designed to meet the specific needs, pain points, and functionalities most important to users in this space.

Core Payment Processing Software Functionality: - 25% of total weighting score

To be considered for inclusion on my list of the best payment processing software, the solution had to support the ability to fulfill common use cases.

- Acceptance of multiple payment methods including credit/debit cards, bank transfers, and digital wallets

- Secure transaction processing with encryption and compliance with PCI DSS standards

- Real-time processing of payments with instant authorization and confirmation

- Integration capabilities with e-commerce platforms, accounting software, and other business tools

- Comprehensive reporting and analytics for tracking transactions, refunds, and customer behavior

Additional Standout Features: - 25% of total weighting score

- Advanced fraud detection and prevention mechanisms that employ AI and machine learning to minimize risk

- Customizable checkout experiences that can be tailored to match the branding and UX design of the e-commerce site

- Support for global payments, including multi-currency transactions and language options, to cater to international customers

- Mobile payment capabilities that enhance the shopping experience for users on smartphones and tablets

- Subscription and recurring billing features that automate the payment process for memberships and services

Usability: - 10% of total weighting score

- A clean, intuitive user interface that simplifies navigation and task execution for users of all technical levels

- Drag-and-drop functionality for customizing payment forms and checkout pages without needing coding skills

- Clear, easily accessible documentation and tutorials that help users maximize the tool’s features

Onboarding: - 10% of total weighting score

- A straightforward setup process that allows merchants to quickly start accepting payments

- Comprehensive resources like training videos, interactive product tours, and templates that facilitate learning and implementation

- Responsive customer support during the onboarding phase to address any setup concerns or questions

Customer Support: - 10% of total weighting score

- 24/7 customer support availability through multiple channels such as live chat, email, and phone

- A knowledgeable support team capable of providing quick and effective solutions to issues

- Access to a community forum or knowledge base for peer support and shared learning

Value For Money: - 10% of total weighting score

- Competitive pricing that reflects the features and capabilities offered by the software

- Transparent pricing structures without hidden fees or charges for transactions

- Flexible plans that can scale with the business's growth and changing needs

Customer Reviews: - 10% of total weighting score

- Positive feedback on user experience, highlighting ease of use and efficient customer support

- High ratings for reliability and uptime, ensuring that payment processing is consistently available

- Testimonials that emphasize the software’s impact on improving sales and customer satisfaction

In choosing payment processing software, it's essential to weigh these criteria based on your business's unique needs and objectives. Remember, the right software should offer a seamless blend of security, usability, and value, empowering your business to thrive in the digital marketplace.

Trends in Payment Processing Software for 2024

The landscape of payment processing software is evolving at an unprecedented pace, driven by the need for more secure, efficient, and user-friendly solutions. Here's a look at the current trends, the most rapidly evolving features, and what's becoming less essential in the realm of payment processing software.

- Rise of Contactless and Mobile Payments: The adoption of NFC (Near Field Communication) and mobile payment solutions has skyrocketed, with platforms like PayPal and Venmo leading the charge. This shift underscores the growing consumer demand for convenience and speed in transactions, making contactless payments a standard feature rather than an added bonus.

- Blockchain and Cryptocurrency Payments: Innovative solutions such as BitPay are integrating blockchain technology to facilitate cryptocurrency transactions. This novel functionality caters to a niche but rapidly growing market of consumers and merchants interested in the security, transparency, and potential cost savings associated with cryptocurrencies.

- Enhanced Security Measures: As cyber threats become more sophisticated, payment processors like Adyen are implementing more robust security protocols, including tokenization and biometric verification. These features are crucial for building trust with consumers and ensuring compliance with global security standards.

- Global Payment Support: With the expansion of e-commerce on a global scale, payment processing software is prioritizing multi-currency and cross-border payment capabilities. Tools like Wise (formerly TransferWise) are making it easier for merchants to accept payments from customers around the world, removing barriers to international sales.

For ecommerce merchants, staying abreast of these developments is key to selecting a payment processing solution that not only meets the current needs of their business and customers but is also poised to adapt to future challenges and opportunities.

What Is Payment Processing Software?

Payment processing software is a digital tool that enables businesses to handle financial transactions electronically. It facilitates the acceptance and processing of various payment methods, including credit cards, debit cards, and online payments.

The purpose is to securely transfer payment information between the merchant, the payment gateway, and the banks involved. It ensures transaction security, adhere to compliance standards, and include features for fraud detection and prevention.

Features of Payment Processing Software

The key features of payment processing software are designed to ensure the secure, efficient, and versatile handling of electronic transactions. Here's a look at some of the essential features:

- Multiple Payment Method Support: The ability to accept a wide range of payment methods, including credit and debit cards, bank transfers, digital wallets, and even cryptocurrencies, to cater to the diverse preferences of customers.

- Security and Fraud Prevention: Advanced encryption technologies and compliance with security standards like PCI DSS to protect sensitive data. Features may also include fraud detection tools that analyze transactions in real-time to identify and prevent fraudulent activity.

- Transaction Processing: Core functionality that includes the authorization, capture, and settlement of payments, ensuring transactions are processed smoothly and efficiently.

- Payment Gateway Integration: Seamless integration with various payment gateways and financial institutions, enabling businesses to connect with their preferred payment service providers easily.

- Mobile Payments: Support for mobile payment solutions, allowing businesses to accept payments via mobile devices, catering to the growing trend of mobile commerce.

- Recurring Billing and Subscriptions: Automated billing features for handling recurring payments, subscriptions, and membership fees, providing convenience for both businesses and their customers.

- Multi-Currency and International Payments: Capability to accept and process payments in multiple currencies and from different countries, essential for businesses operating in the global market.

- Reporting and Analytics: Comprehensive reporting tools and analytics dashboards that provide insights into transaction volumes, sales trends, customer behavior, and more, helping businesses make informed decisions.

- User-Friendly Interface: An intuitive and easy-to-navigate interface that simplifies the management of transactions, refunds, and customer data for users of all technical skill levels.

- Customer Management: Features that enable businesses to manage customer information, payment preferences, and transaction history, enhancing customer service and relationship management.

These features collectively ensure that payment processing software not only facilitates the smooth execution of transactions but also supports businesses in managing their financial operations securely, efficiently, and in compliance with regulatory standards.

Benefits of Payment Processing Software

Payment processing software plays a crucial role in the modern business landscape, especially for ecommerce operations and organizations that conduct transactions online. Here are five primary benefits that payment processing software offers to users and organizations:

- Streamlined Transaction Management: Simplifies the process of managing and executing financial transactions. This software automates the acceptance, processing, and settlement of payments, reducing manual effort and increasing efficiency for businesses.

- Enhanced Security and Fraud Prevention: Implements advanced security measures to protect sensitive financial data. By using encryption, tokenization, and compliance with industry standards like PCI DSS, payment processing software minimizes the risk of data breaches and fraud, safeguarding both the business and its customers.

- Greater Payment Flexibility: Supports a wide range of payment methods and currencies. Businesses can accommodate customer preferences by accepting various payment options, including credit cards, digital wallets, and international currencies, thereby enhancing the customer experience and increasing sales opportunities.

- Access to Real-Time Analytics: Provides valuable insights into payment activities and trends. With built-in analytics and reporting tools, businesses can monitor transaction volumes, identify sales patterns, and make data-driven decisions to optimize their payment strategies.

- Global Market Accessibility: Enables businesses to accept payments from customers worldwide. Payment processing software often includes features for multi-currency support and compliance with international payment regulations, helping businesses to expand their reach and tap into new markets.

By choosing a solution that aligns with their specific needs, businesses can enjoy a more efficient, secure, and flexible payment processing experience, contributing to their overall growth and success in the digital marketplace.

Cost & Pricing for Payment Processing Software

Understanding the different pricing structures and features included in each payment processing software plan is crucial for selecting a solution that aligns with your business objectives and budget constraints. Below is a breakdown of the common plan options, their average prices, and the features typically included.

Plan Comparison Table for Payment Processing Software

| Plan Type | Average Price | Common Features Included |

|---|---|---|

| Starter | $0 - $25 per month | Basic transaction processing, standard security features, support for major credit cards, basic reporting |

| Small Business | $25 - $75 per month | Enhanced security measures, multi-currency support, mobile payments, advanced reporting, email support |

| Professional | $75 - $150 per month | Customizable checkout experiences, integration with e-commerce platforms, 24/7 customer support, analytics |

| Enterprise | Custom pricing | Dedicated account manager, custom reporting and analytics, advanced security protocols, priority support |

| Free | $0 | Limited transaction processing, basic security features, access to community support, standard reporting |

When selecting a payment processing software plan, consider not only the current needs of your business but also anticipate future growth and potential expansion into new markets. Opting for a plan that offers scalability and flexibility can ensure that your payment processing capabilities evolve in tandem with your business.

Payment Processing Software FAQs

To make this list of best payment processing software for ecommerce businesses even more comprehensive, I wanted to cover some of the most frequently asked questions on the topic.

What is payment processing?

What does payment processing software do?

What is a payment gateway?

What security measures do payment processors have?

Can you switch payment processors easily if needed?

How do payment processor platforms handle chargebacks?

How do payment processor platforms ensure PCI compliance?

Can payment processors handle multiple currencies for international sales?

How fast are payment processing times on these platforms?

Additional Payment Software Reviews

These software review lists may complement your search for payment processing software. I focused on software reviews for payment or payment-adjacent technologies, like fraud prevention or BNPL.

- Point-of-Sale (POS) Software

- Ecommerce Sales Tax Software

- Buy-Now-Pay-Later (BNPL) Platforms

- Mobile Payment Solutions

- Ecommerce Fraud Prevention Software

- Ecommerce Accounting Software

Conclusion

These were my top selections for the best payment processing gateway software. But while we are on this topic, how about you learn what buy-now-pay-later payment platforms are? I think it's relevant because there is a case to be made that not using them can actually damage your business.

Want to stay ahead with all things related to ecommerce management? Subscribe to The Ecomm Manager Newsletter and stay ahead with the latest insights from top thinkers in the Ecommerce industry.